Where is the Serial Number on a Savings Bond?

Read on to find out where is the serial number on a savings bond.

There are currently a million ways to save and invest money; in this article, we’ll break down one of the options for you so you can make a sound investment to secure your money. Saving bonds are an innocuous method to manage money and make a generative investment.

A thing to be noted about saving bonds is that the lifetime of a bond can be extended to up to thirty years. This means that there is a possibility that it can be passed on from one generation to another. Thus saving bonds are highly susceptible to wearing off or getting destroyed over time, and you might lose important cryptic information on them, like their serial number.

If you’re new to investing your funds and have bought a savings bond, you may have a couple of inquiries. Like where is the serial number on a savings bond? What is the serial number on a savings bond? We have gathered all the relevant information to help you understand everything you need. So, what are you waiting for? Without much further ado, let us dive right in!

What is a savings bond?

A savings bond is administration security offered to its residents to help store government spending. Saving bonds give savers an ensured, albeit humble, return. These securities are given with zero coupons at a rebate with a suggested fixed pace of interest throughout a fixed timeframe.

Besides this, a savings bond is a typical sort of government security, which is the security a legislative body gives to raise assets from the general population to finance its capital tasks and different activities important to deal with the economy.

When the public authority sells bonds, it is taking an advance from general society, which it vows to repay at some foreordained date later on. To pay for giving it capital, the public authority makes interest installments to its bondholders.

Numerous individuals discover these bonds alluring in light of the fact that they are not liable to the state or neighborhood personal assessments. These bonds can only, with significant effort, be moved and are non-debatable.

Where is the serial number on a savings bond?

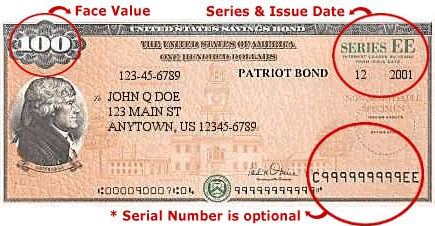

To know where the serial number is on a savings bond, you’ll need to take a closer look at your savings bond. The serial number can be found in the lower right corner of your paper investment funds security.

This data isn’t needed; however, it is significant for record-keeping purposes if your paper bonds are ever lost or wrecked. You can add the serial number to TreasuryDirect’s online calculator for savings bonds to locate the latest estimation of the bond.

It’s a smart thought to compose your reserve funds’ security chronic numbers down and keep them in an area separate from the security declarations. The serial number might be found somewhere else on different kinds of U.S. Depository bonds, commonly in the upper right-hand corner.

Savings bond calculator

To compute the estimation of your investment funds securities, you’ll need to know its sort, division, chronic number, and issue date. When you have this data, you can utilize an investment funds security number cruncher to discover how much your security is worth at the present time. The essential site to do this is treasurydirect.gov, which is controlled by the public authority.

Alongside the adding machine, you can discover point-by-point directions on discovering your security’s future worth, how to assemble and spare stock of bonds (on the off chance that you have multiple), and how to discover the interest to answer to the IRS—which you can do as you go or when the bonds develop.

- Go to the TreasuryDirect “Calculate the Value of Your Paper Savings Bond(s)” site page to get to the U.S. Investment funds Bonds Calculator.

- Skirt the “Worth as of” field that shows the current month and year.

- Check your investment funds security’s sort – EE Bonds, I Bonds, E Bonds, or Savings Notes – at the upper right corner of your security.

- Select that type on the “Arrangement” drop-down menu.

- Select the measure of your bond as shown in its upper left corner – $10, $25, $50, $75, $100, $200, $500, $1,000, $5,000, or $10,000 – on the “Category” drop-down menu.

- Find your bond’s chronic number close to its base right corner. Enter the number in the “Bond Serial Number” field.

- Discover your bond’s issue date in the upper right corner and enter it as a two-digit month followed by a four-digit year in the “Issue Date” field. For instance, “11/2005.”

- Click on the “Calculate” button to see your bond’s present worth.

Are you not sure of the data the calculator is giving you?

Here are brief explanations of each of the fields that the Calculator displays in case you have any queries about any of them.

- Bond Serial Number: Your paper savings bond’s lower right corner contains the serial number. Knowing this information is unnecessary, but it is valuable for keeping records in case your paper bonds are ever misplaced or destroyed.

- “Value as of” Date: The Savings Bond Calculator displays the current value of your paper bonds when you first open it. You can alter the “Value as of” date to see what they are worth in various months. The Calculator can display the value of your paper bonds for any month between January 1996 and the present rate period.

- Series: Your paper savings bond’s series can be located in the top right corner. The following paper savings bond series’ values are provided by this calculator: EE, I, and E.

- Denomination: The face value that is printed in the left-hand upper corner of your paper bond.

- Issue Date: Your paper bond’s issuance date. That is the month and year printed beneath the series on the right side of your paper bond.

- # Bonds: The number of paper bonds that you have listed in this inventory.

- Total Price: How much you spent overall on the paper bonds listed in this inventory.

- Total Interest: The total sum of the payable interest accrued by the paper bonds included in this inventory as of the date indicated in the “Value as of” box.

- Total Value: The total cash value of the paper bonds included in this inventory as of the date indicated in the “Value as of” box. If you were to redeem all of these paper bonds in that month, you would get this sum of money.

- YTD Interest: Interest for the year so far. The total interest earned by the paper bonds in this inventory between January of the year is indicated in the “Value as of” box and the date specified.

- Issue Price: The sum that you forked over for each paper bond shown in this inventory.

- Interest: The total interest each paper bond earned between the issue date and the “Value as of” date.

Note: A three-month interest penalty will be assessed if a bond that was issued in May 1997 or later is cashed before it has matured. The interest displayed here includes the penalty.

- Value: Value of each paper bond as of the date specified in the “Value as of” box.

- Interest Rate: Each bond’s interest rate as of the date indicated in the “Value as of” section. The interest that accrues on the Next Accrual Date is determined using this rate.

- Next Accrual: the first day that each bond’s value improves following the date shown in the “Value as of” box.

- Final Maturity: the day that interest on each bond ceases accruing.

- N/A: The interest rate on a bond at the moment is not known. This indicates one of the following:

a) The bond has ceased to earn interest

b) We won’t be aware of the bond’s interest rate during the “Value as of” date until the next rate period when fresh interest rates are released.

c) The bond’s interest rate cannot be retrieved from the database. - Note: These are brief descriptions regarding the designations of special bonds:

- NI: Not Issued-You modified the ‘Value as of’ date to a date prior to the paper bond’s issuance.

- NE: Not Eligible for Payment.

Bonds with this designation cannot be paid until they have been in existence for at least 12 months. - P5: Bonds issued after May 1997 and less than five years old have a three-month interest penalty.

- MA: Matured- This paper bond has reached maturity and no longer earns interest. (Used with “Value as of” dates after September 2004).

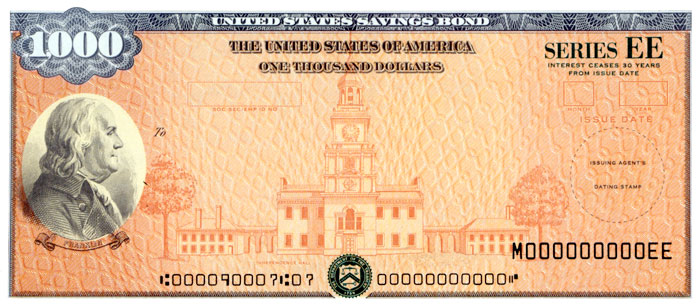

What is a Series EE savings bond?

The Series EE Bond (frequently alluded to as a “Patriot Bond”) is a non-attractive, interest-bearing U.S. government investment funds security. These bonds are ensured at any rate twofold in incentive over the ordinary 20-year beginning term. Some Series EE bonds have complete interest-paying lives that reach out past the first development date, as long as 30 years from issuance.

Coupon rates for Series EE Bonds are resolved at the hour of issuance and depend on the level of the drawn-out Treasury rates. Alongside the Series I security, the Series EE security is one of the two kinds of reserve funds securities given by the US Treasury. Series EE securities can’t be purchased or sold in the open market and are subsequently named non-attractive protections.

Arrangement EE securities given after May 2005 are allocated semi-yearly fixed coupon rates on May 1 and November 1. The rates apply to all issues for the resulting half-year. Bonds given after each date increment in the worth month to month, yet interest installments are passed out semiannually.

Series EE bonds are viewed as super-protected, generally safe ventures whose interest is commonly absolved from state and nearby expenses. Notwithstanding, they are dependent upon government charges, however, just in the year in which the bond develops or is reclaimed. EE Bonds might be bought by U.S. residents, official U.S. occupants, minors, and all U.S. government workers—paying little heed to their citizenship status.

What are some of the pros and cons of saving bonds?

There are pros and cons to saving bonds. Even though saving bonds have a wide variety of benefits attached to them in terms of saving money, you can’t expect every service to be impeccable. Here we have listed some pros and cons that come with purchasing saving bonds.

| Pros | Cons |

| Series I bonds provide a higher yield than conventional savings accounts due to inflation adjustments. | Redeeming within five years of the issue date will result in penalties. |

| At 20 years’ maturity, the value of Series EE bonds doubles. | Less liquid than other forms of savings. |

| There is only federal income tax applicable. | Lower returns than other forms of investments. |

| Risk-free interest income. | Saving bonds are limited in each series to $10,000 each year. |

| It is supported by the United States government. |

How can the serial number aid in preventing financial loss?

Utilizing the serial number can actively prevent financial loss associated with paper savings bonds. If a bond is lost, stolen, or damaged, having access to the serial number facilitates obtaining a replacement swiftly. Instances such as water or fire damage may obscure the serial number or render the bond unusable. However, even without physical possession of the bond or its serial number, ownership rights remain intact.

Every bond is meticulously documented in a secure database maintained by the Department of the Treasury. In the event of physical loss, individuals can download FS Form 1048 from the official website to initiate the replacement process. Providing details such as the purchase month and year, along with personal information like the Social Security number and name printed on the bond, ensures a seamless procedure.

For EE Savings bonds printed on paper, the US Treasury Department offers reissuance services in cases of loss or damage. Importantly, if savings bonds are stolen, they hold no value to anyone without their name printed on them. The serial number acts as a safeguard, protecting the investor’s interest in the asset’s value.

How to track down your savings bond?

If you’re the proprietor or co-proprietor of the bond, with your name showing up on the facade of the bond, you can contact the U.S. Treasury Department to find the bond.

Attempt a local search first

Before you contact the U.S. Depository Department, it suggests beginning at your nearby monetary establishment. Here, you might have the option to follow the whereabouts of your bond all the more rapidly. In the event that your bank can’t help you, your subsequent stage is to contact the Treasury Department.

Compose a request for Series I

Compose a solicitation for data about an arrangement I reserve funds security. Incorporate your complete name, address, and the chronic number of the security. Give your contact data – including phone number and email address – for the Treasury Department to reach you about the bond. Sign and date the solicitation. Mail the solicitation to “Agency of the Public Debt, P.O. Box 7012, Parkersburg, WV, 26106-7012.”

Compose a request for Series EE

Compose a solicitation for data about an arrangement EE reserve funds security. Incorporate your total contact data and the chronic number of the security. Sign and date the solicitation and mail it to “Central Bank of Minneapolis, P.O. Box 214, Minneapolis, MN 55480.” Inquire by phone for EE bonds by calling (800) 553-2663.

U.S. Treasury online tracking

Utilize the Treasury Direct Savings Bond Calculator to follow insights regarding paper EE, E, and I investment funds securities. This instrument works in the event that you have different insights concerning the bond, notwithstanding the chronic number, for example, group and issue date. Visit TreasuryDirect.gov to get to this device.

- Enter the qualities of the bond into the fields and click on “Calculate.” The instrument will restore query items about the bond.

- Spare outcomes from the investment fund security adding machine by clicking “Spare” subsequent to getting data about the security.

- Name the security and spare the document on your hard drive. At the point when you access the record later, open it and pick “re-visitation of reserve funds security number cruncher” from the accessible menu.

- Your Web program will show current information about the bond.

U.S. Treasury email tool

Visit the Treasury Direct site to use an email device for data about electronic I and EE investment funds securities. Enter your name and email address, and spot the chronic number in the message box of the structure. You will get an email from Treasury Direct.

FAQs

What is the serial number for a bond?

An individual alphanumeric code known as a bond serial number uniquely identifies a savings bond.

How can I determine a bond’s value?

TreasuryDirect, the online center for U.S. Treasury savings bonds, allows you to look up a bond’s value. To check the value of your paper bond, check your electronic bonds directly or utilize their savings bond calculator tool. Identification details must be given, including your bond’s serial number, series type, issuance date, and par value.

After 30 years, how much is a $50 bond worth?

A $50 EE bond bought thirty years ago is now worth $103.68. The face value of the bond, which in this example is $25, is to be noted as the guaranteed value after 20 years.

How can I check a bond?

A bond’s serial number and your personal information can be used to verify it.

How can a savings bond be tracked?

Use the serial number to search for a savings bond on the website of the U.S. Treasury Department if you need to hunt it down or transfer it. Your Social Security number and other bond information may be used to trace a savings bond if you can’t access the serial number.

Are bonds searchable by serial number?

Yes, you can search for bonds on the U.S. Department of Treasury website by serial number.

Do savings bonds have a term?

A savings bond has a 30-year maturity period following the date of issuance. Interest on savings bonds stops when they reach their maturity date. You can then take your capital and interest profits out. If you don’t redeem the bond straight away, it won’t expire. You can redeem a savings bond one to thirty years after its issuance. You will be charged a penalty equal to three months’ interest if you redeem a savings bond between the ages of one and five.