Affordable Health Insurance Florida – What Do You Need To Know?

Are you shopping for a health insurance plan in Florida? Are you looking to understand the health insurance market better? Read this article to find critical resources to help you decide about affordable health insurance Florida options.

The State of Florida offers comprehensive health coverage to meet your and your family’s needs through various health plans. Each plan focuses on helping you stay healthy through preventive care benefits and providing access to healthcare services when you need them. Each option covers most of the same health services but provides those services and shares costs with you differently.

For customers, enrolling in a health insurance plan in Florida is confusing and complex, and seemingly minor differences between plans can lead to high out-of-pocket costs or lack of access to critical medicines and even providers. However, some companies combine cutting-edge technology with good old-fashioned friendly expertise to compare hundreds of plans and find the right one for you.

To provide the residents of Florida with affordable health insurance, Florida uses the federally-run health marketplace (exchange). Hence, individuals and families who need to buy health coverage use HealthCare.gov to enroll. Individuals and families use this Marketplace who do not have an option of coverage from an employer or Medicare.

But before you head towards getting all the information regarding affordable health insurance Florida, equip yourself with the basics of health insurance plans. Health insurance is a plan that covers a percentage of doctors’ visits and hospital bills. It exists to help offset the costs of medical events, whether planned or happen unexpectedly. Health insurance may also protect us even if we are feeling good. And may help keep us feeling that way through wellness programs and preventive care.

Now you know why it is imperative to have a health insurance plan. Let’s proceed to provide you with information about available options for affordable health insurance in Florida.

Florida health insurance

We all are aware that health is a key to living a peaceful life. Health care is expensive if we do not have health insurance. Having adequate health insurance helps you seek peace of mind. Therefore, the Florida government always seeks to bring affordable health insurance plans to the table.

It is not surprising that cost is the primary factor while determining the kind of health insurance people looking for. Fortunately, there is a wide range of options available to help citizens of Florida to find a plan that meets their budget. Most people seeking health insurance do their calculation because

- They are self-employed

- Their employer does not offer a group plan

- The group plan does not cover spouses or dependents

- The health plan that they are enrolled in has expensive premiums

- Their needs have changed and the enrolled policy does not meet those changes

If you fall into one of these categories and do not have insurance, you may have to pay a penalty that is more expensive than the cost of a policy. Rather than going without protection, explore your options, and you may find the perfect plan to fit your needs.

Health insurance protects you and your family from the high costs of preventative care, as well as emergency and treatment services. People who do not have insurance through an employer, might find it difficult to evaluate options. That’s why we will further discuss the choices and opportunities available in the Florida health insurance market to help make this process easier.

Affordable care act (Obama care)

The Affordable Care Act, also referred to as Obama Care, requires that everyone have insurance coverage or pay a penalty, although there are a few exceptions. This law states that no one can be denied coverage or charged excessive premiums due to a pre-existing condition, and also established 10 essential services that all policies must include for a person to qualify as insured.

Those 10 essential benefits are as:

- Ambulatory patient services (outpatient care you get without being admitted to a hospital)

- Emergency services

- Hospitalization (including surgery and overnight stays)

- Pregnancy, maternity, and newborn care (both before and after birth)

- Mental health and substance use disorder services, including behavioral health treatment (including counseling and psychotherapy)

- Prescription drugs

- Rehabilitative and habilitative services and devices (services and devices to help people with injuries, disabilities, or chronic conditions gain or recover mental and physical skills)

- Laboratory services

- Preventive and wellness services and chronic disease management

- Pediatric services, including oral and vision care (but adult dental and vision coverage aren’t essential health benefits)

In addition to establishing these requirements, the government created a Marketplace for people to purchase appropriate coverage. There are specific timeframes during which you can apply for coverage as well as special enrollment periods that address significant life changes, such as loss of a job or the birth or adoption of a child.

Some people who enroll in an insurance program through the marketplace qualify for a federal subsidy and this opportunity is only available through a government exchange.

Florida health insurance plans

Unless your employer provides you medical coverage or you qualify for a government healthcare program such as Medicaid or Medicare, you will have to purchase a private plan from the Florida insurance exchange. Premium prices vary, but those with lower premiums tend to have high deductibles and out-of-pocket maximums. This means that you will have to pay more out of pocket if you need a lot of medical care.

We compared different plan types from the Florida insurance exchange for sample buyer ages and incomes to find the most affordable options, making it easier for you to find the best and most affordable health insurance plans in Florida matching your needs and preferences.

The affordable health insurance in Florida by metal tier

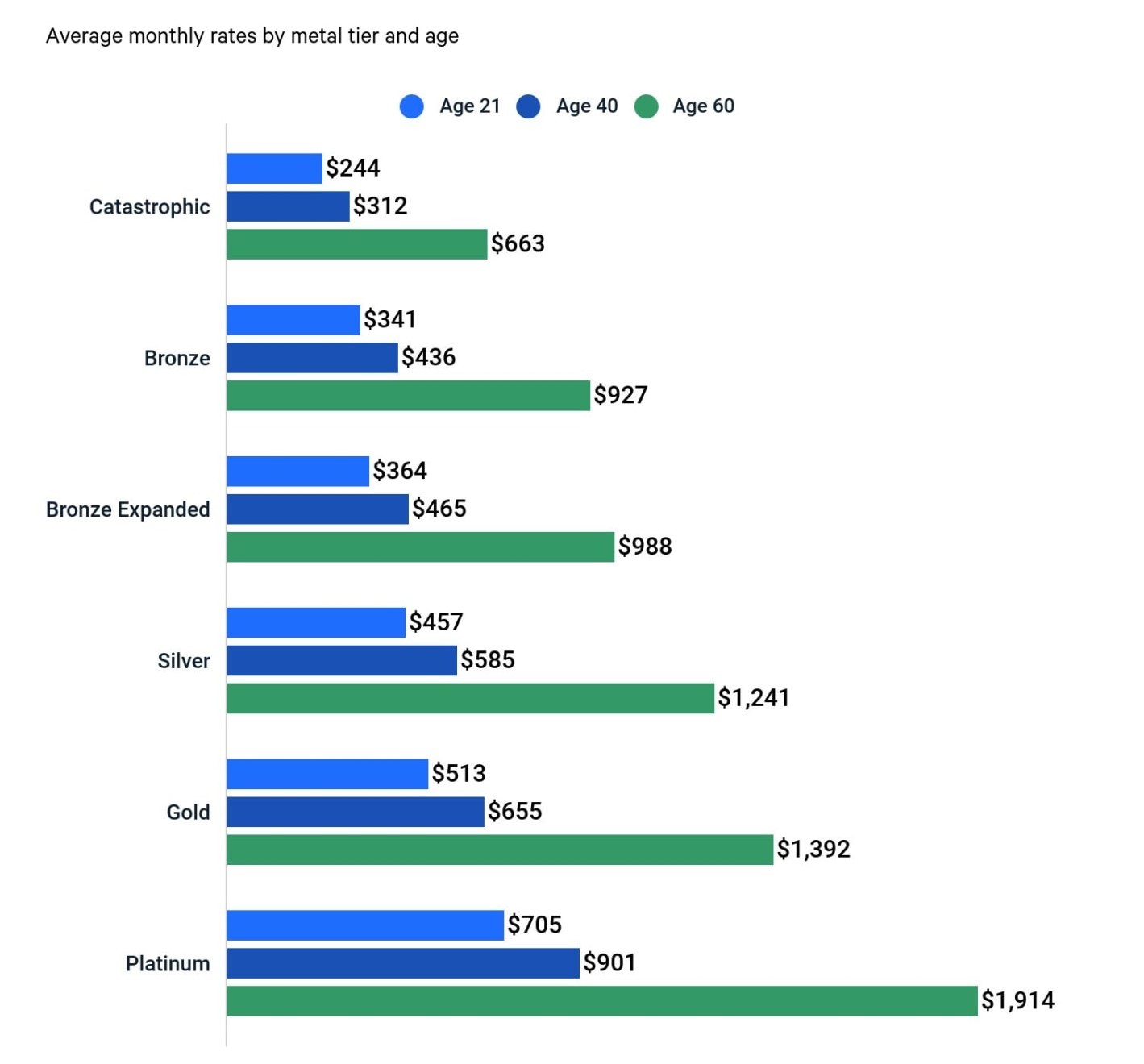

The Florida Marketplace organized health insurance plans by metals to match the affordability of consumers. There are six tiers of private plans available in Florida, including Catastrophic, Bronze, Expanded Bronze, Silver, Gold, and Platinum. Those named for less valuable metals, such as Bronze or Expanded Bronze, tend to cost less per month but may require you to spend more money if you need medical care.

A catastrophic category is only available for people under the age of 30. The costs of these plans increase according to the metals. The different costs, copays, and service options for each of these levels, and you need to evaluate which is best for your needs. Health insurance plans are divided into metal tiers with a wide range of premiums, deductibles, and out-of-pocket maximums.

Aside from the level of coverage you choose, one of the most significant factors in determining health insurance rates is the age of each person insured. Below presented is an image showing the average monthly cost of health insurance in Florida as per metal tier and age.

In this image, you will be able to fathom the fact that a 21-year-old will receive 28% cheaper prices for health insurance in Florida than a 40-year-old. A 60-year-old would pay 112% higher monthly premiums.

Metal Tier |

Affordable Plan |

Monthly Cost |

Deductible |

Maximum Out-of-Pocket |

| Catastrophic | Health First GYM ACCESS Catastrophic HMO 1746 | $195 | $8,700 | $8,700 |

| Bronze | Molina Core Care Bronze 1 | $338 | $6,100 | $8,550 |

| Bronze Expanded | Health First Bronze VALUE 60 1814 | $325 | $8,300 | $8,700 |

| Silver | Health First Silver VALUE 80 1815 | $430 | $6,500 | $8,700 |

| Gold | Health First Gold VALUE 80 1819 | $460 | $2,900 | $8,700 |

| Platinum | BlueSelect Platinum 1451 ($0 Virtual Visits / Rewards $$$) | $657 | $1,250 | $4,250 |

Finding your affordable insurance plans in Florida

Remember, premiums are not the only cost factor when it comes to your health care plans. Out-of-pocket costs in the form of deductibles, copays, and coinsurance are just as important to compare when you shop because these amounts will determine how much you spend on medical care.

The best cheap health insurance plan for you and your family will depend on your income level and expected health care needs.

Households with higher expected medical costs should opt for plans with higher cost-sharing benefits. In contrast, those who expect to be relatively healthy or need little to no routine care should look toward cheaper and affordable plans.

Average consumers should start by browsing silver plans

Unless you are perfectly healthy or know you will have significant medical expenses, you must begin your shopping process by looking at the Silver metal tier health insurance plans. These plans occupy a middle ground between monthly premiums and the cost-sharing responsibilities you will incur with any medical expenses.

The Silver plans are also the only plans on the Florida exchange that make you eligible for cost-sharing reductions that further reduce your copays, coinsurance, and deductibles if you have a household income under 250% of the federal poverty level.

In this case, these plans can offer more benefits than higher-priced Gold and Platinum plans but at a much lower premium.

Younger and healthier households can look to bronze, and catastrophic plans

Bronze and Catastrophic plans will have the lowest premiums available, but the downside is high deductibles. Many plans in these metal tiers will have their cost-sharing near the maximum limits, which means that you will first need to spend thousands of dollars before the plan’s benefits kick in.

These health insurance policies only make sense if you want coverage for costly emergencies and have little to no need for routine care. Catastrophic plans are available to those under age 30, and for those over 30, you will need a hardship exemption to be eligible. Keep in mind that all metal tiers except Catastrophic are eligible for premium tax credits.

Health insurance rate changes in Florida

Health insurance rates, deductibles, and out-of-pocket maximums are set yearly by health insurance companies. The plans are then sent to the federal exchange for approval of the following plan year.

In Florida, the cost of health insurance plans increased an average of 6% from 2021 to 2022. That is about $31 more per month.

The largest price increase was for Platinum plans, which cost 9% more in 2022. Gold, Bronze, and Expanded Bronze plans increased between 5% to 7%. Silver and Catastrophic plans had the smallest change, increasing 2% to 3% between 2021 and 2022.

| Metal Tier | 2020 | 2021 | 2022 | Change (2021 vs. 2022) |

| Catastrophic | $269 | $303 | $312 | 3% |

| Bronze | $401 | $414 | $436 | 5% |

| Expanded Bronze | $434 | $433 | $465 | 7% |

| Silver | $584 | $571 | $585 | 2% |

| Gold | $624 | $618 | $655 | 6% |

| Platinum | $825 | $827 | $901 | 9% |

These monthly premiums are for 40 year old adults.

Choosing a plan with higher premiums, such as Gold or Silver, may require you to pay more per month, but those are cost-effective options if you have high health expenses. These tend to have lower deductibles, and you will end up spending less when you require medical care.

Out-of-pocket maximums, deductibles, and monthly premiums vary between plans within the same tier. One way to have lower deductibles is if you qualify for cost-sharing reductions. These plans are available to low-income buyers who purchase Silver plans and provide you with lower deductibles than usual.

Compare health plans

There is a wide range of options for affordable health insurance in Florida. Before choosing your plan, keep your research thorough and identify all of the benefits you and your family need to maintain health and address anticipated issues. You should also consider your budget, preferred providers, and any medications being taken. In addition, you need to compare the type of plans, health plan networks, out-of-pocket costs, and out-of-state coverage.

Below you will need the details of the first three criteria.

Type of Plans

There are four basic types of health insurance plans, and you need to understand the benefits and drawbacks of each one before you make a decision. Begin by evaluating how you and your family currently use healthcare services in Florida. Identify the type and amount of treatment you have received in the past to help you anticipate future usage.

In a Health Maintenance Organization (HMO) or a Point of Service Plan (POS), your primary physician makes the referrals to specialists, which can save you time but limits your choices. If you or a family member has a chronic condition that requires specialized care, you may want to choose a Preferred Provider Organization (PPO) or an Exclusive Provider Organization (EPO) so you can continue to see your existing specialist or have a choice in who you use.

A PPO and POS are good options if you live in a rural area with limited access to doctors because you will pay less for out-of-network services than with the other plans.

| Plan Type | Do you have to stay in-network to get coverage? | Do procedures & specialists require a referral? | Best if you require |

| HMO: Health Maintenance Organization | Yes, except for emergencies | Yes | Lower out-of-pocket costs and a primary doctor that coordinates your care for you, including ordering tests and working with your specialists. |

| PPO: Preferred Provider Organization | No, but in-network care is less expensive. | No | More provider options and no required referrals. |

| EPO: Exclusive Provider Organization | Yes, except for emergencies. | No | Lower out-of-pocket costs but no required referrals. |

| POS: Point of Service Plan | No, but in-network care is less expensive; you need a referral to go out of network. | Yes | More provider options and a primary doctor that coordinates your care for you, including ordering tests and working with your specialists. |

Health plan networks

Your costs will be lesser if you receive care from a physician or other provider within the plan network because the insurance company signed a contract for specific rates with these providers. For this reason, you need to check that the physicians you and your family prefer are in the networks you are considering.

When in doubt, ask your doctor’s billing manager if they participate in the network. If you do not have a preferred physician, choose a plan with a large network so you will have more options for care and can avoid out-of-network costs.

Understanding Out-of-Pocket Costs: Key Factors to Consider

Out-of-pocket costs are the expenses you pay beyond your premiums.

A copay is a fixed amount you pay for services when you receive care. It is typically a set fee, like $25 per doctor’s visit. Copay amounts vary based on the type of service.

A deductible is the total amount you pay annually before your insurance starts covering a larger portion of your bills. Deductibles can be individual or family-based, significantly impacting your overall expenses. Check the policy details carefully, as family and individual deductibles can differ greatly.

Coinsurance is the percentage of medical costs you cover after meeting your deductible. It ranges from 5% to 30%. If you expect to meet your deductible, this percentage is crucial.

Under the Affordable Care Act, there are established out-of-pocket maximums that cap your total expenses. However, if you buy insurance outside the market, these limits may not apply, though alternative caps are likely.

Comparing out-of-pocket expenses between plans can be challenging. Each plan might categorize services differently, making copay comparisons misleading. Carefully review plan details and consider your expected services to make an accurate comparison.

State of Florida health insurance

The State of Florida Health Insurance Marketplace provides affordable health insurance options for Florida’s Florida’s individuals, families, and licensed professionals. In Florida, the Health Insurance Marketplace is a web-based shopping experience that allows easy access to, and side-by-side comparison of health care products and services.

Florida uses the federally run health marketplace (exchange), so individuals and families who need to buy their health coverage use HealthCare.gov to enroll. Individuals and families use Marketplaces that do not have an option of coverage from an employer or Medicare.

People who purchase Individual/family health plans are self-employed, or, retired before age 65 and need to buy their coverage until they become eligible for Medicare, and people employed by small businesses that do not provide health benefits. The marketplace is also the only place Florida residents can get income-based financial assistance with their individual primary medical health coverage.

Like many states, Florida uses a federally-run health marketplace, which clearly implies that residents who choose qualified insurance have to register each year to renew their policy. Residents can also choose from a variety of non-qualified plans at a lower cost. Here are the major differences between qualified and non-qualified plans:

Qualified plans

These plans are compliant with the Affordable Care Act (ACA) and provide coverage for the ten Essential Health Benefits, which are a set of categories that have guaranteed coverage regardless of the insured’s age, gender, or lifestyle choices.

Non-qualified health insurance plans

These plans do not meet federal requirements; however, they are significantly cheaper and still offer various coverage options.

Understanding health insurance in Florida

Up until 2019, federal law required an individual mandate in each state. An individual mandate is enforcement for all citizens to enroll in health insurance to avoid a fine. When the mandate was federally abolished, states could decide whether they wanted to enforce it.

Currently, Florida does not enforce this, meaning that residents have the option to go uninsured. However, medical costs are the leading cause of debt and bankruptcy in the United States, and having health coverage is one of the best ways to avoid debt in the event of an emergency.

The purpose to design health insurance policies is to help consumers pay for their medical costs up to a certain point before the insurer takes over the rest. The type of insurance you select will affect your monthly premiums and coverage types.

A variety of plan types is available in Florida, such as EPOs and POSs. The most common plan type, however, is HMO.

Suppose you are looking for individual or family health insurance in Florida under the Affordable Care Act, also known as Obamacare. In that case, you will probably have a good chance of getting government subsidies to lower your costs. You can also get low-cost or free Florida health insurance through public programs like Medicaid and the Children’s Health Insurance Program (CHIP).

Florida Medicaid is the state and federal partnership that provides health coverage for selected categories of people in Florida with low incomes. Its purpose is to improve the health of people who might otherwise go without medical care for themselves and their children. Health insurance through Medicare is also a big deal in Florida. So if you are at least 65 years old (or disabled), Medicare may be a cheaper option for you.

Who is eligible for Florida medicaid?

To be eligible for Florida Medicaid, you must be a resident of the state of Florida, a U.S. national, citizen, permanent resident, or legal alien, in need of health care/insurance assistance, whose financial situation would be characterized as low income or very low income. You must also be one of the following:

- Pregnant, or

- Be responsible for a child 18 years of age or younger, or

- Blind, or

- Have a disability or a family member in your household with a disability, or

- Be 65 years of age or older.

To be eligible for Florida Medicaid, you must have an annual household income.

Health plans and programs

In Florida, most Medicaid recipients are enrolled in the Statewide Medicaid Managed Care program. The program has three parts: Managed Medical Assistance, Long-Term Care, and Dental. People on Medicaid will get services using one or more of these plan types:

Managed Medical Assistance (MMA): Provides Medicaid-covered medical services like doctor visits, hospital care, prescribed drugs, mental health care, and transportation to these services. Most people on Medicaid will receive their care from a plan that covers MMA services.

Long-Term Care (LTC): Provides Medicaid LTC services like care in a nursing facility, assisted living, or at home. To get LTC you must be at least 18 years old and meet the nursing home level of care (or meet hospital level of care if you have Cystic Fibrosis).

Dental: Provides all Medicaid dental services for children and adults. All people on Medicaid must enroll in a dental plan.

How to choose the most affordable health insurance plan in Florida

The cheapest health insurance for you depends on your household income and your medical needs. Focus on choosing the right type of plan first, because this will have a greater impact on your total costs than the company you pick.

For those who are looking for a cheap health plan and do not have insurance through a job, we recommend a Bronze plan. It has very low rates and coverage that includes essential health benefits like prescription drugs, mental health services, and preventative care. Because of the additional discounts offered through the American Rescue Plan, about 80% of applicants can find a Bronze health insurance plan for $10 per month after tax credits.

For those who need moderate amounts of medical care or who want a little better coverage, it can be more cost-effective to move to a Silver plan. These plans cost a little more each month, but the better benefits can help you save on health care.

Medicaid is the cheapest health insurance for those with low incomes. Eligibility varies by state, but in Florida, you could qualify as an individual earning less than $17,774 or a family of four with an income less than $36,570.

Another option is a short-term health insurance plan, which can provide stop-gap coverage at affordable rates. However, plans do not usually have restrictions or limitations on coverage.

Individual health insurance

Individual health insurance policy is a coverage that the insured person purchases on their own to maintain their health and take care of medical care whenever required by the insured person. A consumer must pay a medical insurance premium before claiming coverage.

UnitedHealthcare Individual Marketplace plans in Florida offer affordable, reliable coverage options from UnitedHealthcare of Florida, Inc. As part of the American Rescue Plan Act (2021), many individuals are now eligible for lower or in some cases $0 monthly premiums for Marketplace health coverage.

You can get individual health insurance and compare prices in Florida from all carriers in one place with a marketplace. Marketplaces offer more support to help consumers find the right plan that suits their needs at no extra cost to you. To get coverage, simply enter some basic information (age, zip code, gender, etc.) and compare quotes from carriers in Florida.

Conclusion

As healthcare costs continue to rise, finding affordable health insurance becomes more critical. In Florida, the insurance market is highly competitive, which can work to your advantage. However, this competition can also make it challenging to find the right policy for your needs.

To qualify for a health insurance plan in Florida, you must pass a medical examination. Once approved, you’ll need to pay the premium, which varies based on your age and medical history.

Florida offers a range of health insurance plans designed to fit different needs and budgets. These plans typically cover medication, prescriptions, doctor visits, and hospitalization. You can choose from individual health insurance, small group health insurance with a Health Savings Account (HSA), or Health Reimbursement Arrangements (HRA). Each option has its own set of benefits and cost structures, allowing you to find a plan that suits your financial and healthcare needs.

Exploring these options and understanding the benefits of each plan can help you make an informed decision. With the right approach, you can secure an affordable health insurance plan that provides the coverage you need.