What Is APR On Credit Cards?

APR stands for Annual Percentage Rate, which is decided on a yearly basis by the credit card company.

Encountered while shopping for credit cards, mortgages, or auto loans, “APR” stands for “annual percentage rate,” reflecting the annual cost of carrying an unpaid balance within various borrowing contexts.

However, its implications for credit card applicants might be unclear, including how to discern a favorable APR. This article provides an in-depth exploration of the diverse credit card APR categories, techniques for effective comparison, and additional factors essential in evaluating credit card interest rates.

By delving into the nuances of APR, readers can gain a comprehensive understanding of its role in financial decisions. Whether navigating through credit options, mortgages, or other forms of borrowing, comprehending APR empowers individuals to make informed choices aligned with their fiscal objectives.

What is APR?

The cost of borrowing money through a credit card is reflected in its interest rate. This rate is usually expressed annually, known as the annual percentage rate (APR). By settling your balance completely before every month’s due date, you can often avoid interest charges on purchases made with most credit cards.

Expressed as a percentage, the APR signifies the effective annual expense of funds over the loan period or the earnings from an investment. This includes associated fees and extra expenses related to the transaction, excluding compounding effects. By offering a definitive figure, the APR enables individuals to make direct comparisons between various lenders, credit cards, or investment opportunities, facilitating informed financial decisions.

Credit Card APR Explained

APRs serve as a crucial benchmark for evaluating credit cards, impacting the cost of missed payments, with a significant portion of US credit card holders carrying balances. APR yields substantial influence.

Interest rate

Interest, a borrowing expense, encompasses more than the principal sum. Lenders seek profit and consider risk, motivating lending. An interest rate quantifies this service’s value or risk as a percentage of the principal.

Credit card borrowing begins upon swiping, but interest accrual starts after the billing period ends. “Carrying a balance” implies unpaid debt from one billing cycle to another. Here, borrowing costs rise, and interest rates impact heavily.

Annual percentage rate

APR conveys credit card balance-related interest. Lower APRs are desirable. Despite being annualized, APRs often compound daily. Their uniformity aids in comparing diverse card offers.

APR calculation complexities arise due to compound interest involving principal and accrued prior interest.

Determining APRs

Credit card APRs hinge on credit score, report, and the US Prime Rate. Lenders apply margins to the Prime Rate for risk mitigation and profit. Strong credit may yield a 17.5% APR (Prime rate + 10% margin). At the same time, weaker credit could mean a 27.5% APR (Prime Rate + 20% margin).

Lenders analyze payment history, credit report, and debt-to-income ratio. Reward-laden cards usually command higher APRs than their non-reward counterparts.

Types of APR

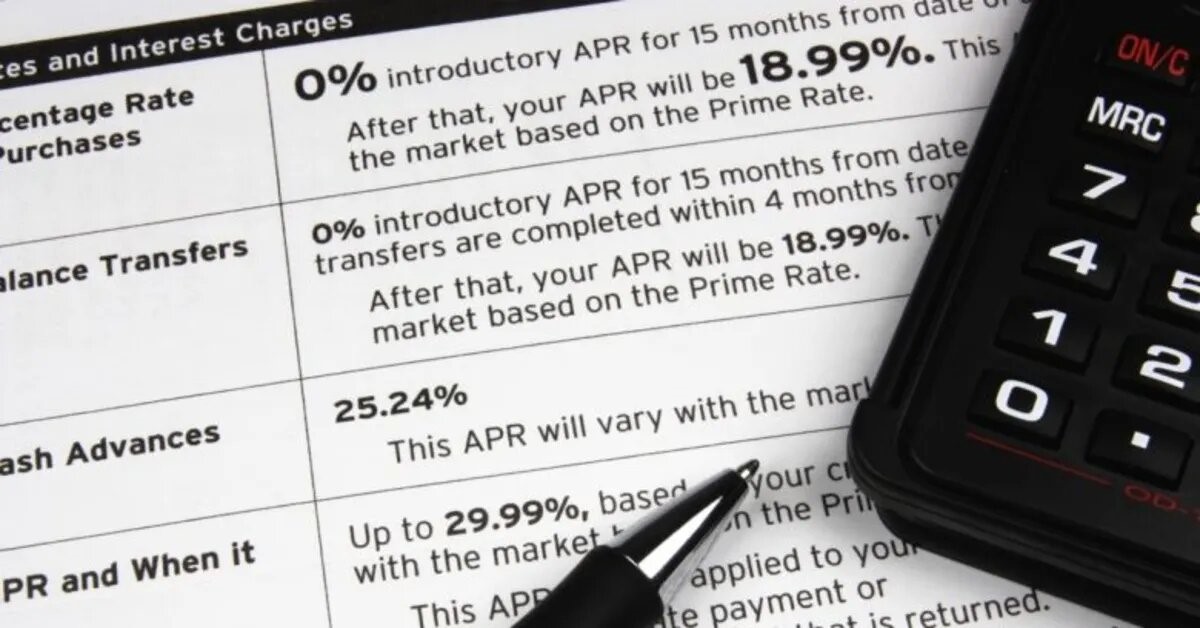

The APR commonly recognized is the purchase APR, yet several other types exist that require attention.

- Purchase APR: This interest rate pertains to all card transactions – online, in-person, or via phone.

- Introductory APR: This promotional rate is lower than the regular APR for a limited span, often as a 0% intro APR. It can apply to purchases, balance transfers, or both. Once it expires, the regular APR governs.

- Cash Advance APR: Borrowing cash via your card incurs a notably higher rate than purchase APR. No grace period applies, and it’s also relevant to convenience checks.

- Penalty APR: Missed or returned payments trigger this, potentially reaching 99%. Repeated on-time payments might revoke it, yet payments exceeding 60 days overdue could lead to applying the penalty APR to your current balance.

How to calculate APR on a Credit Card?

The APR helps in evaluating loan costs. You can calculate APR quickly; bring a pen and paper and follow the steps.

- Add the total interest paid over the duration of the loan to any additional fees.

- Divide by the amount of the loan.

- Divide by the total number of days in the loan term.

- Multiply by 365 to find the annual rate.

- Multiply by 100 to convert the annual rate into a percentage.

And voila! You have got yourself the APR. Find your current APR and current balance in your credit card statement, and then divide your APR rate by 365 (for the 365 days in the year) to find your daily periodic rate. Lastly, multiply your current balance by your daily periodic rate. For example, if your APR is 18%, your daily rate is .00049 (.18/365). This is the amount that will be applied to your new balance each day until it is paid off.

Credit Card APR Calculator

Multiply the DPR (Daily Periodic Rate) by the adjusted balance, which is the previous month’s balance less payments made. Then multiply that result by the number of days in the billing cycle. Assuming that Jon’s balance in May was $300, but he made payments totaling $200:

Monthly interest payment = 0.00041 × (300 – 200) × 30 = $1.23

The multiplication of regularly scheduled installments will lead suppliers to charge a base installment, which is generally an interest payment. It is absolutely important to pay off this figure. Inability to do so may prompt cancellation of the card, lawful procedures, and a precarious drop in the FICO credit score of the holder.

Unless a credit card has a zero or low introductory APR, interest paid on the balance is relatively high. Credit card APRs are normally about 20%, which is generally high for any loan. A good rate of APRs is normally around 8-12%; however, it is feasible for somebody with amazing credit to get even lower rates. This is because credit card debt is unsecured, meaning no collateral backs the loan.

If the borrower defaults, the bank can’t hold onto any resources, and this danger is reflected in the high financing cost. Secured debt, in comparison, requires collateral, such as real estate. If the borrower defaults on the secured debt, the lender can foreclose and take possession of the real estate.

To get an even close estimate of the APR on credit cards, you can log in to an online calculator, enter important details and figures, and have the calculator give you an amount.

What is a good APR for a Credit Card?

A decent APR for a credit card is 14% and underneath. That is generally the normal APR among credit card offers for individuals with incredible credit. Also, an incredible APR for a credit card is 0%. The privilege of 0% Mastercard could assist you with staying away from premium altogether on first-class buys or lessen the expense of existing debt.

If you need to get a credit card with a low APR, it’s imperative to realize where to look and what to search for. Two kinds of cards carry low APRs: 0% APR cards and cards with low ongoing APR.

Zero percent APR cards normally offer no interest on purchases, balance transfers, or both for a set period, ordinarily somewhere between 6 and 21 months. However, when that advancement is finished, your APR could leap to a better-than-expected rate.

A credit card with a 0% APR introductory rate is a strong decision if you have to pay down high-interest credit card debt- and you are certain you can pay the full balance before the advancement time frame closes and your rate spikes.

Then again, a credit card with a low continuous APR ordinarily won’t offer a 0% APR advancement. This might be a superior alternative if you hope to carry a balance consistently.

In the table below, we have highlighted the lenders and typically what APR they have.

| Lender/Lending Platform | APR |

| Affirm | 10.00% – 30.00% (0% APR offered at select retailers) |

| Alliant Credit Union | 6.49% – 10.49% with AutoPay |

| American Express | 6.90% – 19.98% |

| Avant | 9.95% – 35.99% |

| Backed | 2.90% – 15.99% |

| Best Egg | 5.99% – 29.99% |

| Citibank | 7.99% – 17.99% with discounts (rate may be higher) |

| Citizens Bank | 6.80% – 20.91% with AutoPay |

| Discover Personal Loans | 6.99% – 24.99% |

| E-LOAN | 7.99% – 35.99% |

| Earnest | 5.99% – 17.24% |

| FreedomPlus | 7.99% – 29.99% |

| KeyBank | 7.49% – 15.24% with AutoPay |

| Lending Club | 6.95% – 35.89% |

| LendingPoint | 9.99% – 35.99% |

| LightStream | 4.99% – 19.99% |

| LoanStart | 4.85% – 35.99% |

| Marcus | 6.99% – 19.99% |

| Mariner Finance | Up to 36.00% |

| Mr. Amazing Loans | 19.9% – 29.9% |

| Navy Federal Credit Union | 8.19% – 18.00% |

| OneMain Financial | 18.00% – 35.99% |

| Payoff | 5.99% – 24.99% |

| Peerform | 5.99% – 29.99% |

| PersonalLoans.com | 5.99% – 35.99% |

| PNC Bank | 5.99% – 25.49% with AutoPay |

| Prosper | 6.95% – 35.99% |

| Regions Bank | 7.50% – 18.83% with AutoPay |

| RocketLoans | 7.161% – 29.99% |

| Santander Bank | 6.99% – 16.99% with ePay |

| Self Lender | 10.58% – 14.77% |

| SoFi | 5.99% – 18.83% with AutoPay |

| TD Bank | 6.99% – 18.99% with AutoPay |

| Upgrade | 7.99% – 35.97% |

| Upstart | 7.46% – 35.99% |

| Wells Fargo | 5.49% – 22.99% |

What’s a Good APR for a Personal Loan?

A good APR for a personal loan ranges between 4% and 36%, depending on your credit score. If your credit score isn’t great, you can take steps to improve it and secure a better APR.

Start by paying your credit bills on time; even one missed payment can hurt your score. Set alarms to help you remember. An alarm two days before the due date reminds you to arrange funds if needed, while one on the due date ensures you pay immediately.

Keep your credit card usage below 30% of your limit. This helps manage spending and improves your credit score. Avoid applying for new credit cards, as this can lower your rating. These simple steps can boost your credit score in 3-6 months.

The broader economic landscape affects personal loan rates. Currently, rates are higher than last year. According to the Federal Reserve, the average rate for a two-year personal loan was 11.48% in Q1 2023, up from 9.39% in Q1 2022. This increase is due to the Federal Reserve’s rate hikes, leading to higher borrowing costs for both lenders and borrowers.

APR vs. APY

While an APR addresses simple interest, the annual percentage yield (APY) encompasses compound interest, leading to a higher APY than APR. A larger interest rate and, to a lesser extent, shorter compounding periods amplify the APR-APY discrepancy.

For instance, consider a loan with a 12% APR that compounds monthly. Borrowing $10,000 incurs $100 interest in the first month, increasing the balance to $10,100. This compounding effect continues, resulting in an effective interest rate of 12.68% annually. APY captures these nuances due to compounding, unlike APR.

Another perspective is comparing an investment at 5% yearly to one compounding monthly. Initially, APR and APY were 5%, but the second month reflects a 5.12% APY due to monthly compounding.

Lenders highlight the more appealing figure—APY—resulting in both APR and APY disclosure. This applies to savings and lending scenarios. Mortgage calculators aid in comparing APR and APY rates.

APR vs. APY example

Consider XYZ Corp.’s credit card with a daily interest rate of 0.06273%, yielding an advertised 22.9% APR. Using compounding formulas, if you charged $1,000 daily and paid after the due date, each item’s cost would be $1,000.6273.

To compute APY or effective annual interest rate, add one, raise it to the power of compounding periods, subtract one, then convert it to a percentage. For this case, APY becomes 25.7%.

APY = (1 + Periodic Rate)n – 1

Where n = Number of compounding periods per year

In this case your APY or EAR would be 25.7%:

((1+.0006273)365)−1=.257

For a single month’s balance, the equivalent yearly rate is 22.9%, but over a year, the effective rate becomes 25.7% due to compounding.

Best Personal Loans for People with Bad Credit

As discussed, your interest rate on loan and APR depends on your credit rating, what your DTI is, and several other factors. Don’t feel disheartened if you’re one of the people with very poor credit. A couple of companies give out loans to people with poor credit performance.

Here’s a table from where you can find the best personal loans for poor credit performers and compare their rates.

| Lender | APR | Loan Amount | Terms | Key Benefit | SimpleScore |

| OneMain Financial | 18%–35.99% | Up to $20,000 | Up to 60 months | Same-day funding. | 4.5/5 |

| Peerform | 5.99%–29.99% | $4,000–$25,000 | 3 years | Easy application process. | 4/5 |

| NetCredit | 34.00%–155% | Up to $10,000 | 6–60 months | Low credit scores accepted. | 3.2/5 |

| Avant | 9.95%–35.99% | $2,000–$35,000 | 24–60 months | Mobile application process available. | 3.75/5 |

| PersonalLoans.com | 5.99%–35.99% | Up to $35,000 | 90 days–72 months | Short-term loans available if needed. | 4.25/5 |

| BadCreditLoans.com | 5.99%–35.99% | $500–$5,000 | 3–36 months | Large affiliate network to fund your loan. | 3.6/5 |

Note: Sample rates have been extracted online, courtesy of TheSimpleDollar.

Calculating the impact of APR interest

A glimmer of positivity arises: by settling your balance in full and on schedule each month, you circumvent any imposition of interest charges. Furthermore, this practice bestows upon you a grace period, typically spanning 21 days, commencing at the conclusion of the billing cycle. Clear your newly accrued balance within this timeframe exempts you from incurring interest.

In the event that you do retain a balance, interest begins to accumulate. Moreover, the grace period eludes for subsequent months, even if the balance persists for merely one month. The quantum of interest you will be subject to rests upon your card’s APR, the magnitude of your balance, and the extent of your monthly payment.

In the year 2022, the average credit card balance for an American stood at $5,910, while Bankrate approximated the prevailing average interest rate to surpass 20%. Keep in mind that credit card interest compounds, thereby augmenting as you prolong the retention of the balance.

Outlined below are scenarios encompassing an array of APRs, a minimum monthly payment fixed at 3% of the balance, and an assumption of no supplementary card expenditures:

| Minimum monthly payment (3%) | Repayment timeline | Total interest charges | |

| $5,315 at 12% APR | $159 | 41 months | $1,186 |

| $5,315 at 16% APR | $159 | 45 months | $1,768 |

| $5,315 at 24% APR | $159 | 56 months | $3,551 |

Effective strategies for reducing credit card interest payments

Leveraging a credit card for purchases yields numerous advantages, especially when aiming to fortify your credit score reap rewards. Nonetheless, the specter of interest charges looms, potentially translating into substantial financial outlays.

Learn how to curtail these experiences with the following strategies, delivering immediate and lasting benefits.

- Consistently settle your full balance: Maximizing your gains begins with paying off your monthly credit card bill. Capitalize on the grace period most cards offer, starting from the billing cycle’s culmination and extending to the due date for payment. Clearing your statement balance within this timeframe exempts you from incurring interest on your transactions. Streamline your payments by opting for automatic bill pay, ensuring timely settlement every cycle.

- Opt for early payments: You don’t need to wait for your billing statement’s closure to initiate payment. In fact, by remitting your credit card dues ahead of schedule, you can effectively mitigate interest charges on revolving balances. This practice reduces your average daily balance across the month, leading to noticeable interest savings.

- Explore balance transfer solutions: If burdened by existing high-cost debt, consider transferring your balance to a credit card that boasts a zero percent introductory APR period. Top-tier balance transfer credit cards provide an interest-free span of up to 21 months before the standard APR takes effect, furnishing valuable respite for debt management.

- Negotiate for a lower rate: Direct communication is key if you seek a diminished credit card interest rate. Initiate contact with your card issuer and make a polite request for a lower rate. Before reaching out, acquaint yourself with pertinent details: your prevailing APR, statement due date, and outstanding balances. Such proactive interaction can yield favorable adjustments.

By embracing these strategies, you can effectively diminish the impact of credit card interest, optimizing your financial outlook in the present and future.

FAQs

What is the concept of variable APR on a credit card?

Unlike the traditional fixed APR, the variable APR on a credit card is designed to change in response to shifts in an established index. While fixed ARPs can also change over time, they are subject to more restrictions. In the context of credit cards, variable APRs are typically adjusted by the mentioned Prime Rate.

Is it possible to avoid APR charges on a credit card?

Yes, it’s indeed possible. Even individuals with a high APR on their credit cards can avoid dealing with interest rates entirely by consistently making on-time payments. Most credit cards offer grace periods when interest doesn’t accrue if the balance is paid off promptly.

However, it’s important to be cautious as the end of 0% introductory APR periods approaches. When this period concludes, the card’s standard variable APR applies to all balances. To prevent interest charges, it’s advisable to aim for paying down the balance before the promotional period ends.

When searching for the best 0% APR credit cards, what should one consider?

This notion of the “best” credit card is subjective. It depends on individual financial circumstances, lifestyle, and goals if you’re seeking a card with a low APR for a limited duration.

How do Representative APR and AER differ from each other?

When borrowing money, interest is the cost associated with the act of borrowing. Representative APR estimates the annual cost of borrowing, including standard fees like Annual Card fees.

On the other hand, the AER (Annual Effective Rate), also known as the Annual Equivalent Rate, reflects the actual rate considering both the borrowed amount and the interest accrued over a year. The AER employs compound interest calculations, factoring in interest accumulating on previously billed interest.

Can the advertised APR rate be guaranteed?

No, the advertised APR rate is extended to a minimum of 51% of applicants. Most card issuers offer a range of APRs, and your credit score and financial history influence the actual rate you receive. Many credit card issuers provide an eligibility check to determine the likely card and APR you qualify for. For instance, Lloyds Bank offers a simple credit card eligibility checker called One Check, which takes about 5 minutes to complete.

Conclusion

In simple terms, the interest rate is the cost of borrowing a loan, charged on every installment. The APR, however, includes the loan’s cost, broker fees, and other hidden charges, encapsulating the interest rate too.

Your credit score significantly impacts both rates. A good credit score offers a competitive interest rate, thus a lower APR. Conversely, a poor credit score results in higher rates. But don’t worry; online lenders and credit unions cater to those with bad credit. Just prove you’re a reliable borrower who will repay promptly.

If getting a credit card isn’t urgent, spend a few months improving your credit score. Pay on time and avoid missing any credit deadlines. Even small efforts can make a big difference.

The best tip for securing a good credit card rate is to shop around! Compare rates, policies, and lenders to find the best deal. Don’t settle for something unsatisfactory. Ask friends and family for recommendations on companies with easy policies and lower APRs.

By following these tips, you can navigate the complexities of interest rates and APRs with confidence.