When Were Credit Cards Invented?

If you want to know when were credit cards invented, then read on.

Many people now consider using a credit card to be routine. You could use your card to purchase morning coffee. There’s a strong possibility you swipe or tap your card to pay for petrol as well. Credit cards may have been around forever since consumers are so used to having them available. Today’s market offers hundreds of different credit card varieties composed of plastic, metal, and even only digitally saved on cell phones.

These include charge cards (which require full payment at the end of each month), revolving credit cards (which let you “revolve” or carry a balance from month to month), and those with a wide range of other features. In the past few decades, credit card transactions have also advanced quickly. Instead of taking a physical imprint of your card, you can now swipe, dip, tap, or wave your information at a payment terminal.

Credit charge cards are the foundation of the American economy. “Paying with plastic” is typical because absolute U.S. Visa obligation beat $1 trillion a year ago, as indicated by the Federal Reserve. However, have you ever stopped considering how we got to this spot? The most surprising thing about Mastercards is how rapidly they’ve become fundamental to current private enterprises. Most history specialists followed the advanced Mastercard to the establishment of Diners Club in 1950, the principal charge card that could be utilized to make buys at numerous retailers.

If you want to know more about when credit cards were invented, you have come to the right place. We have gathered all the relevant information to help you understand everything you need. So, what are you waiting for? Without much further ado, let us jump right in.

Prehistoric Forms of Credit

Though credit cards, as we know them today, didn’t exist until the mid-20th century, the concept of credit is quite old. Evidence suggests that some form of credit was used even in prehistoric times. For example, historians have found records of loans made between families and friends in early Mesopotamian societies. These loans were often made as livestock or other valuables and usually had to be repaid within a certain period. This early form of credit allowed people to get the needed resources without bartering.

Who invented the credit card?

A credit card is a little plastic card containing a method for recognizable proof, for example, a mark or picture, that approves the individual named on it to charge products or administrations to a record, for which the cardholder is charged intermittently. The utilization of Mastercards started in the United States during the 1920s, when individual firms, for example, oil organizations and inn networks, started giving them to clients for buys made at organization sources. The primary widespread Mastercard, which could be utilized at an assortment of foundations, was presented by the Diners’ Club, Inc., in 1950.

While feasting out with customers in New York in 1949, Frank McNamara was humiliated to find that he’d left his wallet at home. While his better half rescued him and paid for the dinner, the experience gave McNamara a thought: What if there was a way he could buy the supper on layaway and pay for it toward the month’s end?

It was the start of the creation of the cutting-edge charge card. Within days, McNamara and his accomplices had built up the thought for the Diners Club card, which turned into the principal contemporary Visa. In 1950, McNamara and his lawyer, Ralph Schneider, dispatched Diners Club International, which was initially acknowledged by 27 New York eateries and utilized by around 200 of their companions and colleagues.

When did credit cards become widely used?

An age prior, it was customary to be out for supper with companions or at the register with a truck loaded with staple goods and acknowledge you needed more money to cover the bill. However, you’ll probably pull out a charge or Mastercard and wait to consider something today. It’s hard now to envision when those noncash alternatives weren’t accessible, mainly if you were brought into the world during the 1970s or later. Visas have existed since the 1950s, and check cards were presented in the 1970s. By 2006, 984 million bank-gave Visa and MasterCard credit and check cards were in the United States alone.

Why should you use credit cards?

Why not utilize your charge card to keep everything more straightforward? There are a couple of reasons:

To protect your bank account

Credit cards offer more robust extortion assurance and detachment from your financial records, filling in as an additional well-being measure. Credit cards are associated straightforwardly with your financial records. At whatever point you make a buy — regardless of whether that buy is handled as credit or as Charge — reserves are drawn quickly from that record and moved to the dealer. In that manner, it resembles an electronic check.

To earn rewards

Even though prize check cards used to exist, the Durbin alteration to the Dodd-Frank purchaser assurance act passed in 2010 limits the expenses banks can charge shippers to deal with charge cards. Therefore, purchaser utilization of check cards at retailers is less beneficial to card guarantors, so those backers need more motivation to boost shoppers to utilize them.

Credit cards, nonetheless, stay beneficial to banks, so they’ve put all the more intensely into contributing shoppers a cut of those trader expenses as remuneration. Cards like the Chase Sapphire Preferred Card offer 2x focus on movement and feasting and 1x point on everything else. In contrast, Chase Freedom Unlimited offers 1.5% money back on most buys (Freedom Unlimited, likewise, as of late, began offering reward money back on qualified travel, staple, and drugstore buys).

To build your credit history

Every grown-up has a credit profile, which credit detailing departments keep. This profile contains data about each credit you’ve applied for, held, and paid. That data makes up your financial assessment, a mathematical portrayal of your credit profile. Your economic judgment is influenced by things that show a background marked by utilizing credit responsibility, for example, a past filled with on-time installments, having held numerous records, not having an excessive amount of obligation, and having held admittance to credit for an extensive period. Then again, it’s contrarily influenced by missing an installment, being late, or needing more history of holding credit.

For better purchase and travel protections

Many credit cards offer certain buy and travel assurances for better purchase and travel protections. For instance, the Chase Sapphire Preferred Card offers hearty inclusion, for example, trip defer protection—that takes care of your expenses for things like inns, garments, food, and toiletries for up to $500 per individual if your flight or other travel is deferred for the time being, or over 12 hours during the day.

When were debit cards invented?

Debit cards are another technique to execute money between a purchaser and a dealer of merchandise or administrations. They supplant the premium-bearing obligation made by utilizing debit cards and limit the client to the objective measure of cash in his record when the card is used, like an ATM card or for online buys.

- Elderly history: Many financial transactions used precious metals like gold or silver. The usage of paper money as a substitute for precious metals dates back to the 1200s. A paper cheque would finally be invented sometime in the late 1600s. For the following 200 years, most Global Economies relied on a mix of checks, paper money, and precious metals.

- 1800s: In the last half of the nineteenth century, the first credit cards started to appear. Paper loyalty cards were made by several retailers and distributed to consumers. The clients used these cards to purchase throughout the month and build a balance. The cashier would mark each total credit on the card, and a record was made for the cardholder and the retailer. The retailer would collect the debt at the end of the month to eliminate the balance and begin again.

- The 1960s: As technology advanced, these paper cards increasingly advanced. Beginning of the 1960s, plastic cards offered a significant advance. Store cards now have magnetic stripes instead of the manual markings of library cards. The information about the owner and the point-of-sale system used to complete the transaction could be found in magnetized film fragments. These two pieces of information produced a data network and a backlog of transactions.

- The 1970s: Debit card technology wouldn’t be available for some decades. Chip and Personal Identification Number (PIN) cards were produced in the late 1970s. Debit cards were made by placing a silicon integrated circuit chip into a plastic smart card rather than a magnetic stripe like credit cards. Customers could only use Automated Teller Machines (ATM) to withdraw cash using the initial generation of debit cards. Customers might withdraw a certain amount of money by inserting their debit card, entering their PIN, and doing so.

- The 1980s: The primary charge cards were designated “ATM cards” because their sole capacity was to empower bank clients to pull out money from their financial balances utilizing ATMs. The first ATM cards couldn’t be used to make retail buys. Numerous shippers had started to utilize modernized retail location Computerized Point-of-Sale (POS) frameworks, which empowered clients to swipe their ATM cards at sales registers, enter a PIN, and pay for their buys through an electronic exchange of assets from their ledger to the vendor. POS frameworks were fundamentally accessible at supermarkets, corner stores, and different organizations that handled a high volume of clients making generally economical buys.

- The 1990s: The turning point for check cards came in the mid-1990s when the cards were improved with the Visa or MasterCard logos, implying that they could be utilized to make buys anyplace that Visa or MasterCard Visas were acknowledged. This advancement immeasurably extended the utilization of charge cards.

Brief History of Credit Cards

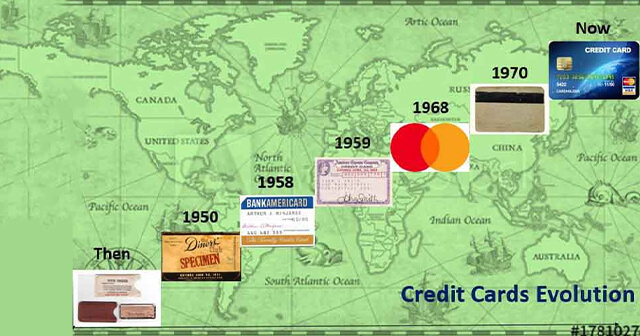

Credit cards have come a long way since their inception in the mid-20th century. Today, billions of credit card transactions are carried out yearly, totaling trillions of dollars. The first credit card was created in 1946 by John Biggins. This card allowed customers to charge purchases at local stores to their account with the issuer, which would then be paid off at the end of the month. Frank McNamara is also credited with inventing the credit card, as he created the Diners Club card in 1950. Following are years along with technological advancement.

| Years | Technology |

Descriptions |

| 1910 | Metal Card | Western Union launched a “metal money” card that can be used to make purchases and withdrawals from any of their offices. |

| 1920 | Charga-Plate | Charga-Plate is introduced as a way to streamline the credit process for merchants. It is a metal plate that contains the customer’s name and account number. |

| 1950 | Diners Club Card | Diner’s Club unveils its first charge card. It can only be used at select restaurants in New York City. In 1959 American Express launched a cardboard card, followed by the first plastic credit card. |

| 1960 | Bank America card | Bank of America launched the first mass-produced payment card, the BankAmericard. It was later renamed Visa and considered the first modern credit card. |

| 1970 | Master Charge | The Interbank Card Association (now MasterCard) introduces Master Charge as a competitor to BankAmericard. |

| 1980 | Magnetic Strips | Although invented two decades earlier, by this stage, most credit cards started getting magnetic stripes on the back, which allowed them to be read by specialized electronic machines. |

| 1990 | Internet Purchases | Credit cards are introduced to the Internet, allowing people to purchase online. |

| 2000 | Chip Cards | It was introduced to reduce fraud. It is also known as EMV cards (chip-and-PIN in Europe). |

| 2005 | Radio-frequency identification (RFID) | Radio-frequency identification (RFID) was introduced at a few Caen, France stores and retailers utilizing Samsung NFC smartphones. |

| 2010 | Tapping card | Introduction of the contactless payment card by Barclay and Orange. This technology, which works similarly to EMV smart chips in terms of encryption, enables customers to complete a transaction by simply tapping their card against a compatible terminal. |

| 2014 | Apple Pay | makes contactless payments with an iPhone possible. It was followed by Android Pay (now known as Google Pay) in 2015. |

| 2015 | Google Pay | It’s a contactless mobile payment system. |

| 2021 | Gasoline retailers | The liability change for petrol sellers is implemented. |

| 2023 | Mobile payments | As more retailers and service providers provide mobile-based payment alternatives, it is anticipated that the usage of smartphones and other mobile devices will increase in popularity. |

When were bank cards invented?

In 1946, John Biggins, a Brooklyn-based banker, developed the “Charg-It” card to attract new customers. Those with bank accounts could use their card at a few certain stores. The bank would then pay for the things purchased after receiving the receipts from the retailer and send the consumer a bill for repayment.

In bank Visa frameworks, the cardholder may decide to pay on a portion premise, in which case the bank acquires revenue on the exceptional equilibrium. The premium pay grants banks to abstain from charging cardholders a yearly expense and demanding taking interest dealers a lower administration charge. A different preferred position of the framework is that dealers get their installments instantly by storing their bills of offer with the bank.

A paper BankAmericard with a pre-approval maximum of $300 was issued to 60,000 customers in Fresno by the California-based Bank of America, who went one step further and distributed the card throughout the entire state by 1966. This initial attempt ultimately proved to be successful by 1966. This initial attempt ultimately proved to be an expensive error in judgment due to high delinquency rates and widespread fraud.

The principal bank cards were ATM cards given by Barclays in London, in 1967, and by Chemical Bank in Long Island, New York, in 1969. In 1972, Lloyds Bank gave the central bank card to include an individual distinguishing proof number (PIN) for security alongside the data encoding attractive strip.

Evolution of Credit Card Technology

Today, credit cards have evolved into a sophisticated tool that offers much more than just a way to borrow money. Credit cards now have various features and benefits that can save you time and money.

Some of the latest credit card features include:

- Contactless payments – This new payment method allows you to purchase by simply waving your credit card before a contactless reader. There is no need to swipe or insert your card into the reader, which can save time at the checkout.

- Rewards programs – Many credit cards now offer rewards programs that allow you to earn points or cash back on your purchases. These rewards can be used for various purposes, such as redeeming for travel, shopping, or money around.

- Online account management – Most credit card issuers now offer online account management tools that allow you to view your account balance, transactions, and payment history from any internet-connected device.

Security concerns and how to deal with them

Do you recollect the scandalous Target information break? A December 2013 declaration affirmed that over 40 million credit and charge account numbers had been taken from Target’s installment information base. It was only one of many Visa security penetrations to stand out as truly newsworthy in a brief timeframe.

Notwithstanding information programmers, card skimmers have likewise exploited Mastercard installment innovation. Skimmers can recreate cards and rapidly pile up a wide range of extortion charges by duplicating the card data put away in the attractive stripes of Visas. Self-serve service stations and ATMs have been the most defenseless against these security assaults, to such an extent that the U.S. The Secret Service has gotten severe about service station skimmers. While cardholders confronted these mounting security issues, the U.S. started embracing EMV installment innovation to scramble installment data and battle fake Mastercard extortion. The cycle began in 2011, and the authority’s cross-country move happened on October 1, 2015.

EMV installment innovation utilizes an encoded smart chip rather than an attractive stripe to hold account information and complete installments. Today essentially, all Visas sport silver EMV chips and purchasers are changing by another installment cycle at store registers: embedding cards instead of swiping them. Attractive stripes are, as yet, on the backs of most credit cards simply if a retailer can’t acknowledge chip cards. Yet, the objective is for the U.S. to move away from attractive stripe installments to all the more reasonable secure installments at registers, service stations, and ATMs.

The evolution of credit cards over the years

Credit cards worked like past decorations, coins, and plates from the start. Shippers would make a print of the cards, which is natural to any individual who recollects the number of credit card buys made up until the 1990s. However, by the 1980s, numerous cards began having an attractive stripe on the back, which could be pursued by particular PC hardware that was best in class.

Soon after the credit card trend became widespread, banks started issuing their credit cards. Consumers may have revolving credit, in which balances are carried over from month to month, rather than being required to pay off the entire debt at the end of each month.

American Express

American Express gained publicity by transferring customers’ belongings and providing travelers’ cheeks. But to give travelers more flexibility, it introduced its charge card in 1958. The corporate card for business travelers was developed in 1966.

BankAmericard

The BankAmericard was the first credit card to offer revolving credit when it was introduced by Bank of America in 1958 as the first consumer credit card. Today, a multinational firm, Visa, was first known as BankAmericard in 1976.

MasterCard

The Interbank Card Association was established in 1966 by a group of banks that used credit cards as payment. By the 1970s, it had evolved into MasterCard International, a worldwide alliance.

Discover

On September 26, 1985, a $26.77 test transaction was made using the new Discover card. Before being made available to the general public with its initial television advertisement during the Super Bowl XX, testing for the card proceeded in Atlanta and San Diego. Discover purchased Diners Club International in 2008.

Innovation In Credit Cards

Changes were made throughout time to enhance the use of technology and security. Among these innovations are:

Magnetic Strip.

Before the magnetic strip, credit cards had to be manually entered into the computer at a processing facility after being placed on the machine and stamped onto a charge slip. When an IBM engineer created the magnetic strip in 1969, it was incorporated as a practical method of handling credit card data.

Additionally, it added a level of security that was previously absent. The magnetic strip quickly became the norm, enabling data transfer worldwide.

The EMV chip, which stands for Europay, Mastercard, and Visa, was created with new technology to make credit cards safer as security concerns grew. It is a more secure payment method since the chip creates a one-time code during a transaction to authorize the purchase.

Contactless Payment

Touch-free credit card payments have gained popularity recently. Mastercard claims this method is quicker and safer than simply swiping your card. Cleanliness is one factor contributing to the rising acceptability of contactless. Today more aware of the need for hygienic payment methods, and customers favor the new technology over other payment methods.

Industry Regulations

Early on, the credit card business was rife with discriminatory practices. Many companies wouldn’t give African American credit cards. Additionally, women could only obtain a card with a male co-signer before 1974. Before the 1970s, there were no regulations, so there were no standards for calculating interest rates or safeguards for cardholders.

The Fair Credit Reporting Act was first introduced in 1970. Due to this legislation, credit card providers had to provide accurate information to credit reporting agencies. In 1974, the Equal Credit Opportunity Act was passed, outlawing racial and gender discrimination by credit card businesses.

The Credit Card Accountability Responsibility and Disclosure Act of 2009 added new laws in response to the exorbitant fees and penalties that credit card firms impose on consumers. This law shields cardholders against card issuer deceit.

Credit Card Legislation

Currently, no specific credit card legislation exists in the United States. However, there are a few proposals in Congress that could change that. The first proposal, introduced by Senators Durbin and Schumer, would give the Consumer Financial Protection Bureau (CFPB) the authority to regulate credit cards. The second proposal, introduced by Representative Maloney, would provide the Federal Reserve the power to hold credit cards.

It is still being determined if either of these proposals will become law. However, there is a growing need for credit card regulation in the United States. A recent study found that Americans paid $27.1 billion in credit card fees in 2010. It is an increase of $5.1 billion from 2009. The study also found that the average American household has $9,100 in credit card debt.

With such a large amount of debt and fees being paid, it is evident that something needs to be done to protect consumers. Credit card regulation helps prevent companies from charging.

Truth In Lending Act (TILA)

The Truth in Lending Act (TILA) is a federal law enacted in 1968. The purpose of the law is to promote the informed use of consumer credit by requiring disclosures about its terms and cost.

Under TILA, creditors must disclose certain information to consumers, such as the annual percentage rate (APR), the finance charge, and the total amount of credit. TILA also gives consumers the right to cancel certain credit agreements, such as home equity lines of credit, within three days of signing the contract.

TILA is enforced by the Consumer Financial Protection Bureau (CFPB). The CFPB can take action.

Fair Credit Billing Act (1974)

The Fair Credit Billing Act (FCBA) is a federal law enacted in 1974. The FCBA protects consumers from unfair credit billing practices.

Under the FCBA, creditors are required to correct errors on credit bills. If a creditor does not fix a mistake, the consumer can withhold payment on the disputed amount. The FCBA also gives consumers the right to deny inaccurate information on their credit reports.

The FCBA is enforced by the Consumer Financial Protection Bureau (CFPB). The CFPB can take action against creditors who violate the FCBA.

Credit card companies are required to follow the rules outlined in the Credit CARD Act of 2009.

Fair Debt Collection Practices Act (1977)

The Fair Debt Collection Practices Act (FDCPA) is a federal law enacted in 1977. The FDCPA protects consumers from unfair debt collection practices.

Under the FDCPA, debt collectors are prohibited from using abusive, deceptive, or unfair tactics when collecting a debt. They must also provide certain information to consumers, such as the debt amount and the creditor’s name.

The FDCPA is enforced by the Federal Trade Commission (FTC). The FTC can take action against debt collectors who violate the FDCPA.

Debt collectors are also subject to state laws. Some states have debt collection laws.

Credit Card Accountability Responsibility and Disclosure Act of 2009 (CARD Act)

The Credit Card Accountability Responsibility and Disclosure Act of 2009 (CARD Act) is a federal law enacted in 2009. The CARD Act protects consumers from unfair credit card practices.

Under the CARD Act, credit card companies must give 45 days’ notice before making specific changes to their terms and conditions.

Credit Card Competition Act of 2022

The Credit Card Competition Act of 2022 was presented by U.S Senators Richard Durbin (D-IL) and Roger Marshall (R-KS) “to ensure that giant credit card-issuing banks offer a choice of at least two networks over which an electronic credit transaction may be processed.” At first, second, or third glance, it will be stated that it is difficult to support legislation that would allow the Federal Reserve to follow a non-market conclusion within a sector (credit cards) that represents markets.

The two credit card corporations that have received the ire of Durbin and Marshall, Visa 0.4% and MasterCard, funded nearly $3.49 trillion worth of transactions in 2021 alone. Some obvious conclusions can be drawn from the previous number. Consider the situation of big and small companies throughout the globe without Visa and Mastercard. The two industry behemoth cards are accepted worldwide, as their combined market value of $3.49 trillion ideally implies.

When the 21st century started, most online transactions were once again carried out through the U.S. mail, but that is no longer true in 2023. Once more, see Visa and MasterCard. Looking ahead, numerous aspects of business in the evolving United States; none of them are fixed. The growth of transactions on Amazon alone demonstrates how different the way we buy products in 2030 will be from how it is in 2023.

In other words, there is no need for laws regarding credit cards and competition. The latter is produced by profits, which are now at work as you read this.

Why do credit cards exist?

Credit cards are like debit cards just to the degree that their structure factors are comparable. Regarding what occurs in the foundation is an extraordinary cycle. Pre-loaded, charged, and credit cards can be sorted as instruments that empower you to ‘pay previously,’ ‘pay now’ and ‘pay later”. The requirements for these three kinds of tools will consistently be there. They were there in the past before plastic appeared, and they will outlive plastic as a structure factor.

The compensation before included was utilized in the voyager’s checks and will remain valuable in transportation in the future. Credit cards will be required for individuals who could be more trustworthy to get a Mastercard. Credit cards will be needed because there are times when you have to make enormous spontaneous buys, and it doesn’t bode well to keep a lot of cash in your ledger for such an outcome.

Credit Card Technology Evolution

Technology advancements have periodically taken center stage in the drama of cashless payments since the early 1960s when IBM introduced magnetic stripe (or mag-stripe) verification to credit cards. However, some technological advancements have become standards. Although most credit cards still have magnetic stripes from the 1960s, microchip-enabled cards with a visible front are becoming the norm. Here are some developments in credit card technology over time.

- The 1980s: The first credit card with an intelligent chip was developed in the 1980s and quickly gained popularity across Europe. It even made an appearance in the 1995 movie “French Kiss.”

- 1996: The joint publication of the EMF chips, or Europay, MasterCard, Visa, standard innovative chip specifications. Instead of depending on an unencrypted magnetic stripe that is simple to read and duplicate onto a counterfeit card, sometimes known as cloning, these chip-enabled cards have the benefit of employing encrypted communication.

- 2005: The introduction of radio-frequency identification (RFID) at new Caen France stores and retailers utilizing Samsung NFC smartphones.

- 2010: The introduction of a contactless payment card by Barclay and Orange. This technology, which works similarly to EMV smart chips in terms of encryption, enables customers to complete a transaction by simply tapping their card against a compatible terminal.

- 2014: When Apple released Apple Pay in 2014, cardholders could save their information on their smartphones instead of using physical cards.

- 2015: Google releases Android Pay, currently known as Google Pay, its contactless mobile payment system. In the same year, the retail payments sector saw a liability shift that made retailers responsible for paying for fraudulent transactions if they decided not to upgrade their terminals to accept the new cards.

- 2021: The liability change for petrol sellers will be implemented in 2021.

The future of credit cards

Like any technology-based sector, credit card innovation continues to influence what issuers can provide and how consumers use them. One of the most recent developments in the payment sector incorporates credit cards with blockchain technology in various ways. A rewarding alternative to cash back or points on some cards is Bitcoin. Select shares of cryptocurrency can occasionally be bought using a credit card. Additionally, from a business perspective, issuers’ current methods of recording transactions may be replaced by blockchain technology’s indestructibility as a recording ledger.

Contactless payment technology, which increased due to Covid, is expected to continue to rise as consumers switch from traditional credit cards to mobile wallets and wearable technologies. Issuers are expected to move away from the sparse data points offered by credit reports and towards adding more comprehensive information about applicants as artificial intelligence develops and assumes a more significant role in determining risk when evaluating a credit card application.

It is still being determined what the future of credit cards will be in the United States. However, there is a need for regulation. With consumers’ increasing debt and fees, something must be done to protect them. One possibility is that the Consumer Financial Protection Bureau (CFPB) will be more significant in regulating credit cards. Another option is that Congress will enact new legislation to hold credit cards. Either way, we will likely see more regulation of credit cards in the future.

FAQS

Who created the credit card?

A few different people have been credited with inventing the credit card. Some say that John Biggins made the Charge It card in 1946. This card allowed customers to charge purchases at local stores to their account with the issuer, which would then be paid off at the end of the month. Others credit Frank McNamara, who created the Diners Club card in 1950. This card was initially intended for use by business people when traveling so that they would not have to carry large amounts of cash with them. Regardless of who invented it, the credit card has become essential for many people worldwide.

What is the Credit Card Act of 2009?

The Credit Card Act of 2009 is a U.S. law enacted to protect consumers from some of the more predatory credit card industry practices. Some of the law’s key provisions include prohibiting companies from raising interest rates on existing balances without 45 days’ notice, banning specific fees (such as over-the-limit fees), and requiring that payments above the minimum be applied to the balance with the highest interest rate first. The Credit Card Act of 2009 has helped to make credit cards more manageable for consumers, though there are still some areas where improvement is needed.

What inspired the first credit card?

There are a few different stories about what inspired the first credit card. Some say it was created in response to a dinner party where Frank McNamara forgot his wallet and borrowed money from a friend to pay for his meal. Others say that John Biggins was inspired by a similar incident where he could not pay for his hotel room after forgetting his wallet. Regardless of the true story, it is clear that the credit card was created to make life more convenient for people who often found themselves without cash when they needed it.

When were credit cards invented?

The first credit card was designed in 1946 by John Biggins. This card allowed customers to charge purchases at local stores to their account with the issuer, which would then be paid off at the end of the month. Frank McNamara is also credited with inventing the credit card, as he created the Diners Club card in 1950. This card was initially intended for use by business people when traveling so that they would not have to carry large amounts of cash with them. Regardless of who invented it, the credit card has become essential for many people worldwide.

What makes it a credit card?

When a credit card is used, the bank (or other financial institution) is lending the cardholder money or extending credit.

How long are the numbers on credit cards?

Sixteen numbers, typically credit card numbers, consist of 16 digits, which are grouped into four groups. There are 15 digits in American Express numbers. Some credit card companies use 19 digits, though this is uncommon.

What was used by individuals earlier to use credit cards?

They are approximately 70 years old, which begs the issue of what people did before credit cards were invented. The quick response is that customers usually save up the money required to make a purchase and pay for it with cash, a cheque, or they may have bartered.

Conclusion

Since the 1950s now, credit cards have come a long way. With improved technology nowadays, credit cards are something that is used globally. Now that you have read this article, you know all about the history of credit cards, when they were invented, and why they are necessary.