How To Calculate APR On Credit Card And Car Loan

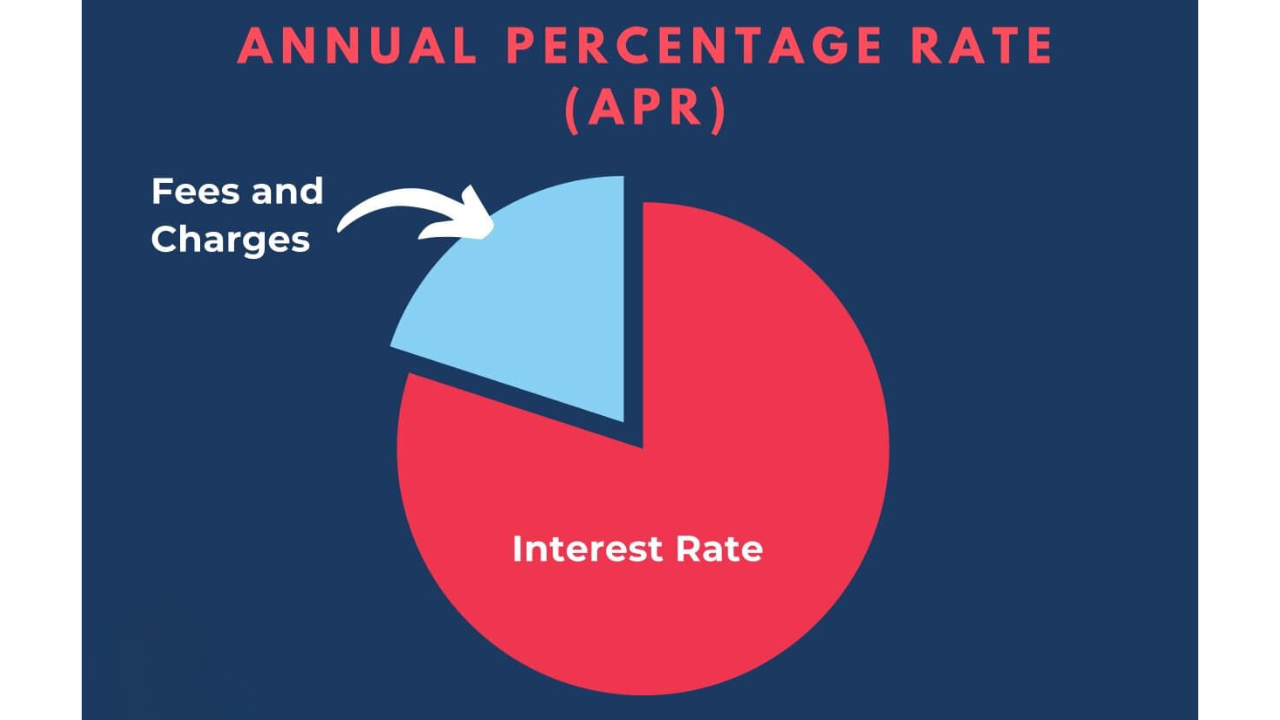

APR is the annual rate that is charged for a loan, representing the actual yearly cost of a loan over the term of the loan. This includes financing charges and any fees or additional costs associated with the loan such as closing costs or points.

APR is a term you’ve probably encountered while looking for a car loan or credit card. APR, which stands for annual percentage rate, indicates how much borrowing money will cost. Knowing how to compare credit card or loan items quickly will enable you to select the best offer.

Fees are involved when taking out a loan or borrowing money from an institution. The deposits consumers place in banks and other financial organizations help such institutions generate revenue. They generate money by charging a portion of the amount lent to those who borrow from them.

APR is a percentage that represents the actual annual cost of funds for a loan or investment throughout the loan. Consumers use the APR as a bottom-line number to compare and decide among lenders, credit cards, or investment products.

What is the annual percentage rate (APR)?

The yearly interest earned by a sum charged to borrowers or paid to investors is the annual percentage rate (APR). It includes any fees or additional costs incurred during the transaction but excludes compounding. Consumers can use the APR to evaluate lenders, credit cards, and investment goods since it gives them a single number to compare.

How the annual percentage rate (APR) works

An interest rate is a percentage rate stated as a yearly percentage rate. It works out what proportion of the principal you’ll pay each year by factoring in monthly payments. APR is the annual interest rate paid on investments, excluding interest compounded over the year.

How is APR calculated?

You determine a loan’s APR and have a better understanding of the condition given by using the APR formula. But first, here are some figures you should be familiar with:

- Total interest charges: The total cost of borrowing money is the charge for the interest. When you receive a loan offer, the lender should disclose your interest rate. If you already have a loan, it should be included on your statements, or you may find it in your loan agreement.

- Fees: They might differ depending on the lender and loan type. Review your terms and conditions to discover the costs associated with your loan.

- Loan amount: You must know the initial loan balance, often the principal.

- Days left on the loan term: since the annual percentage rate (APR) represents the cost of borrowing money, multiply 365 by the number of years left on the loan. Use the number of days for periods that are shorter than a year.

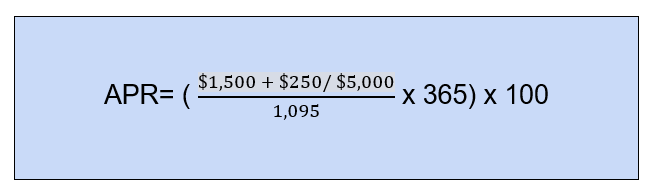

APR is calculated by multiplying the periodic interest rate by the number of periods in a year in which it was applied. It does not indicate how often the rate is applied to the balance. When you have these figures, use the following formula to determine APR:

You don’t have to perform all the calculations by yourself; this formula might assist you in understanding how APR is determined. Fortunately, the Truth in Lending Act ( TILS) mandates that lenders reveal APR when extending credit to you. To calculate the APR of a loan, you might alternatively use an internet calculator.

The APR of a loan may be calculated in 6 stages

While you might not often utilize the APR calculation, comparing loan offers might be helpful. The APR for a $5,000 personal loan with a 5% origination charge, 10% interest rate, and a three-year payback period may be calculated using the following example.

- Step 1: Find the interest rate and charges

You need to figure out the entire interest costs associated with a loan for the APR formula. You might apply the simple interest approach if the loan has a simple interest. To arrive at this figure, multiply the principle by the interest rate and the number of years remaining on the payback period.

- Step 2: Add the fees

Add the financing costs or fees associated with the loan after the interest charges. In this instance, the 5% origination cost is $250 since 0.05 x 5,000 equals 250.

- Step 3: Divide the sum by the principal balance

Divide the total of your interest and any expenses by the balance of your initial investment.

- Step 4: Divide by the number of days in the loan’s term

Divide the final figure by the number of days remaining in the loan’s term. That would be 1,095 days with a three-year loan.

- Step 5: Multiply by 365

The yearly rate is then calculated by multiplying that value by 365.

- Step 6: Multiply by 100

To obtain the yearly rate as a percentage, multiply the previous figure by 100.

The loan’s APR, in this instance, would be 11.67%. The loan does, however, include a 10% basic interest rate. It is one of the reasons why comparing APRs is crucial when looking for a loan.

Types of APRs:

Most credit accounts have an APR that is either variable or fixed. Knowing what kind of APR your loan has will assist you in planning your spending.

- Variable APR

- Fixed APR

Variable APR

Usually, credit cards and adjustable-rate mortgages have variable APR initially, but the rate may rise later. An interest rate that serves as a benchmark, such as the prime rate, may be used to calculate this form of APR. The APR may rise or fall due to changes in the benchmark rate over time. Therefore, these modifications may have an impact on both your monthly payment and overall borrowing costs. Credit cards, for example, may come with promotional deals like 0% APR. These credit card offers must be valid for at least six months; some might be extended. When the promotion expires, the APR might rise, impacting how much a borrower owes.

Fixed APR

Non Variable APRs are independent of an index rate. Thus, they won’t fluctuate in the same manner. Although they are occasionally referred to as fixed APRs, it doesn’t mean they are always constant. Missed payments could result in a fixed APR change, depending on the conditions of a card or the rules of an issuer. However, the Consumer Financial Protection Bureau asserts that issuers must inform you beforehand.

Many personal, vehicle, and house loans and other loans with fixed APRs have an interest rate that won’t fluctuate during the loan. An index rate may impact the APR for a loan you are provided. However, you lock in a particular rate by accepting the loan’s conditions.

The APR on a credit card varies depending on the type of charge:

- The credit card company may charge a different APR for purchases, cash advances, and balance transfers from another card.

- Customers are also subjected to high-rate penalty APRs if they make late payments or break other cardholder agreement terms.

- There’s also the introductory APR, which many credit card firms use to lure new customers to sign up for a card by offering a low or 0%

- APRs on bank loans are usually either fixed or variable. A fixed APR loan has an interest rate that will not fluctuate over the loan or credit facility’s term. The interest rate on a variable APR loan might vary at any time.

- Their credit score also determines borrowers’ APR. Rates for those with good credit are much lower than those with bad credit.

- The annual percentage rate (APR) does not consider interest compounding over a year; it is exclusively based on vital interest.

APR vs. APY

The annual percentage yield (APY) considers compound interest, whereas the annual percentage rate (APR) exclusively considers vital interest. As a result, the APY on a loan is larger than the APR. The wider the gap between APR and APY, the higher the interest rate and, to a lesser extent, the shorter the compounding time.

Consider a loan with a 12-percent annual percentage rate (APR) that compounds once a month. If a person borrows $10,000 for one month, the interest is 1% of the balance, or $100. As a result, the proportion has increased to $10,100. The following month, 1% interest is applied to this amount, resulting in an interest payment of $101, which is somewhat more significant than the previous month’s payment. Your effective interest rate rises to 12.68 percent if you carry the balance for a year. APR does not account for these modest changes in interest expenses due to compounding, whereas APY does.

Here’s another way to look at it. Say you compare an investment that pays 5% per year with one that pays 5% monthly. For the first month, the APY equals 5%, the same as the APR. But for the second, the APY is 5.12%, reflecting the monthly compounding.

Given that an APR and a distinct APY can represent the same interest rate on a loan or financial product, lenders frequently highlight the more flattering number, which is why the Truth in Savings Act of 1991 mandated that both APR and APY be displayed in commercials, contracts, and agreements.

Given that the former has a more significant figure, a bank will advertise the APY of a savings account in a larger font and the matching APR in a smaller type. When a bank works as a lender, it seeks to persuade its borrowers that it is offering a low-interest rate. A mortgage calculator is an excellent tool for comparing APR and APY rates on a loan.

APR vs. Nominal Interest Rate vs. Daily periodic rate

An APR is usually higher than the nominal interest rate on a loan. Because the nominal interest rate does not consider any additional costs incurred by the borrower, this is the case. The nominal rate may be cheaper if you don’t include closing expenses, insurance, and origination fees in your mortgage. If you decide to roll these costs into your mortgage, your loan balance will rise, as will your APR.

The daily periodic rate, on the other hand, is the daily interest rate levied on a loan’s balance (the APR divided by 365). Lenders and credit card companies can depict APR every month as long as the complete 12-month APR is posted someplace before the contract is signed.

Disadvantages of annual percentage rate (APR)

While APR is a helpful tool for estimating overall borrowing costs, it also has limitations that make it unsuitable for comparing loans. The following are the main drawbacks of selecting a loan package based on APR:

- An APR is usually higher than the nominal interest rate. Because the nominal interest rate does not consider any additional costs incurred by the borrower, this is the case. The nominal rate may be cheaper if you don’t include closing expenses, insurance, and origination fees in your mortgage. If you decide to roll these costs into your mortgage, your loan balance will rise, as will your APR.

- The daily periodic rate, conversely, is the daily interest rate levied on a loan’s balance (the APR divided by 365). Lenders and credit card companies can depict APR every month as long as the complete 12-month APR is posted someplace before the contract is signed.

- APR has issues with adjustable-rate mortgages as well (ARMs). Estimates usually assume a constant rate of interest, and while APR considers rate limitations, the final figure is still based on fixed rates. Because the interest rate on an ARM will fluctuate once the fixed-rate period ends, APR calculations may significantly underestimate actual borrowing expenses if interest rates rise in the future.

- Appraisals, titles, credit reports, applications, life insurance, attorneys and notaries, and document preparation may or may not be included in mortgage APRs. Other fees, such as late and one-time charges, are purposefully removed.

- It can make comparing similar items complex because the fees included or eliminated vary per institution.

- APR only functions when you are confident in your ability to repay the loan in full. The term and circumstances for obtaining a new APR from a different lender may change if you intend to refinance the loan midway through, rendering your initial APR calculations meaningless.

- Lenders have different APRs. It’s crucial to compare all the rates provided while looking for a loan, especially when they include secondary fees and variable interest rates. The APR could not be correct if the interest rate is variable since any change in the interest rate would alter the total cost of the loan.

- The effect of interest rate compounding is not taken into account by APR. The APR won’t accurately indicate cost when a loan option has a compounding impact on the interest rate.

Why is the annual percentage rate (APR) disclosed?

With adjustable-rate mortgages, APR has specific issues as well (ARMs). Even if APR considers rate caps, the final value is still based on fixed rates. Because the interest rate on an ARM will fluctuate after the fixed-rate term ends, APR calculations may significantly underestimate actual borrowing expenses if mortgage rates rise in the future.

Appraisals, titles, credit reports, applications, life insurance, attorneys and notaries, and document preparation may or may not be included in the mortgage APR. Other expenses, such as late fines and additional one-time charges, have been purposefully omitted.

All this may make it difficult to compare similar products because the fees included or excluded differ from institution to institution. To accurately compare multiple offers, a potential borrower must determine which of these fees are included and, to be thorough, calculate APR using the nominal interest rate and other cost information.

What is a good APR?

What constitutes a “good” APR will be determined by factors such as market competition, the central bank’s prime interest rate, and the borrower’s credit score. Companies in competitive industries sometimes offer very low APRs on their credit products when premium rates are low, such as 0% on vehicle loans or lease alternatives.

Although these low rates may appear appealing, clients should double-check whether they are permanent or just introductory rates that will revert to a higher APR once a certain period has passed. Furthermore, reduced APRs may be limited to customers with good credit scores.

How to calculate APR on a car loan

The annual percentage rate on a car loan is the cost of financing a vehicle over a year, including expenses, expressed as a percentage. Before you sign a loan agreement, lenders must reveal the APR they will charge you. You can also generate your own APR by plugging in the loan amount, interest rate, fees, and loan length. Because the APR offered by each lender can differ, it’s critical to shop around and compare loan APRs and other stipulations.

Shopping for a car can be stressful when deciding on a make, model, and options. And you’re not finished yet. Shopping for a car loan is just as important, and knowing how to calculate an auto loan’s APR will help you assess whether a loan is good for you.

And you’re not finished yet. Shopping for a car loan is just as important, and knowing how to calculate an auto loan’s APR will help determine if a loan is good for you.

When it comes time to sign on the dotted line — or walk away if the loan doesn’t meet your financial demands — the more you know about how to calculate the APR on a car loan, the better educated you’ll be.

A car loan’s annual percentage rate (APR) is the cost of borrowing each year, represented as a percentage. It contains not only the loan’s interest rate but also some costs. On the other hand, the interest rate merely indicates the annual cost of borrowing money and does not include any fees. When comparing loans, the Consumer Financial Protection Bureau recommends looking at annual percentage rates (APRs) rather than interest rates because APRs better reflect how much you’ll pay to finance a car.

Let’s look at how to calculate APR on a car loan and some of the elements that may influence the APR you’re provided.

Calculating APR on a car loan

We’ve put together a method using computer spreadsheet software to calculate the estimated APR on a car loan. To go that route, you’ll need the following information:

- Loan amount: The total amount you plan to finance, typically the price of the vehicle, minus any down payment or trade-document payment on your auto loan or trade-in, will lower the amount you need to invest, which can reduce your monthly income)

- Loan term: The length of your auto loan

- The loan’s interest rate (this is an estimated rate until you formally apply)

- Specific fees, like origination fees

The first step in calculating APR is calculating your estimated monthly payment.

1. Calculate your monthly estimated payment

You can skip this step if you already know your estimated monthly loan payment. If you don’t, you can easily calculate your monthly car payment on a spreadsheet by typing the formula below into a cell.

=PMT(interest rate as a decimal/12, number of months in the loan term, loan amount, with fees)

The result is your estimated monthly payment. It will be a negative number but don’t worry. You didn’t make a mistake. Keep this number handy for calculating your APR.

Let’s say you want to finance $13,000 ($12,500 plus a $500 loan application fee) with a loan term of 60 months and an interest rate of 4%. Here’s what your formula would look like with those numbers plugged in.

For example, your spreadsheet would calculate your monthly payment to $239.41.

2. Calculate your estimated APR

To estimate your APR on a loan using a spreadsheet, enter the formula below into a cell. This formula assumes that it calculated your monthly payments in step 1 or includes fees. If you didn’t calculate your monthly payment in Step 1 or aren’t sure whether the monthly payment you’re using reflects costs, keep in mind that this formula may not be the best way to calculate your estimated APR.

RATE(number of months in loan term, estimated monthly payment, value of loan minus fees)*12

Using the monthly payment you calculated (-$239.41), here’s what you’d enter into the cell for this loan example.

=RATE(60,-239.41,12500)*12

Entering the formula above would calculate your estimated APR at approximately 5.6%.

How do I know what my APR is?

Once you’ve received a formal and final offer, you can find the APR in one of two ways.

- Ask your lender: The federal Truth in Lending Act, which helps ensure consumers are informed, requires lenders to give you certain specifications on your loan, including the APR, before you sign the loan agreement. If you have the loan documents in hand, you should be able to find the APR on your contract.

- Estimate it yourself: If you have the loan details, you can calculate the estimated APR on an auto loan with a computer spreadsheet program. Check out the formula below for calculating the estimated APR on a car loan.

Why is APR on a car loan important?

The APR on a car loan is crucial because it tells you how much it will cost to borrow from that lender. The lower the annual percentage rate (APR), the less you’ll have to pay to finance your car.

When comparing loans, look at the APRs to see which is the least expensive. Even a one-percentage-point discrepancy can mount up over time.

Imagine you’re deciding between two $23,000 loans, each with a four-year term. The interest rate on one loan is 5%, whereas the interest rate on the other loan is 6%. The loan with the 6 percent APR would cost you $503 more in interest than the loan with the 5 percent APR.

What’s a good car loan APR?

According to the Federal Reserve, commercial banks charged an average APR of 4.98 percent on 48- and 60-month car loans in August 2020. However, remember that interest rates differ per lender, and various other factors can influence the APR you receive. Here are a few examples.

- Your credit ratings

Your loan rate will be cheaper if you have good credit. Before you start automobile shopping, check your credit ratings to understand where your credit stands.

- The length of your loan

A more extended loan period, such as 72 or 84 months, can reduce your monthly payment, but it may also come with a higher interest rate than a shorter-term loan. You’ll also pay more interest throughout the loan if you take out a longer term.

- The loan-to-value (LTV) ratio

You may be charged a reduced APR if the amount you wish to borrow is much less than the value of the automobile you’re buying — perhaps because you put down a sizeable down payment or have a car with a high trade-in value. It is because the loan carries a lower risk for the lender than a loan to cover the entire vehicle cost.

How to calculate credit card APR charges

It’s critical to understand how your credit card’s Annual Percentage Rate (APR) is calculated and applied to your outstanding balances if you want to keep your overall credit card debt under control.

The Annual Percentage Rate (APR) on your credit card is the monthly interest rate you are charged on unpaid credit card balances. By calculating the daily periodic rate on your credit cards, you can better grasp how compound interest affects how much you pay back in interest. It may break down your APR yearly or monthly on your monthly bill, but you may do it yourself and break it down to a monthly APR.

This information helps you in deciding which credit cards to apply for. This information could assist you in determining which credit cards you should pay down soon (if they are costing you too much in daily interest) and how much it costs you to borrow from your credit card company each day. Monthly APR can also help you figure out how much it costs to carry a loan each month if you don’t pay it off ultimately.

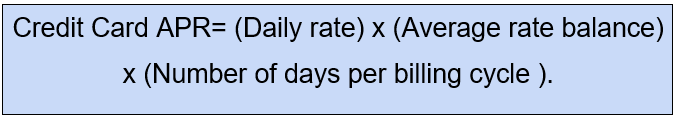

Calculation

Within a billing cycle, you may figure out the APR that is applied to the remaining amount on your credit card. All you have to do is look up a few numbers first:

- Daily rate: APR divided by 365 days yields the daily rate for a certain card. Your daily rate would be 06% if your credit card had a 22% APR. When entering this rate into the calculation, use the decimal format.

- Daily average balance: The credit card amount for each day of the payment cycle should be added up. The average daily balance is then calculated by dividing this amount by the number of days in the billing cycle.

- Days in a billing cycle: The regular billing cycle for credit cards is 28 to 31 To see how many days are in the billing cycle for your card, check your loan agreement or bills.

When you have these figures, enter them into the following credit card APR formula:

For instance, the following APR would apply to a credit card with a daily rate of 0.06%, a daily amount of $100, and a 28-day billing cycle:

- (0.0006) x ($100) x (28)= 1.68.

You would therefore be required to pay $1.68 in interest each month if these were the conditions and balance of your credit card. Remember that you typically won’t have to pay interest on new purchases if you pay off your debt in full each month before the due date. There are ways to pay off debt and reduce the interest you spend on credit cards, even if this might not always be viable.

How to calculate your monthly APR on a credit card

Calculating your monthly APR rate can be done in three easy steps:

- Step 1: Find your current APR and balance in your credit card statement.

- Step 2: Divide your current APR by 12 (for the twelve months of the year) to find your monthly periodic rate.

- Step 3: Multiply that number by the current balance amount.

For example, if you owe $500 on your credit card over the month and your current APR is 17.99 percent, you may determine your monthly interest rate by dividing 17.99 percent by 12, or 1.49 percent. Then multiply $500 by 0.0149 to get a monthly payment of $7.45. As a result, based on your $500 amount, you should have been charged $7.45 in interest charges.

How to calculate your daily APR on a credit card

Your credit card company may calculate your interest with a daily periodic rate.

Calculate your daily APR in three easy steps:

- Step 1: Find your current APR and balance in your credit card statement.

- Step 2: Divide your APR rate by 365 (365 days in the year) to find your daily periodic rate.

- Step 3: Multiply your current balance by your daily rate.

If the procedures above need to be clarified, consider the following example of how to compute APR on a credit card.

If your current amount is $500 for the month and your APR is 17.99 percent, divide your current APR by 365 to get your daily periodic rate. Your daily APR would be around 0.0492 percent in this situation. You can calculate your regular daily rate by multiplying $500 by 0.00049. Simply multiply this daily periodic rate by the days in your billing cycle to calculate the monthly interest payments on your debt. The usual billing cycle for most credit cards is around 30 days.

With this in mind, staying on top of monthly payments is a good idea to reduce the impact of daily compounding interest.

The techniques outlined above will aid you in not only understanding how to calculate APR on a credit card and how to use your credit card effectively.

Why should I know my daily and monthly APR?

The balance on your credit card might change on a daily, weekly, and monthly basis. You can better understand how much your money will interest you by calculating your daily and monthly APR. Understanding how much of your money goes to interest rather than your balance may drive you to pay off your debt or assist you in deciding which purchases are worthwhile to place on your credit card. You may learn more about the interest you’re earning over time and utilize this information to make financial decisions by breaking down your interest rates daily and monthly.

Will I have to pay annual percentage rate charges?

If you have a credit card balance, your issuer will charge you APR interest at a rate they computed and decided. Fixed rate, variable rate, and promotional rate are the three primary types of APR. If you have a fixed-rate card, your APR will likely remain the same for the duration of your account unless otherwise stated. Depending on federal rates, variable rates may rise or fall. Zero-interest or low-interest periods offered as introductory incentives by credit card providers are examples of promotional rates.

Check your cardmember agreement and monthly credit card bills to see which rates are linked to your credit card.

The bottom line

When applying for a loan, investment, or mortgage, it is common for lenders to charge fees or points in addition to interest. Hence, instead of merely focusing on interest, lenders should pay more attention to the annual percentage rate, or real APR, when considering the actual cost.