Fraud Triangle in Business

Opportunity, pressure, and rationalization are the motives of an individual or group that compel them to conduct fraud. But do you wonder how to spot it and deal with it? Read this article to get the insight in order to prevent your business from any potential fraud.

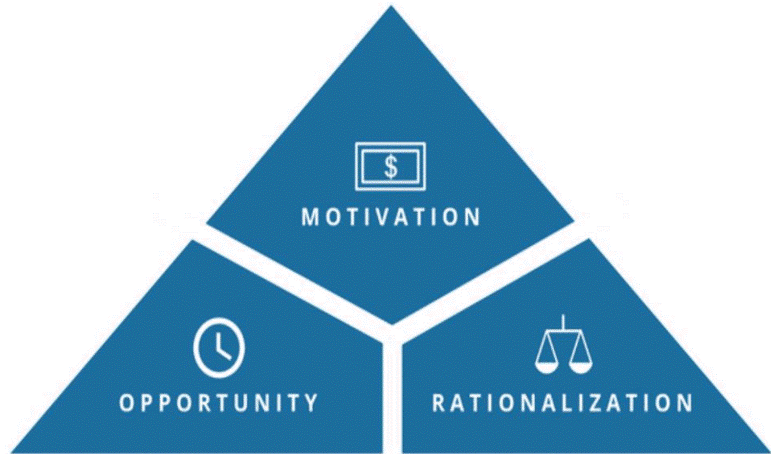

In business, comprehending the intricacies of fraud is paramount for deterring, detecting, and investigating fraudulent activities. Delving into the “how” and “why” behind such actions equips managers and business owners to establish policies and internal controls that effectively mitigate fraud risks. The enduring concept of the fraud triangle acts as a symbolic map, aiding our understanding and analysis of fraud. This theory identifies three critical elements that drive fraudulent behavior: perceived financial need, opportunity, and rationalization.

The motivation to fathom the psychology behind employee fraud is evident. While crime insurance can provide coverage post-incident, uncovering the factors leading to employee fraud can facilitate proactive prevention. Criminologist Donald R. Cressey’s 1970s model, known as the “fraud triangle,” highlights three essential conditions that elevate occupational fraud risk: motivation, opportunity, and rationalization.

When an employee harbors a motive, seizes an opportunity, and justifies their actions, the likelihood of occupational crime surges. Discover each facet of the fraud triangle, their contribution to fraud, and strategies to avert their emergence within your workforce. Smaller businesses, lacking the resources for preemptive measures, become susceptible to potential fraud. Their inability to promptly detect and counter scams amplifies their risk. Embracing the Principles of the fraud triangle becomes pivotal for both small and large enterprises, acting as a shield against potential criminal activity perpetrated by employees.

Shifting the focus to proactive measures is imperative to safeguard businesses against fraud. Relying on a reactionary approach can lead to substantial losses before the true extent of damage is realized. Creating a culture of whistleblowing empowers employees to raise concerns, allowing the organization to act swiftly and mitigate risks. This early intervention mechanism prevents substantial losses by gathering information and implementing timely interventions.

What is fraud?

Fraud is a calculated deception orchestrated by an organization to secure personal gain. It highlights deceitful tactics aimed at unauthorized advantages or illicit profits, inflicting financial harm on the affected parties. Without detection, an employee clandestinely pocketing cash from the company’s register exemplifies this deceitful act, favoring personal benefit while causing a company loss.

This intricate maneuver often hinges on manipulating information through withholding facts or disseminating false data. The perpetrator capitalizes on information asymmetry, using their insider knowledge to deceive victims. The endeavor may involve forging documents, tampering with computer files, embezzlement, fraudulent financial reporting, or procuring payment for undelivered goods or services. Fraud isn’t confined to individuals; organizations can use deceptive practices for substantial gains.

Fraud capitalizes on a lack of transparency, imposing a significant resource cost to validate and verify data. It discourages investments in fraud prevention measures. Fraudulence extends its reach to individual, group, and organizational levels. Instances of conflict of interest, unethical behavior, and unauthorized receipt of wages or benefits fall within its spectrum.

Occupational fraud remains a grave global concern, siphoning off substantial revenue. Research indicates that companies lose 5% of their annual income to occupational fraud, translating to a staggering $4 trillion loss on a global scale. Organizations vulnerable to such threats often lack robust anti-fraud policies, as the 2018 Global Study on Occupational Fraud and Abuse highlights.

To combat this menace, I gained insights into the fraud triangle. At the heart of this activity, the perpetrator has the information used to deceive the victim by taking advantage of information asymmetry. The resource cost of reviewing and verifying the data can be significant enough to create a disincentive to invest in fraud prevention.

There can be innumerable examples of fraud happening at the individual, group, and organization levels; some of the models, however, can be:

- Forgery or alteration of documents

- Unauthorized manipulation or alteration of computer files

- Embezzlement

- Fraudulent financial reporting

- Authorization or receipt of payment for goods not received or services not performed.

- It is a violation to use university resources such as funds, supplies, facilities, equipment, services, inventory, or other assets in a manner that misappropriates or misuses them.

- Conflict of interests or ethics violation

- Authorization or receipt of unearned wages or benefits.

Occupational fraud is a severe issue for organizations around the world. Research from the Association of Certified Fraud Examiners states that occupational frauds cost companies 5% of their revenue every year, which makes a $4 trillion loss on the global scale. A 2018 Global Study on Occupational Fraud and Abuse study stated that companies at risk of bearing occupational fraud have failed to carve comprehensive policies to prevent, detect, and mitigate fraud.

Gaining insight by understanding the fraud triangle can help these companies, accountants, and counsel develop proper internal controls to help formulate strategies to decrease fraud activities at the workplace.

Fraud Triangle

To combat the pervasive threat of fraud, it’s insufficient to acknowledge its occurrence merely. Delving deeper into the roots of its emergence is crucial. This understanding facilitates the development of effective policies and strategies and serves as a proactive measure to eradicate the issue for the long haul. At the heart of this pursuit lies the “fraud triangle,” pioneered by the esteemed American criminologist Donald R. Cressey.

In his seminal work “Other People’s Money: A Study in the Social Psychology of Embezzlement,” Cressey tackled a pressing question: What prompts individuals to succumb to the allure of fraud? Cressey’s hypothesis encapsulates the essence of the fraud triangle: “Trusted persons become trust violators when they conceive of themselves as having a financial problem which is non-shareable, are aware this problem can be secretly resolved by violation of the position of financial trust, and can apply to their conduct in that situation verbalizations which enable them to adjust their conceptions of themselves as trusted persons with their conceptions of themselves as users of the entrusted funds and property.”

His curiosity drove him to explore the intricate circumstances that push individuals to transform from trusted entities to fraud perpetrators. By recognizing the convergence of financial strain, the perception of non-shareable financial woes, and the internal justification for breaching the boundaries of trust, Cressey unveiled the intricate mechanics behind fraudulent behavior.

This understanding of the fraud triangle empowers organizations and individuals to proactively address the root causes of fraud. Armed with this knowledge, they can design robust safeguards, cultivate a culture of transparency, and preemptively thwart the allure of fraudulent conduct. The fraud triangle is a beacon guiding us toward a future untainted by fraudulent behavior.

Three essential elements

To effectively combat fraudulent behavior, it’s crucial to recognize its occurrence and delve deeper into its underlying causes and methodologies. This understanding is pivotal in devising comprehensive policies and strategies that can mitigate the issue in the long term. Renowned American criminologist Dr. Donald R. Cressey introduced the “fraud triangle” concept in his book “Other People’s Money: A Study in the Social Psychology of Embezzlement.” Dr. Cressey’s search highlighted that all three elements of the fraud triangle must coexist for a person to commit fraud. Let’s take a closer look at each of these parts:

- Opportunity

- Pressure

- Rationalization

They made a triangle explaining that these temptations justify the embezzlers to conduct fraud in their capacity.

Securing Opportunities Against Fraud in Organizations

In the realm of theft, opportunity arises when valuable assets meet lax oversight, facilitating fraudulent acts. Financial difficulties or the craving for status can motivate individuals to commit fraud, exploiting weaknesses in organizational systems. Strong controls prevent such exploits, whereas inadequate oversight and unsegregated duties create vulnerabilities.

For instance, an employee with access to customer emails, check deposits, and accounts receivable can easily divert funds without checks and balances. Effective measures include strict segregation of duties and vigilant supervision to deter fraud. Organizations must enforce punitive measures to discourage potential wrongdoers from exploiting any gaps in the system.

Pressure

The second aspect, opportunity, refers to the perceived chance to commit fraud with minimal risk of detection. It is where individuals identify loopholes or weaknesses in a system that allows them to execute fraudulent acts. Examples of such opportunities include:

- Manipulating work hours or sales numbers for higher pay.

- Generating fake invoices to pocket money.

- Selling confidential company information to competitors.

The allure of maintaining social status often prompts fraudsters to keep their actions hidden, emphasizing the need for foolproof methods.

PressureIt is also known as motivation for the individual to commit fraud. Finding the guts to go off the record and putting the effort into doing something risky to its core, the perpetrator would have the motivation that overrides all the potential risks. These motives can be personal or occupational. Unique situations caused an increased demand for money, for example, vices like drugs and gambling or merely life problems such as a spouse losing a job, children needing tuition fees, overwhelming debts, addiction, or divorce. Occupational motives may include unrealistic performance targets pushing an individual to go off the board.

Rationalization

Rationalization is the element that pushes the perpetrator to justify their act. There can be multiple channels through which he can explain his fraud as not a wrongful activity but as a forceful compensation to him in exchange for the injustice that happened to him. For instance, a person may feel stealing is justifiable because they did not pay their due compensation or management did not care about their overburdening workload.

Rationalization constitutes the third corner of the triangle. After identifying motivation and opportunity, individuals must rationalize their actions as justifiable. Many first-time offenders don’t perceive themselves as criminals but as individuals facing difficult circumstances. Rationalizations involve considering the act as borrowing money or feeling entitled due to perceived injustices, such as low pay, lack of recognition, or personal financial burdens.

The other way of justifying the wrongful act is by seeing the superiors at the organization showing unethical behavior and getting away with it. In this scenario, the employee may feel that the management does not care about the wrongful behavior conducted by other workers, which is tolerated and overlooked. So, he can assume that he can also get away with it.

The fraudsters often use these sentences to justify what they are doing as not a big deal:

- Everyone skims a little off the top

- We waste so much anyway; why shouldn’t I benefit from it?

- They expect you to do this; it is one of the perks of the job

- Our company is so huge if I’m taking a little, it won’t miss it

Companies should champion transparency in their finances to prevent these little but constant mistakes and misgivings. If it explains that a holiday bonus depends on the company’s specific financial target, they would probably better realize the value of some dollars here and there.

Also, companies should make preemptive policies rather than responsive ones. Such as management should know the people working at the firm. There should be programs that can alleviate pressure on the workers; for example, these programs should help them in their time of need. If they are battling addiction or other family issues, It should provide anonymous help where they turn around when needed.

Management should remain “in tune” with the needs of their employees so that they can know the people working for them to achieve tremendous success. If they can win their trust, they will Pay off in the long run.

Red flags for fraud

It is the responsibility of the manager and employers to watch out for the people working under the organization. They should be aware of the red flags for fraud as these are the warning signs that the risk is higher. One or two characters should not be considered a grim concern, but it is better to contact the Internal Audit Department if they occur often.

Here are examples of employee red flags:

- Significant debt and credit problems

- Employee lifestyle changes: expensive cars, jewelry, clothes, homes

- High employee turnover, especially in those areas that are vulnerable to fraud

- Behavioral changes: alcohol, drugs, gambling, or just fear of losing a job

- Lack of segregation of duties in vulnerable areas

- Refusal to take sick leaves or vacation

Red flags for management

- Management frequently overrides internal controls

- Managers showing significant disrespect for regulatory bodies

- Weak internal control environment

- Accountant personnel are lax or inexperienced in their duties

- Policies and procedures are not documented or enforced

- Decentralization without adequate monitoring

- High employee rate turnover; low employee morale

- Refusal to use the serial numbered written (receipts)

- A compensation program that is out of proportion

- Excessive number of checking accounts; frequent changes in bank accounts

- Photocopied or missing documents

- A disproportionate number of year-end transactions, unnecessarily convoluted transactions

- An individual or small group dominates management decisions

- Reluctance to provide information to or engage in frequent disputes with auditors

Types of fraud

The Association of Certified Fraud Examiners states in their study that organizations worldwide lose 5% of their revenue on fraud inside their place. Although the percentage seems minuscule, by summing it up, it makes a whopping $3.7 trillion annually. It does not even count the effects of the loss that the company faces as the result of this fraud, which also renders more money loss, such as negative reputation and company morale.

So, companies must watch out for their employees’ conduct at the office and take measures to prevent that from happening frequently. Below is the list of common types of fraud that organizations worldwide have to cater to.

Payroll fraud

There are multiple ways through which employers get to do scams on payroll, such as:

- Lying about their productivity, sales, and working hours to get higher pay

- Requesting for an advance payroll without having any intention of giving it back on time

- En-listing a co-worker to manipulate their attendance record by clocking in and out for them

- They falsely claim expenses they will reimburse without having the right to do so, such as a meal with friends and family as a business expense.

- They are falsifying pay rates through internal collaboration between employees and the payroll department, whereby additional funds are allocated, paid out, and then divided between the two parties.

- She was unjustly receiving commissions and funds from employees.

Studies suggest that Payroll frauds are likely to occur within small businesses as they don’t have advanced anti-fraud measures and systems.

How to avoid it: Do background checks frequently on every employee, and if you suspect anyone in the office, ask your managers to watch their activities closely. Also, ask your managers to manage timesheets and use a secure payroll service system nearby. If there is any misfortune event happening at the place by anybody, try to take strict action against him so that others in the organization get a lesson for the future.

Invoice fraud schemes

Invoice fraud occurs when an employee, usually from sales and accounting, creates fake invoices for products and services never bought to steal money from the organization for his unlawful benefit. He can also create a phony supplier or shell to funnel cash to or award inflated rewards to his friends and family. He abused his power by hoarding money for personal benefit.

How to avoid it: Cross-check every invoice the team produces to confirm that it only mentions the goods and services bought. Do comprehensive background checks before approving a new supplier.

Asset misappropriation

This type of fraud happens by the most trusted employees in the organization as they hold and manage the assets and interests of an organization. Typically, the scam includes cash or cash equivalents such as vouchers and credit notes, but it can extend to include company data and intellectual property.

The fraud may occur by an employee lying about their qualifications to get the job, or it can be done by an organized crime group that infiltrates the organization and takes advantage of the weak process and inadequate security system and controls.

How to avoid it: Keep rotating cash-handling staff and never entrust all financial tasks to just one employee. Also, if you suspect the fraud is occurring right now, you should contact the police to start a criminal investigation. If you have found out the employee(s), fire them immediately and look for others to identify whether there is any kind of systematic failure across your organization to prevent this from happening again.

Financial statement fraud

This fraud happens by fudging essential facts such as revenues, assets, sales, and liabilities to deceive investors or the public and manipulate stock or bonuses—the scam. Someone usually does it. To quietly fix the business problem that prevents them from achieving the expected profit or complying with loan covenants. It is also the case that they do it to obtain or renew financing that They cannot acquire by providing honest financial statements.

How to avoid it: Closely watch the financial statements for accurate and consistent information before publication. Also, delegate the different accounting functions to the diverse employees over time.

Data, intellectual property, and identity theft

Securing the sensitive information of your company, which can be personal data or intellectual property, is a crucial matter for each organization because data theft can damage the businesses if trade secrets get leaked, or patents are shared with the competitors by an inside employee of the organization, they can hurt the reputation of the company by lowering customer trust.

How to avoid it: Tighten your security inside the organization and restrict access to high-level documents of the company. Formulate a security policy for the classification and handling of sensitive information.

Tax fraud

This type of fraud occurs when an individual or business entity intentionally provides false information about the earnings and expenses of the company to the Internal Revenue Service to limit the amount of tax liability. The company cheats on the reporting tax return to avoid paying the entire tax obligation.

Tax fraud includes:

- Claiming a false deduction.

- Using an incorrect Social Security

- Claiming personal expenses as business expenses.

- Not reporting income

The government suffers millions of dollars in loss each year due to tax fraud.

How to avoid it: Do not misreport your company’s earnings and expense information in tax returns. Ensure that you file your taxes ultimately and accurately on time.

Insurance and banking fraud

Insurance fraud is an illegal fraud that happens from both the buyer’s and seller’s sides. This fraud from the seller’s side includes selling policies from companies that don’t exist, failing to submit premiums, or swapping policies to cost more commissions. Buyers fraud, however, by exaggerating claims, post-dated policies, providing falsified medical history, viatical fraud, faking death, disease, kidnapping, and murder.

How to avoid it: Companies should be strict about the requirement of the filing of the information from the customers while filing insurance/workers’ compensation. Ensure that the documents provided at the hand of the customer are not fake and the information provided is accurate.

Money fraud

Money fraud occurs when customers fake the bills to make actual purchases. If you don’t check the accounts on time, you may make foul decisions and not even notice before it’s too late, as they would pay counterfeit notes.

How to avoid it: Train your employees to check if the customer is paying counterfeit banknotes. You can invest in the counterfeit money detector if you regularly handle large amounts of cash.

Return fraud

Some retail businesses have a return, refund, and exchange that allows the customers to return defective items. Still, some customers take advantage of this policy by lying about the purchases, returning stolen items, using items before the return period is up to get the money back, stealing receipts, etc. The return industry loses $24 billion annually in fraud or policy abuse, accounting for 8% of returns.

How to avoid it: Make sure to receive receipts of returns and exchanges. If you must refund the customers, give store credit instead of cash.

Bribery and corruption:

If a company has a frequent practice of bribery and corruption, it can ruin the organization from its core. It encompasses a variety of techniques, such as skimming/getting kickbacks from projects, manipulating contracts to favor some over others, and using money to influence significant company decisions.

How to avoid it: Make policies and implement stricter measures and gifting guidelines so that the employees give rewards for their responsible conduct at the organization. Conduct due diligence with the employees, management, and third-party vendors.

Challenges of the Fraud Triangle

In the realm of fraud prevention, the fraud triangle model unveils several significant challenges that organizations must address head-on. Let’s delve into these challenges and explore strategies to overcome them:

Strong internal control

A formidable internal control system is paramount to obstruct the inclination of organizations and management toward fraud. It entails adhering to legal mandates and establishing stringent penalties for fraudulent activities. Organizations can significantly curtail its occurrence by creating an environment where the risk of fraud actively meets with severe impact.

Favorable employee policies

A vital challenge lies in crafting policies that foster a supportive environment for those facing financial constraints. Offering avenues for employees needing Financial assistance from the company can diminish the temptation to resort to fraud. Providing alternatives that alleviate financial pressures can be a potent deterrent against fraudulent behavior.

Strong fraud deterrence policies

Instilling a culture of deterrence is crucial. Robust policies that emphasize the dire repercussions of fraud can deter employees from even contemplating dishonest actions. The awareness of stringent consequences is a powerful barrier against unethical conduct and increases the organization’s dedication to integrity.

Ethical training

Equipping all employees with comprehensive moral training forms a critical challenge. Such activity underscores the paramount importance of ethics in all facets of life. By instilling the understanding that fraud and deception are inherently unethical, organizations can reshape the mindset of potential fraudsters. This approach cultivates a culture where ethical considerations take priority over fraudulent temptations.

To navigate these challenges successfully, organizations must develop a multifaceted strategy encompassing solid internal controls, empathetic employee policies, potent fraud deterrence measures, and pervasive ethical education. By addressing each facet of the fraud triangle’s challenges, businesses can construct a robust defense against fraudulent activities. In doing so, they reinforce their commitment to ethical conduct, safeguard their reputation, and fortify the financial well-being of their operations.

Other fraud risk protection measures

- Make fraud reporting a welcoming culture in your organization where everyone gets accessible channels to deliver if they see any red flags in the office. Ensure that the one writing any mischief happening in the office is highly rewarded.

- Restrict and closely monitor access to sensitive information.

- Make surprise audits and inspections a norm of the organization, and regular checkups can help you spot and identify fraudulent behavior and mitigate the damage immediately. These practices will also help you identify the system’s weakness that needs prompt action.

- Compose comprehensive anti-fraud, anti-bribery, and anti-corruption policies and implement them in their true spirit. And make sure the perpetrators meet the consequences if they commit any fraud.

- Welcome to the whistleblowing environment.

Reporting fraud and scams

If you have been scammed fraud by a criminal group or a business entity, you can claim a copy to your respective authorities by:

- Report the scam to your state consumer protection office

- Reporting federal government via federal agency directory

- It is submitting a complaint online with the Federal Trade Commission. FTC is the most common agency that collects scam reports. The claim can be reported online or by phone at 1-877-382-4357

- Contacting your local police or sheriff’s house,

- Reporting claim to your state attorney general

Real-Life Examples of the Fraud Triangle

Fraudulent schemes often find their roots in the three critical elements of the fraud triangle: incentive, opportunity, and rationalization. Let’s delve into a couple of real-life instances that vividly illustrate these components and shed light on the complexities of fraud:

Theranos: A blood-testing deception

The story of Theranos and its founder, Elizabeth Holmes, stands as a compelling case of fraud that epitomizes the fraud triangle’s dynamics. Promising revolutionary medical technology, Theranos aimed to revolutionize blood testing with a mere drop of blood instead of vials. The company garnered attention, secured partnerships with pharmacy chains, and amassed investments from notable figures.

However, beneath the facade, the technology was non-functional. Holmes manipulated the trust of her board and investors through charisma and media coverage. It conducted no audits, allowing the company to publish fictitious financial figures. The Securities Exchange Commission finally exposed the fraud, demonstrating how incentive, opportunity, and rationalization can intertwine to deceive even the most discerning eyes.

Ultracolour’s employee drain

In another instance, a small business owner, Greg, experienced a significant theft of $3.7 million by a trusted employee, Vicki. Vicki, responsible for administration and accounting, exploited her access to the company’s bank accounts and accounting system. She masked her embezzlement through intricate transactions. Vicki’s motive was driven by her gambling addiction, illustrating the decisive role of incentive in the fraud triangle. With access and an enticing explanation, she capitalized on the opportunity to commit fraud.

Navigating real-life complexities

These are just two examples of countless instances of fraud that occur daily. Employee theft, often involving cash, remains a pervasive issue. Small businesses, with limited internal control systems and entrusted employees, are particularly susceptible. Accountants and management are crucial in implementing internal controls to mitigate the opportunity’s lure. Internal auditors, external auditors, and certified accountants play instrumental roles in this endeavor.

Mitigating risk and ensuring transparency

While internal control systems offer a defense against fraud, they can be overridden if not upheld by management. Establishing robust controls and adhering to ethical standards become paramount. The case of UltraColour also highlights the significance of empathy and understanding the motivations behind fraud. With their distinct vulnerabilities, small businesses must actively address the three components of the fraud triangle to foster a culture of transparency and accountability.

As these real-life examples demonstrate, the fraud triangle serves as a valuable framework to comprehend the intricate interplay between incentives, opportunities, and rationalizations in the realm of fraud. It reinforces the importance of proactive measures, ethical training, and vigilant oversight to prevent and deter fraudulent activities within organizations.

FAQs

What three categories of fraud exist?

There are three main categories of fraud: asset misappropriation, bribery and corruption, and financial statement fraud. These categories encompass various fraudulent activities that individuals might engage in within a business setting.

What traits does the fraud triangle have?

The fraud triangle consists of three essential elements: non shareable financial need, apparent opportunity, and rationalization. When all three parts are present, it increases the likelihood of someone engaging in fraudulent behavior.

What is the purpose of the fraud triangle in auditing?

The fraud triangle is a valuable tool in auditing as it guides internal auditors to assess anti-fraud internal controls thoroughly. It helps auditors identify potential vulnerabilities and gaps in an organization’s measures against fraud.

What are the three stages of fraud?

Fraud typically occurs in three stages: opportunity, pressure, and rationalization. The first stage involves finding a way to commit fraud without being detected. The second stage involves external or internal forces that drive someone to commit fraud. The third stage is the cognitive process of justifying the fraudulent behavior.

Is the fraud triangle a theory?

The fraud triangle is a theoretical framework explaining the psychological and situational factors contributing to fraudulent actions. It comprises the three key components: opportunity, pressure, and rationalization.

What is meant by the fraud triangle?

The fraud triangle is a theory used to understand the dynamics of fraudulent behavior within organizations. It helps analyze how opportunity, pressure, and rationalization interact to create an environment conducive to fraudulent activities. Auditors and businesses use this concept to evaluate and strengthen their anti-fraud measures.

How does the fraud triangle relate to employee theft?

The fraud triangle provides insights into the factors that may lead to employee theft. When employees face financial pressures, perceive an opportunity to steal, and can rationalize their actions, the conditions for employee theft are met.

Can the fraud triangle prevent fraud?

While the fraud triangle doesn’t prevent fraud directly, understanding its components allows organizations to design better preventive measures. By addressing the root causes of fraud chance, pressure, and justification, businesses can implement strategies to minimize the risk of dishonest proceedings.

Are there any real-world instances of the fraud triangle in activity?

Yes, there are real-world cases where the fraud triangle’s elements played a role. One notable example is the Theranos scandal, where a charismatic CEO capitalized on perceived opportunities, financial pressures, and rationalizations to deceive investors and the public.

How can businesses use the fraud triangle to protect themselves?

Businesses can use the fraud triangle to enhance their fraud prevention efforts. By identifying potential vulnerabilities, reducing financial pressures on employees, and promoting an ethical culture, organizations can create an environment less conducive to fraudulent behavior.

Conclusion

Effective management teams can turn a company into a market success or cause chaos through mismanagement and fraud. Fraudulent activities within an organization can severely undermine its foundation, leading to long-term consequences. It is crucial for companies to establish and maintain vigilant management teams that actively detect and prevent any potential fraud, whether initiated by individual employees or groups across different departments.

Implementing comprehensive anti-fraud policies is essential to ensure ethical business conduct and prevent criminal behavior from becoming institutionalized. In the event of any wrongdoing, prompt reporting to relevant authorities is imperative. Perpetrators must face strict consequences to deter future misconduct within the organization. Additionally, fostering a whistleblowing culture encourages early detection and reporting of issues before they escalate and cause significant harm.

By proactively managing these aspects, companies not only protect their integrity but also create a culture of transparency and accountability. This approach not only mitigates risks but also enhances trust among stakeholders and strengthens the organization’s standing in the market.