House Insurance Cost: An Informative Understanding Unveiled

House remains an important component of one’s life therefore it is pivotal to get one self-insured but the question that comes to the mind of many is what exactly is the cost of house insurance.

House insurance, often known as homeowner’s insurance (abbreviated as HOI in the real estate sector in the United States), is a type of property insurance that protects a private residence.

It is a policy that combines various personal insurance protections, such as losses to a homeowner’s home, its contents, loss of use (additional living expenses), or loss of other personal belongings, as well as liability insurance for accidents that may occur at the home or at the hands of the homeowner within the policy territory.

In addition, homeowner’s insurance protects you financially in the event of a disaster. A conventional home insurance coverage covers both the house and the contents inside.

Insurance companies in this sector often offer packages that include other coverage more or less directly related to home or family life, such as liability insurance, travel assistance insurance, legal aid insurance, etc.

In horizontal ownership dwellings, multi-risk insurance for each dwelling often coexists with other community insurance, which covers similar risks but in terms of the common elements of the building.

One of the most important aspects to take into account when securing a home is the concept of underinsurance.

Underinsurance occurs when the value of the insured capital is less than the replacement value of the insured object. In the case of home insurance can be given both on the mainland (building value) and in the content (trousseau, appliances, etc).

When declaring a claim, an expert verifies the policy values. If there’s underinsurance, the proportional rule applies: “Compensation is reduced proportionally to the amount of underinsurance.” For example, if a home valued at $40,000 is insured for $30,000 and suffers a $5,000 loss, compensation is $3,750 due to 25% underinsurance.

What is house insurance?

A house insurance policy is a multiple-line insurance policy, which means it covers both property and liability risks and has an indivisible premium, which means it is paid once for all risks. This means that it covers both property damage and liability for injuries and property damage caused to others by the owner or members of his or her family.

It could also involve damage caused by dogs in the home. In the United States, standardised policy forms are used to categorise coverage. Coverage restrictions are usually expressed as a percentage of primary Coverage A, which covers the primary residence.

The cost of homeowner’s insurance is often determined by the cost of replacing the house and the policy’s supplementary endorsements or riders.

You may have pondered about the worth of home insurance if you’re buying a new home or have already paid off your mortgage. Your house is most likely one of your most valued assets. In a variety of ways, homeowners insurance protects your investment — and you.

Significant reasons to consider homeowner’s insurance

Here are some of the most significant reasons to consider homeowner’s insurance.

Homeowners insurance is necessary in some circumstances.

According to the Insurance Information Institute, if you have a mortgage, your lender will almost certainly require you to obtain homeowners insurance (III).

Before funding or refinancing your mortgage, the mortgage company will usually require confirmation that your home is fully insured. This is because the lender wants to ensure that its financial investment in your property is protected in the event of a fire or other unforeseen events.

What else do mortgage firms require?

Other types of insurance may be required by mortgage firms in addition to home insurance. Different insurance requirements may apply depending on where you live. If your home is in a high-risk flood zone, for example, you may be required to get flood insurance.

If you don’t have homeowners insurance, your lender is permitted to purchase it and charge you for it, according to the Consumer Financial Protection Bureau.

Keep in mind, however, that the lender’s insurance policy may be more expensive and provide less coverage than what you could get on your own.

Why is house insurance important?

Homeowner insurance protects more than your house

While a regular homeowners policy might help protect your home, it usually covers more than just the physical structure.

A normal homes insurance policy may cover everything from your personal items to the shed in your backyard, as well as medical fees if a guest is harmed on your property:

Dwelling coverage

Dwelling coverage, often known as “dwelling insurance,” is a component of your homeowners insurance policy that may assist in the rebuilding or repair of your home’s physical structure if it is damaged by a covered danger.

It helps pay for repairs if a covered peril damages your home and any associated structures, such as a deck or garage.

The quantity of dwelling coverage you require is typically determined by the square footage of your home and the cost of rebuilding it.

This isn’t always your home’s market value. Certain dangers, or perils, are covered by most conventional homes insurance plans, according to the Insurance Information Institute.

While coverage varies from state to state and geographical region to geographical region, homeowners policies commonly cover the following events:

- Fire/smoke

- Hail explosions caused by windstorms when lightning strikes

- Vandalism

- Theft

- The weight of snow, sleet, or ice causes damage.

- Objects that fall

- An aeroplane has caused damage.

- Accidental damage caused by a motor vehicle

While housing insurance usually covers these risks, you should always verify your own homeowners insurance policy to see what it covers.

What is not covered by dwelling insurance?

Floods, earthquakes, sewer backups, and damage caused by a lack of upkeep are often not covered by a normal homeowners insurance policy.

To assist cover some of these additional risks, you may be able to purchase supplementary coverage or a separate insurance policy. To help cover sewage backups, you might be able to add water backup coverage to your existing homeowners insurance policy.

Alternatively, flood insurance may be available to help protect your house from floods.

Find out what choices are available to you by speaking with your insurance representative.

A homeowners policy’s dwelling coverage differs from a condo insurance policy’s building property protection.

Building property protection helps pay for repairs to your condo unit’s walls and interior if it is damaged by a covered risk. Other sections of the building, such as the roof, elevator, basement, courtyards, or walkways, may be covered by your condo association’s insurance policy.

Coverage of other structures

If a covered danger damages or destroys detached structures on your property, such as a fence or shed, the other structures covered in your policy helps pay for repairs or replacement.

Other structures coverage is a feature of a homes insurance policy that helps cover the cost of repairing or replacing structures other than your home, such as a fence, if they are damaged by a covered risk. Other structures coverage, for example, may assist pay for repairs if a tree falls on your detached garage.

How much coverage does one have for other structures?

According to the Insurance Information Institute, additional structure coverage may be based on a proportion of your dwelling coverage.

For example, if your dwelling coverage is $300,000 and applies to your house and attached structures, your fence and other unattached structures on your land may be covered for up to $30,000.

If you’re making changes to your property, such as installing a gazebo, check your other structures’ coverage limits to be sure you have adequate coverage to pay for repairs or replacements of unattached structures in the event of a covered loss.

Your insurance company can assist you in modifying your coverage limitations.

Coverage of personal belongings

Personal property coverage assists with the replacement of specific items such as furniture and electronics that are stolen or damaged as a result of a covered loss.

Replacement cost and actual cash value are the two forms of personal property coverage.

A replacement cost policy covers the amount required to purchase a new item at the time of a claim.

Depreciation is factored into an actual cash value policy, which provides reimbursement based on the item’s current worth. It’s also worth noting that most personal property insurance policies have restrictions on how much they’ll pay to replace an item or a group of goods.

Do my belongings get covered by renters insurance?

Renters frequently believe that their landlord’s insurance policy will cover their personal items. While landlord insurance can assist protect a property from certain threats, it usually does not cover a renter’s personal possessions.

Personal property coverage in a renters policy helps to protect your items, such as cameras and computers, up to the policy’s coverage limits.

Is my personal property covered by homeowners insurance?

In addition to providing coverage for your house and liability, most homeowners insurance policies also cover personal items up to the policy’s limitations.

As a result, if your home is damaged by a covered risk, such as fire, homeowners insurance often helps pay for repairs not only to the structure of the home, but also to the contents inside.

Coverage is subject to the restrictions and limitations set forth in your policy, so read it carefully or contact your agent with any questions.

What are the exclusions to personal property coverage?

When your items are destroyed by certain hazards, personal property coverage kicks in. It’s crucial to remember that a regular insurance policy does not cover all dangers.

Personal property coverage under a homeowners, condo, or renters insurance policy, for example, is unlikely to reimburse you if your goods are damaged in a flood.

You may be able to file a claim for flood-damaged objects in your house if you have a separate flood insurance policy. To find out what types of hazards your insurance may or may not cover, read your policy or contact your agent.

Because the value of your possessions can quickly accumulate, it’s critical to understand what kind of coverage you have in place in case the unthinkable happens.

Coverage for personal liability

Liability coverage may assist pay for related repair expenses and legal fees, as well as medical bills, if you or a family member is found legally responsible for accidentally destroying someone else’s property or hurting someone.

Medical coverage for visitors

If a visitor is hurt on your property by accident, your policy’s guest medical coverage helps pay for their medical expenditures.

Coverage of extra living expenses

If you are unable to remain in your home due to a fire or other insured loss, your homeowners insurance coverage may cover temporary living expenses such as hotel fees.

Homeowners insurance limits and deductibles

Keep in mind that coverages have limits, which are the maximum amounts your insurance policy will pay toward a covered claim.

Consider things like the cost of reconstructing your home or replacing your goods when deciding on your coverage limits. That way, you’ll be better prepared if a fire or other covered peril damages or destroys your home or goods. Many policies include deductibles, so keep that in mind.

The amount you must pay before your insurance benefits kick in to help compensate you for a covered claim is referred to as a deductible.

A homeowners insurance coverage will not prevent damage to your home or personal items, but it will provide a financial safety net in the event that something unforeseen happens.

An insurance agent can assist you in purchasing a homeowners insurance coverage that meets your needs, allowing you to be better prepared in the event of a storm or other disaster.

How is homeowners insurance calculated?

How much will my homeowner’s insurance cost? This may be one of the first questions that comes to mind while purchasing a new house. And it’s a crucial question, especially if you’re attempting to figure out how to budget your living expenses. To answer that question succinctly, it depends. Here are a few things to consider when determining how much homeowners insurance will cost you:

- The deductible that you select

- The worth of your home and possessions

- Your claim history with insurance

- Other factors to consider are your home’s age and location.

A variety of factors influence the types and amount of coverage you require. These factors include the location, size, and amenities of your home. There is no one-size-fits-all “rule of thumb” that applies to everyone.

Also, the amount you pay for your home may not be a significant factor in your insurance premiums. Many other factors are factored into the process for determining adequate insurance.

How Location Affects Home Insurance Coverage

The threats your house faces often depend on its location. For example, homeowners in Miami need different insurance coverage compared to those in Boston, even for identical homes.

Why? Replacement cost varies by region due to differences in construction and material prices. Labor and materials also differ geographically.

Homeowners insurance helps cover the cost of repairing or rebuilding your home if it’s damaged or destroyed. Thus, the amount of insurance you need depends on local costs.

Labor costs can vary significantly between regions. Selecting coverage based solely on your home’s purchase price might not be accurate. Repairing or rebuilding could cost less or more than your purchase price.

To ensure adequate coverage, consider the actual cost of repairs or rebuilding in your area, not just the purchase price.

Construction materials and improvements

Do you have a unique tile roof on your house? In the event of hail or similar covered threat, this could cost more to repair or replace than a house with a regular asphalt roof.

Interior details are the same way: When deciding the proper amount of insurance for your house, consider features such as crown mouldings, hardwood floors, a gourmet kitchen with granite counters, or a spa-quality bathroom.

Structures not included

When deciding on coverage limits, think about things like a pool, shed, fences, and other structures on your property that could be damaged so you can make sure your coverage limits are adequate.

Household, age, risk factors, and other factors affecting cost

The cost of your home’s insurance coverage can be influenced by a number of things. According to the III, the following are some of the factors that may influence how much you spend for home insurance:

- Your residence’s age

- The roof’s condition

- Where do you reside?

- The characteristics of your house (such as a swimming pool or fence)

It’s helpful to understand how the coverages, coverage limits, and deductibles you select affect the cost of a policy while searching for homes insurance.

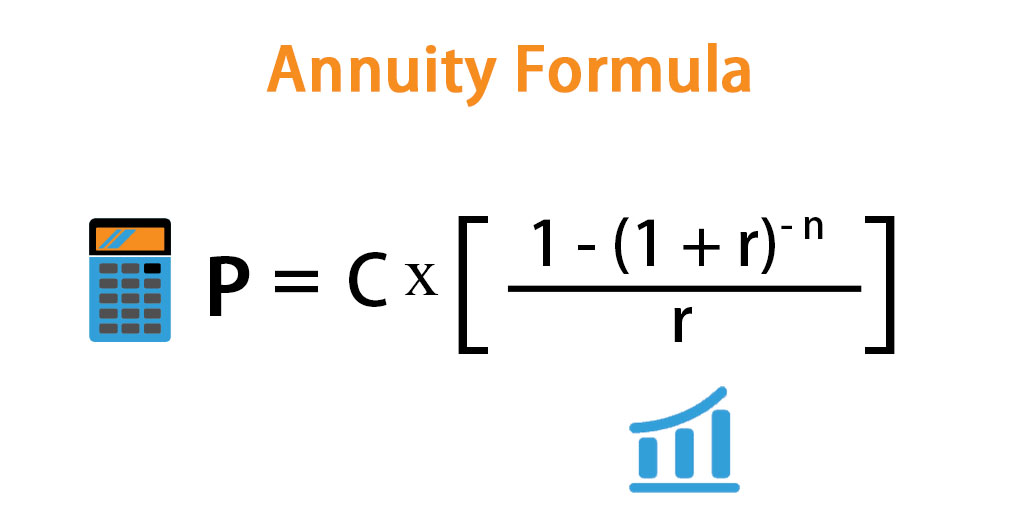

House insurance cost calculator

To get an exact cost comparison, you’ll need to know three things: the cost of replacing your home at today’s building and labour prices, the worth of your personal items (excluding vehicles), and the value of your combined assets in case you’re sued for an accident.

Calculate the cost of replacing your home

The amount of dwelling coverage you require will be determined by your replacement cost estimate, which is an estimate of how much it would cost to rebuild your home from the bottom up.

Keep in mind that your dwelling coverage maximum should be equivalent to the rebuild cost of your property, not its fair market value or sales price.

Calculate the worth of your own belongings

You’ll need adequate personal property coverage to cover your clothes, furniture, electronics, and jewellery, among other things.

Although your personal property coverage limit is normally set at 50% of your dwelling coverage limit by default, most insurers will give you the choice to increase it, upgrade your loss payment conditions to replacement cost rather than actual cash value, or adjust your payout limitations for valuables.

Taking an inventory of everything you own is the best approach to determine your personal property coverage needs.

Inventories make classifying and valuing your personal possessions by room and property category simple. Items to consider including in your inventory include, but are not limited to:

- Kitchenware

- Furniture

- Clothing

Calculate the worth of your assets

Personal liability coverage is the element of your insurance that protects your assets if you’re found legally accountable for harming someone or causing property damage to them.

Slip and falls, whether inside or outside the home, dog attacks, and trampoline accidents are all common liability insurance claims. Suits are costly, both in terms of legal bills and the court settlement, and they can put all of your assets at danger.

Most insurers offer personal liability limits of $100,000 to $500,000 in $100,000 increments, but homeowners with a lot of risk on their property (say, a pool on the edge of a cliff) or valuable assets, such as a second home or a sports car collection, should consider getting more liability coverage than the standard amount.

What is the average home insurance cost as per zip code?

According to the National Association of Insurance Commissioners, the average cost of homeowners insurance in the United States is $1,249 per year as of September 2021.

States, zip codes and average home insurance cost

Florida with a zip code of 33050 has a current average home insurance cost of $ 6,295. Texas, the largest US state, has a zip code of 77455 and an average home insurance cost of $ 5, 911. Alabama with a zip code of 36619, has an average home insurance cost of $5,752.

The state of Oklahoma with a zip code of 73016 has an average home insurance cost of $4,966. This is a snapshot of diverse states within the USA with diverse zip codes and varying average home insurance costs too.

What is house insurance cost per month?

According to a survey released by the National Association of Insurance Commissioners (NAIC) in 2021, the average monthly cost of homeowners insurance is $104.08.

Your homeowners insurance quote will be determined by factors such as your location, house value, coverage levels, and discounts.

Managing house insurance monthly cost

Raising your deductible

Raising your insurance deductible, or the amount you pay if you have to file a claim, is a quick way to lower your rate.

According to Mark Friedlander, a spokeswoman for the Insurance Information Institute, if you had a $500 deductible, increasing it to $1,000 may save you up to 20%.

Raising your deductible puts money in your pocket each month that would otherwise go to your insurance company. Just be sure you have enough money set aside to handle a larger out-of-pocket payment in the event you need to file a claim.

Increase the safety of your home

When it comes to home security, even the simplest can save you money.

According to Friedlander, having a smoke detector, burglar alarm, or deadbolt locks on your home can get you a 5% discount.

Taking it a step further and installing a thorough sprinkler system as well as an actively monitored fire and burglar alarm might save you 15% to 20%, according to him.

Don’t bother with minor claims

Even while it may be tempting to submit a claim with your insurer when anything little occurs, you may be better off in the long run if you pay for these lesser charges yourself.

This is because some insurers may give you a discount if you don’t file a claim for a particular amount of time, usually a few years.

Get rid of everything that poses a danger

Even if it’s entertaining, possessing something your insurer considers an “attractive nuisance” — such as trampolines, swimming pools, or playground equipment — will raise your homeowners insurance cost. Getting rid of such things could save you a lot of money on your insurance.

Combine your auto and house insurance policies

According to the Insurance Information Institute, bundling car and house insurance with the same insurer saves you between 5% and 15% on your homeowners premium. Many insurers offer discounts if you purchase many types of policies from them, though this varies by business.

Conclusion

In the U.S., most home buyers secure a mortgage, and lenders often require homeowner’s insurance. This insurance protects the bank if the home is damaged or destroyed.

Several factors influence insurance costs: location, coverage, and the home’s replacement cost. The replacement cost is based on how much it would take to rebuild the home.

Homeowner’s insurance is vital for maintaining the safety and security of your home. It’s essential not to overlook its importance. To manage insurance effectively, understand its costs and adjust your budget accordingly to stay cost-effective.

Remember, homeowner’s insurance safeguards your investment and provides peace of mind, making it an indispensable part of homeownership.