What Is FSA?

When talking about health insurance, there is a lot of jargon and countless acronyms. Most individuals might have heard of FSAs but may not exactly know what a flexible spending account is.

What is FSA? This is a question posed by employees all over the country. A few managers offer a health flexible spending account, or FSA, as an employee advantage. Specific to the U.S., an FSA is a savings account that accompanies tax benefits for you, the employee. The idea is to support the account with pre-tax cash and utilize the funds for particular health and clinical costs.

Notwithstanding you as the employee, your spouse and dependents can utilize the FSA. Qualified dependents also incorporate children who are adults who are no older than 26 years of age. To finance your FSA, you will have a predetermined sum deducted from your check. The large reward here is that you do not pay taxes on any cash put into your FSA.

In contrast to a Health Savings Account (HSA), you do not have to purchase a particular health insurance plan to open an FSA. Indeed, you do not need to keep a health plan at all. However, your FSA should be offered through an employer-offered benefits program; you should not be qualified for Medicare, and if you have a Healthcare FSA, you cannot add to an HSA simultaneously.

What is FSA insurance?

It is a plan through your employer that allows you to pay for some out-of-pocket clinical costs with tax-free dollars. Permitted costs incorporate insurance copayments and deductibles, qualified prescription medications, insulin, and clinical devices. You choose the amount to place in an FSA, up to a limit set by your employer. You are not taxed on this cash. In case cash is left toward the year’s end, the employer can offer one of two choices (not both):

- You can carry over up to $500 for the next plan year.

- You get 5 more months to spend the leftover money.

Flexible Spending Accounts are often called Flexible Spending Arrangements.

What is an FSA, and how does it work?

A flexible spending account (FSA) is a tax-advantaged savings account that offers individuals specific benefits. It is alternatively known as a “Flexible spending arrangement” and can be set up by employers for their employees.

Individuals can contribute a portion of their pre-tax earnings through an FSA, and employers may also contribute. Withdrawals from the account must be used to reimburse the employees for eligible medical and dental services expenses.

Another type of FSA is the dependent-care flexible spending account, designed to cover childcare expenses for children aged 12 and under. Additionally, it can cover the care of qualifying adults, including a spouse, who cannot care for themselves, based on specific guidelines provided by the Internal Revenue Service (IRS). The maximum contribution rules differ between a dependent-care FSA and a medical-related FSA.

How does FSA work?

One of the primary advantages of an FSA is its ability to reduce your taxable income by deducting the contributed funds from your earnings before taxes. By making regular contributions to an FSA, you can effectively lower your annual tax liability.

The Internal Revenue Service (IRS) imposes annual limits on FSA contributions. For medical expenses FSAs in 2023, the maximum contribution limit per employee is $3,050.

If you are married, your spouse can contribute up to the annual limit through their employer. While employers can contribute to an FSA, it is not mandatory, and their contributions do not affect the amount you are allowed to contribute. Employer contributions are not subject to taxation.

In 2023, the contribution limit for a dependent-care FSA is $5,000 for both joint and individual tax returns and $2,500 for married taxpayers filing separately.

In response to the COVID-19 crisis, the IRS provided employers additional flexibility for benefit plans, including special provisions for health FSAs. However, most of these provisions expired at the beginning of 2023, except for specific carryover periods extending into the year’s first half.

Who qualifies for an FSA?

Generally, to be qualified for an FSA, you only have to be an employee of an employer that provides an FSA. Unlike an HSA, you must not be covered by a High Deductible Health Plan (HDHP). You can have many insurance plans or none. You do not need health coverage to qualify for a health FSA.

What if I have an HSA and want an FSA? You are qualified for a limited health FSA covering only dental and vision costs. You may contribute to an HSA and a limited FSA to maximize tax deductions and savings. Moreover, you may still contribute the maximum for the HSA and a limited health FSA.

What are the requirements for having a dependent care FSA? Firstly, your employer needs to be offering an FSA. You additionally cannot utilize cash from a health FSA or a limited health FSA for childcare expenses. You or your spouse should work or be searching for work for childcare expenses to be qualified. Moreover, you may contribute up to $5,000 if you file together. If you are recording single or married filing separately, the limit is $2,500.

For the dependent care expenses to be qualified, the kid should be under 13 years of age. If the child turns 13 during the plan year, childcare expenses after the birthday are ineligible. Be that as it may, If you have a youngster or other dependent relative over 13 who is mentally or physically incapable of caring for themselves, your dependent care FSA can be utilized to pay for expenses.

Eligible dependents include:

- Dependent children

- Spouse

- Qualified relative

- Individuals who do not satisfy the federal criteria for “dependent child” may still be your “dependent relative” and have their dependent care expenses reimbursed if they:

– Are not the “dependent child” of anyone else

– Do not file a joint tax return

– Have a gross income that is less than $3,200

What expenses are covered under a health FSA?

Not all clinical and health expenses can be covered by your FSA, and the IRS and your employer dictate the guidelines. The most fundamental prerequisite is that a qualified health cost should be paid out of pocket for the care given to you, your spouse, or one of your dependents. The IRS characterizes medical care as any assistance or item that assists with diagnosing, treating, or preventing any infection or ailment. You can likewise utilize your FSA to take care of any transportation costs caused while getting medical care.

Another rule related to qualified expenses is that you cannot go for seconds, implying that if you get reimbursed for a medical cost from your FSA, you cannot be reimbursed by any other person, like your health insurance agency. Also, you should utilize your FSA funds during the assigned plan year, which has a distinct beginning and end date.

Medical equipment and specific treatments may also be eligible, including:

- Acupuncture and chiropractic care

- Bandages and crutches

- Birth control, pregnancy tests, and breast pumps

- Insulin and supplies for blood sugar testing

- Prescription medication

- Psychological care

- Smoke cessation

Some of these may need approval from your doctor or care provider.

You can utilize your FSA for over-the-counter medication, yet you will, in any case, need a prescription from your care supplier. The doctor should be in the state where you purchase the medication, except for insulin. Other over-the-counter things are qualified, including bandages and thermometers. Furthermore, you can utilize your benefits card at the checkout counter. By rule, you cannot go through your FSA to stock up long-term with things bought over the counter. Instead, anticipate your requirements for the plan year only; otherwise, you risk not being reimbursed.

What expenses are not covered under a health FSA?

FSAs come with several ineligible expenses, including:

- Counseling (family or marital)

- Cosmetic surgery and procedures

- General health herbs, vitamins, and supplements

- Gym memberships

- Insurance premiums

- Personal care, like makeup and toothpaste

- Prescription drugs from outside the S.

Services performed outside the plan year are also not qualified, as are any expenses you have been reimbursed for elsewhere.

FSA benefits

Flexible Spending Accounts (FSAs) offer valuable benefits that deserve attention. These accounts allow you to use pre-tax funds from your paycheck to cover various healthcare expenses:

- Clinical, dental, or vision care costs.

- Child or adult daycare expenses, enabling you to continue working or actively search for employment.

The specific expenses eligible for reimbursement with FSA contributions depend on the type of FSA plan you have. Irrespective of the FSA account type, the pre-tax nature of these accounts brings significant financial advantages:

- Saving pre-tax money from your paycheck lowers your gross income, potentially resulting in a lower tax rate depending on your annual income and tax bracket.

- Using FSA funds to cover clinical, dental, vision, or dependent care expenses reduces your overall expenditure compared to using after-tax income.

- This means you can save up to 30% on these expenses, depending on your tax bracket.

From the employee’s perspective, once the FSA plan begins, the entire allocated amount for the year becomes immediately available for use.

This accessibility is a clear benefit:

- If employees require access to the entire FSA amount on the first day of the plan, it is readily accessible.

On the other hand, employers benefit from any remaining funds, which, after considering any applicable rollover limits (such as the $500 rollover), can be added to the company’s financial resources for plan-related expenses.

FSAs allow for the reimbursement of various medical expenses:

- Payments for diagnoses, treatments, relief, preventive measures, and management of diseases, sickness, or ailments affecting any body part.

- However, expenses for cosmetic surgeries and items or services that solely contribute to general health, such as vitamins, are not eligible for reimbursement.

- Qualified clinical expenses for FSA owners, their spouses, and dependents are covered.

Furthermore, FSAs cover the purchase of medical equipment, such as:

- Diagnostic devices

- Bandages

- Crutches

Expenditures for prescription medications, including prescription and over-the-counter (OTC) drugs prescribed by a healthcare professional and insulin, can be reimbursed using FSA funds. In 2020, the Coronavirus Aid, Relief, and Economic Security (CARES) Act expanded the reimbursable qualified medical expenses to include over-the-counter medications without a doctor’s prescription, making this provision permanent. The CARES Act also allows FSA funds to be used for reimbursing the costs of menstrual care products, which is another permanent provision.

Healthcare FSA

You can use your FSA contributions to pay for costs for yourself, your spouse, and your dependents. This list is an example of the eligible medical expenses for utilizing your Healthcare FSA contributions.

- Acupuncture

- Acupressure mats and other tools

- Anything on the FSA Store

- Coinsurance

- Copays

- Deductibles

- Emergency care

- Insulin refills. No prescription needed

- Medical supplies like bandages, antiseptic wash, joint braces, first aid kits, and more

- Medical aids like crutches, hearing aids, and more

- Menstrual care products. The CARES Act added these to the list of “qualified medical expenses.”

- Over-the-counter drugs. Due to the CARES Act, these no longer need a prescription.

- Prescriptions

- Sunscreen

Limited Purpose FSA (for vision and dental care)

Limited Purpose FSAs can be simultaneously active with an HSA. Taking advantage of both could give you a way to pay for vision and dental costs using your FSA while saving your HSA money for the future.

- Coinsurance

- Contact lenses

- Copays

- Deductibles

- Dental procedures like treatments for cavities, crowns, teeth grinding, and more

- Eyeglasses

- Teeth cleaning

- Vision tests

You can use your FSA contributions to cover the costs for yourself, your spouse, and your dependents. Similar to the list provided for Healthcare FSAs, this list is not exhaustive. For a complete list of Limited Purpose FSA, IRS-approved costs read “Common Flexible Spending Account (FSA) Eligible Items.”

Dependent Care FSA

To be qualified to contribute to a Dependent Care FSA, you need to be the primary caretaker of children under 13 or an adult dependent who cannot take care of themselves. In both situations, the eligible dependents must mostly live in your home.

These costs must be brought about while you work or look for work. That implies that you cannot use contributions for date-night babysitters. Or care providers that allow you to volunteer. An extra advantage is keeping a Dependent Care FSA while contributing to an HSA.

Just as the previously provided lists, this one only partially represents all the costs for which you can use your Dependent Care FSA contributions.

- Adult daycare programs for adult dependents who can’t take care of themselves

- After-school programs for minor children under the age of 13

- Daycare for minor children under the age of 13

- In-home care services for adult dependents who can’t take care of themselves

- Nanny for minor children under the age of 13

- Preschool fees

- Summer programs for minor children under the age of 13

- Transportation costs for caretakers

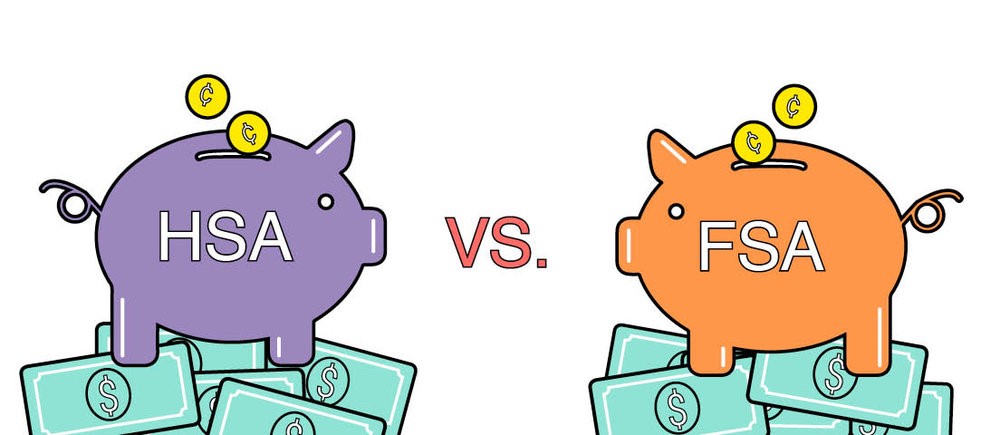

Differences between FSA and HSA

Although FSAs and HSAs permit people to use pretax income for qualified medical costs, there are significant differences between the two account types. These incorporate the qualifications, contribution limits, rollover rules, changing contribution amounts, and withdrawal penalties. We have compiled the main differences below.

Qualifications

- Flexible Spending Account

- It must be set up by the employer.

- Health Savings Account

- Requires a high-deductible health plan (HDHP).

- Cannot be eligible for Medicare.

- It cannot be claimed as a dependent on another person’s tax return.

Annual Contribution Limits

- Flexible Spending Account

- Up to $2,650 per individual.

- Up to $5,300 per household.

- Health Savings Account

- Up to $3,450 per individual.

- Up to $6,900 per household.

Account Ownership

- Flexible Spending Account

- Owned by the employer and lost with job change unless eligible for continuation through COBRA.

- Health Savings Account

- Owned by individuals and carries over with employment changes.

Rollover Rules

- Flexible Spending Account

Employer chooses whether:

- Funds expire at the end of the year.

- Employees get a grace period of 2 1/2 months to use funds.

- Employees can roll over $500 into next year’s FSA.

- Health Savings Account

- Unused funds roll over every year.

When You Can Change Contributions

- Flexible Spending Account

- At open enrollment.

- If your family situation changes.

- If you change your plan or employer.

- Health Savings Account

- Any time, as long as you don’t go over the contribution limits.

Optimal Choices for Health Spending Accounts

When considering health spending accounts, it’s crucial to understand their withdrawal penalties. For a Flexible Spending Account (FSA), reimbursements require expense submissions, and nonmedical fund use might be restricted by employers. Conversely, Health Savings Accounts (HSAs) allow tax-free withdrawals after age 65 but incur a 20% penalty plus tax declaration if used earlier for nonmedical purposes.

Typically, HSAs offer higher limits and the ability to roll over contributions, making them advantageous if eligible. FSAs, unless an employer permits $500 rollover annually, do not grow over time and may lose unused balances annually. The choice between FSA and HSA often hinges on employment and insurance specifics.

In many cases, individuals cannot simultaneously hold both an FSA and HSA due to overlapping health expense coverage tied to insurance or employer policies. However, pairing an HSA with a limited-purpose FSA (LPFSA), dedicated to dental and vision expenses, can optimize tax savings, especially with anticipated high medical costs.

FSAs during COVID-19

Regardless of the cash set in an FSA, it generally should be utilized before the finish of the arrangement year. In any case, a plan can offer a grace period of up to two months to wrap up using that subsidizing. If such an alternative is not taken, a plan might permit you to roll over to $550 per year of unused funds from your account. Both choices are optional, yet the plan might offer just one. Any funds in your FSA are lost when the year closes or the grace period terminates. In this manner, you should carefully calibrate the amount of cash you intend to place into your account and how you expect to spend it throughout the year.

The Internal Revenue Service has reported that in light of the effect of COVID-19, it will allow, but not expect, employers to correct health plans so employees can change elections that normally are permitted only one time each year. Additionally, the IRS will permit employers discretion to change FSA plans for 2020 and 2021 to enable employees to carry over more than the current $550 maximum or to broaden the grace period for utilizing unspent FSA funds through December 31 of every year.

Is opening an FSA worth it?

If you found items or services in the list of FSA-approved expenses you know you will need in the upcoming year, an FSA could be worth opening. Keep in mind that these costs could be incurred by you, your spouse, or your dependents. By opening an FSA, you will save money by lowering your taxable income and ensuring that the money is socked away for when you require it during the plan year.

Be careful because you could lose money remaining in your account on the last day of your plan. To prevent this, ensure that you select your funding election carefully. There are only two scenarios where left-over funds could still be utilized after the last plan day; that too, only if your employer permits it.

Firstly, employers can permit you to roll over up to $550 of your contribution from 2020 to 2021. Or, they could allow a 2.5-month grace period for you to use the rest of the contribution. Either way, select your FSA contribution carefully to avoid losing any contributions at the end of the year. Moreover, ensure your monthly household budget can afford the FSA contribution you opt for. This is essential since you cannot change these elections until the next open enrollment period or unless you experience a qualifying life event such as marriage, childbirth, or dependent death.

FAQs

How much should I contribute to my FSA?

The appropriate contribution amount varies for each individual, and FSA elections should be based on an evaluation of your expected out-of-pocket healthcare expenses for the upcoming year. Carefully assess your specific situation to determine the right contribution level.

Are FSAs the same thing as HSAs?

While it’s easy to confuse FSAs and HSAs, these two healthcare accounts are distinct. Although both accounts can be used to pay for similar items and are associated with health plans, a health savings account (HSA) is not tied to an employer’s health plan. HSAs are specially linked to high-deductible health plans, and the funds in HSA roll over from year to year. However, it’s important to note that you cannot borrow against the future value of your HSA.

How much can my employer contribute to my FSA?

Employers have the option to contribute to an FSA. As per IRS regulations, employers are permitted to contribute up to $500 to an employee’s FSA, even if the employee does not make any contributions. If the employee does make contributions, the employer can match those contributions up to the maximum allowed amount of $3,050 in a calendar year, and your employer can match that by contributing an additional $3,050 resulting in a total of $6,100. However, it’s important to note that not all employers contribute to employee FSAs.

What if I have a different health insurance plan than my spouse or tax dependents?

You can utilize funds from your healthcare FSA to cover eligible medical dependents, regardless of their enrolled insurance plan. However, to use FSA funds for your dependents, they must be claimed on your tax return, and dependents can not file their return.

Can I use an FSA with a Health Insurance Marketplace High-Deductible Plan?

No, an FSA cannot be used in conjunction with a Marketplace plan. In this scenario, you can opt for a similar product known as a Health Savings Account (HSA). HSAs allow you to allocate pretax funds to cover certain health expenses if you have a high-deductible health insurance plan obtained through the Marketplace.

Can I use a dependent care FSA to pay for private school tuition?

No, dependent care FSAs cannot be used for private school tuition expenses. These FSAs are designed to cover expenses such as preschool and daycare. However, there are exceptions to this rule. If the private school is specifically aimed at addressing the special needs of a child with a developmental or physical disability, there is a higher likelihood that your dependent care FSA may cover those tuition costs.

Conclusion

If your job provides a health plan, consider using a Flexible Spending Account (FSA) to cover copayments, deductibles, medications, and other healthcare expenses. An FSA can reduce your taxable income, providing significant savings. The advantages of opening an FSA apply universally, regardless of your account type. Ultimately, you must decide if opening an FSA aligns with your financial goals. For specific details about your employer’s plans, reach out to your HR Department. They can provide the information you need to make an informed decision.