What Is The Average Cost Of Supplemental Insurance For Medicare?

Learn the costs of supplemental insurance for medicare to make an informed decision.

When securing comprehensive healthcare coverage for your retirement, understanding the ins and outs of Medicare Supplement Plans, often called Medigap, is essential. These plans enhance your Original Medicare benefits by providing additional financial protection. It’s essential to note that Medigap differs considerably from Medicare Advantage Plans, as it supplements rather than replaces your current Medicare coverage. In this blog post, we’ll investigate a fundamental question: “What Is The Average Cost Of Supplemental Insurance For Medicare?”

Private insurance businesses offer Medigap plans that demand a monthly premium in addition to the standard Part B premium paid to Medicare. While they provide precious coverage, particularly in copayments, excess, and other out-of-pocket costs, it’s vital to understand that they do not include prescription drug coverage. If you demand support with medicine drug costs, you may need to consider enlisting in a Medicare Part D plan separately.

The price of Medicare Supplement plans can vary broadly depending on multiple factors, including your location, the individual program you choose, and the insurance supplier. To make an informed ruling about your healthcare coverage, researching the average costs connected with different Medigap plans and comparing offerings from various insurance companies is crucial. By knowing the nuances of Medigap, you can empower yourself to make knowledgeable choices that rank your health and financial well-being during your rank years. So, let’s dive deeper into the world of Medicare addition plans and uncover the ordinary costs you can expect in your trip toward extensive healthcare coverage.

Medicare Supplement Plans

When securing comprehensive healthcare coverage for your retirement, Medicare Supplement Plans, often called Medigap, emerge as a popular choice. It’s essential to note that Medigap differs considerably from Medicare Advantage Plans, as it plans agreeably with your Original Medicare benefits to provide an extra financial safeguard.

Here’s a safeguard of what you need to know about Medicare Supplement Plans:

- Monthly rewards: With Medigap, you pay monthly rewards to a private insurance company. This fee is extra to the monthly Part B premium paid to Medicare.

- Individual coverage: It’s essential to understand that a Medigap plan only covers one person. You must purchase separate plans if you and your spouse require Medigap coverage. Fortunately, you can choose a Medigap plan from any insurance company licensed in your state to offer these plans.

- Guaranteed renewability: The beauty of a Medigap plan lies in its guaranteed renewability feature. Even if you develop health circumstances, the insurance company cannot annul your Medigap plan as long as you carefully pay the premiums.

- Prescription drug coverage: While some older Medigap plans used to include medical drug coverage, this changed after January 1, 2006. New Medigap plans are not allowed to give prescription drug coverage. You can enroll in a Medicare Prescription Drug Plan (Part D) if you need support with prescription drug costs. Remember that you might need to manage two separate payment streams if you acquire Medigap and a Medicare drug plan from the same group. Reach out to your chosen provider to explain payment processes.

- Medicare Advantage plans: Knowing you cannot simultaneously hold a Medicare Advantage Plan and a Medigap policy is vital. However, if you wish to switch back to Original Medicare, you can investigate Medigap options again.

In essence, Medicare Supplement Plans, or Medigap, offer individuals an opportunity to enhance their healthcare safety net. By filling the gaps left by Original Medicare, these plans provide financial security and peace of mind during retirement. As you board on your trip to secure the best Medicare additional insurance, understanding the nuances of Medigap can authorize you to make informed alternatives about your healthcare coverage. Remember, your health and well-being merit extreme security, and Medigap is here to help you achieve that.

Types of Supplemental Insurance for Medicare

Several additional insurance options are available for Medicare beneficiaries, each designed to fill in the gaps and cover expenses that Original Medicare (Part A and Part B) may not fully address. These supplemental insurance plans, Medigap or Medicare Supplement plans, can be a precious addition to your healthcare coverage. Here’s a failure of the diverse types:

- Medigap Plan A: Provides basic coverage, helping with expenses like coinsurance for hospital stays and medical services. It’s a good option if you want minimal additional coverage.

- Medigap Plan B: Similar to Plan A but with added coverage for the Part A deductible. It can be helpful if you anticipate hospital stays and want to reduce out-of-pocket costs.

- Medigap Plan C: A comprehensive plan covering deductibles for Part A and Part B and excess charges from healthcare providers. Plan C offers extensive coverage.

- Medigap Plan D: This plan covers the Part A deductible and copayments, making it suitable for reducing hospital-related expenses.

- Medigap Plan F: Among the most popular plans, it offers robust coverage, including deductibles for Part A and B, excess charges, and foreign travel emergency care. However, it’s no longer available to new Medicare beneficiaries.

- High-Deductible Plan F: Similar to Plan F but with a higher deductible. Once the deductible is met, it covers the same benefits as Plan F.

- Medigap Plan G: This plan is like Plan F but doesn’t cover the Part B deductible. However, it often comes at a lower monthly premium than Plan F.

- Medigap Plan M: It covers half of the Part A deductible and offers limited coverage for skilled nursing facility coinsurance. It’s a more budget-friendly option.

- Medigap Plan N: With this plan, you’ll have copayments for some doctor’s office and emergency room visits, but it covers the Part A deductible and excess charges. Plan N is a cost-effective choice for those willing to share some costs.

It’s significant to note that Medigap plans are exchangeable, meaning the coverage for each plan type is the same, irrespective of the insurance supplier. However, insurance companies’ prices vary, so it’s sensible to match sites to find the best deal.

When choosing a supplemental insurance plan for Medicare, individuals should consider their specific healthcare needs, budget, and preferences. These plans offer peace of mind by reducing out-of-pocket expenses and ensuring access to the required healthcare services.

How much does Medicare Part B cost?

In 2020, the standard Part B premium is $144.60 every month. The vast majority pay the standard premium sum. It’s either deducted from your Social Security check, or you may pay Medicare straightforwardly, contingent upon your circumstance.

Individuals with tax-reported incomes over $87,000 (single) and $174,000 (joint) must compensate for an Income-Related Monthly Adjustment Amount (IRMAA). The table beneath shows Part B charges for 2020 by recording status and pay level. The IRMAA depends on your announced changed gross pay from two years prior.

Medicare Supplement Plan G stands out as a top choice for seniors and Medicare beneficiaries seeking comprehensive coverage. This robust plan offers extensive benefits, except for the Medicare Part B deductible, which amounts to just $226 in 2023. Once you cover this deductible, Plan G provides financial support for various healthcare services, including doctor visits, blood tests, and outpatient medical treatments.

It’s worth highlighting that Plan G enjoys immense popularity among new Medicare enrollees. However, it’s essential to consider the associated costs, as the average monthly premium hovers around $145. Evaluating this monthly expense against your anticipated medical expenditures for the year is prudent to make an informed decision.

Filing Individual Tax Returns |

Filing Joint Tax Returns |

Total Monthly Part B Premium |

| $87,000 or less | $174,000 or less | $144.60 |

| Over $87,000

& Up to $109,000 |

Over $174,000

& Up to $218,000 |

$202.40 |

| Over $109,000

& Up to $136,000 |

Over $218,000

& Up to $272,000 |

$289.00 |

| Over $136,000

& Up to $163,000 |

Over $272,000

& Up to $326,000 |

$376.00 |

| Over $163,000

& Less than $500,000 |

Over $326,000

& Less than $750,000 |

$462.70 |

| $500,000 or more | $750,000 or more | $491.60 |

Note: Sample rates have been extracted online, courtesy of AARPMedicarePlans.

What is the average cost of Supplemental Insurance for Medicare?

The typical cost of Medicare supplemental insurance hovers at approximately $150 monthly, with premiums spanning from $50 to $450 monthly. Remember that premium rates vary significantly based on the specific plan you choose.

Here’s an overview of the average monthly premiums for some of the most popular Medigap plans:

- Medigap Plan A: $200 – $300

- Medigap Plan B: $100 – $150

- Medigap Plan C: $250 – $300

- Medigap Plan D: $140 – $160

- Medigap Plan F: $165 – $185

- High-Deductible Plan F: $60 – $70

- Medigap Plan G: $120 – $140

- Medigap Plan M: $190 – $215

- Medigap Plan N: $100 – $120

Please note that these figures represent national averages. As demonstrated in the Plan F vs. Plan G comparison, premium rates can significantly differ from one state to another.

Medigap Cost Comparison Chart

Medigap plans, or Medicare supplemental plans, cover out-of-pocket medicare costs.

Here is a cost comparison chart of Medigap policies, as per Healthline.

| Plan A | Plan B | Plan C | Plan D | Plan F | Plan G | Plan K | Plan L | Plan M | Plan N | |

| Part B deductible | no | no | yes | no | yes | no | no | no | no | no |

| Part A Hospital Coinsurance | yes | yes | yes | yes | yes | yes | Yes | yes | yes | yes |

| Part A deductible | no | yes | yes | yes | yes | yes | 50% | 75% | 50% | yes |

| Part B coinsurance | yes | yes | yes | yes | yes | yes | 50% | 75% | yes | yes (but with copays) |

| Blood (first 3 pints) | yes | yes | yes | yes | yes | yes | 50% | 75% | yes | yes |

| Hospice care | yes | yes | yes | yes | yes | yes | 50% | 75% | yes | yes |

| Skilled nursing facility care coinsurance | no | no | yes | yes | yes | yes | 50% | 75% | yes | yes |

| Part B excess charge | no | no | no | no | yes | yes | no | no | no | no |

| Foreign travel emergencies | no | no | 80% | 80% | 80% | 80% | no | no | 80% | 80% |

| Plan deductibles | $1,408

hospital; $198 medical |

$0

hospital; $198 medical |

$0

hospital; $0 medical |

$0

hospital; $198 medical |

$2,370 | $2,370 | $704

hospital; $198 medical |

$352

hospital; $198 medical |

$704

hospital; $198 medical |

$0

hospital; $198 medical |

| Out-of-pocket maximum | no | no | no | no | no | no | $6,220 | $3,110 | no | no |

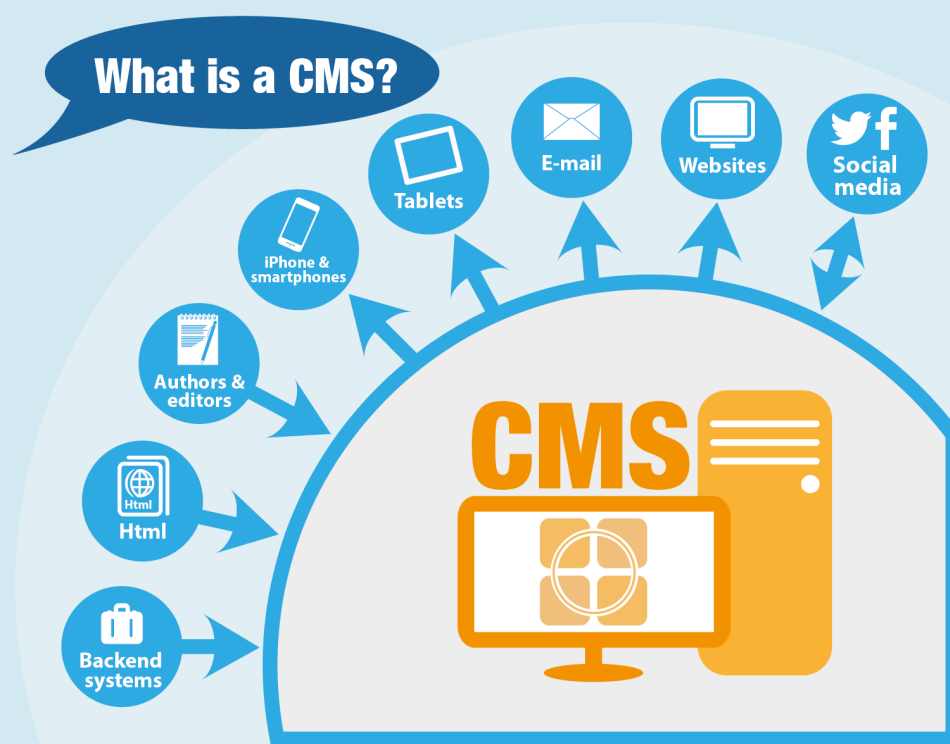

What is a Medicare Supplement (Medigap) Plan?

A Medicare Supplement Plan, generally called Medigap, is a secret insurance policy designed to supplement and cover the gaps left by First Medicare, which includes Part A and Part B. These additional plans work alongside Original Medicare and do not apply to other individual insurance policies, independent Medicare plans, or Medicare Advantage plans.

It’s significant to note that Medigap plans usually do not include medical medication coverage. To address medicine drug expenses, people may consider enrolling in Medicare Part D, a medicine drug coverage plan, or opt for a Medicare Advantage plan integrating drug coverage.

Medigap plans should not be perplexed with Medicare Part C or Medicare Advantage. While Medicare Advantage plans offer a substitute method to obtain reporting for Medicare Part A and Part B, Medigap plans alone focus on covering the expenditure that Original Medicare does not.

So, what expenses do Medicare Supplement Plans cover? These plans handle out-of-pocket costs that may arise with Original Medicare but are not covered by Part A or B. These costs include

- Deductibles: The initial amounts you must pay for healthcare services or prescriptions before your Medicare plan provider contributes to the payment.

- Copayments: Fixed amounts you might need to pay for specific benefits after fulfilling the deductible.

- Coinsurance: You may need to pay a percentage of the cost for certain services after satisfying the deductible.

In addition to these expenses, some Medigap plans may extend coverage to emergency medical services required while traveling outside the United States.

Who is eligible for Medicare Supplement Plans?

To qualify for a Medigap plan, you must be enrolled in Original Medicare Part A and Part B, excluding Medicare Advantage. Eligibility categories include:

- Age 65 and older: If you’re 65 or older, you can enroll in a Medigap plan.

- Under 65 with Disability Benefits: Individuals under 65 receiving disability benefits can also be eligible.

- Under 65 with ALS (Amyotrophic Lateral Sclerosis): If you are under 65 and diagnosed with ALS, you meet the criteria.

- Under 65 with ESRD (End-Stage Renal Disease): Those under 65 diagnosed with end-stage renal disease are also eligible.

It’s worth noting that insurance companies may impose a waiting period of up to six months for coverage of pre-existing conditions if you lack creditable coverage (other health insurance) before enrolling in Medicare.

Your Medigap, open enrollment period kicks off in the first month you sign up for Medicare Part B insurance at age 65 or older, even if you previously delayed enrollment due to group health coverage. Insurance companies cannot cancel your Medigap policy due to changes in your health status as long as you continue to pay your premiums. You can apply for a new program or switch between projects if enrolled in a Medigap plan.

How do insurance companies determine Medigap premiums?

These premiums, the monthly payments for your Medigap coverage, are selected through a process known as medical underwriting, which serves two primary purposes:

- Whether to offer you a Medicare supplement plan: Insurance companies use this process to assess whether they will provide you with a Medigap plan.

- How much to charge you: It helps insurers decide the appropriate premium amount based on your risk factors.

The process of medical underwriting initiates with questions about your medical history and personal habits, including inquiries about tobacco usage, weight, age, and more. These questions serve as valuable indicators for the insurance company, helping them gauge the likelihood of you requiring medical services. They aim to decide if your medical history and way of life suggest a higher opportunity of falling ill or developing a persistent condition.

Here’s how it works: If you are sensed as a higher risk than the average Medicare recipient, the insurance company may take one of two deeds. They might decline to offer you a Supplement plan entirely, citing the increased risk. Alternatively, they might be prepared to provide coverage at a higher premium rate. This higher rate accounts for the elevated risk associated with your health and lifestyle factors.

The medical underwriting process plays a crucial role in shaping your Medigap experience. It influences whether you can secure a plan and the cost you’ll pay for that coverage. Therefore, it’s essential to be transparent and provide accurate information during this evaluation, as it directly impacts your access to Medigap benefits and expenses.

What occurs when you have guaranteed issue rights?

Having guaranteed issue rights is a valuable safeguard when obtaining a Medigap policy. It means your Medigap coverage application won’t be subjected to medical underwriting. It translates to significant benefits: you won’t face denials or inflated premiums, even if you have preexisting health conditions or a history of tobacco use.

Guaranteed issue rights are not an everyday occurrence for Medicare beneficiaries. They are typically associated with specific situations; the first instance is your Medigap Open Enrollment Period (OEP). This six-month window begins when you turn 65 or older and are enrolled in Original Medicare, encompassing Medicare Part A (hospital insurance) and Medicare Part B (medical insurance).

Within your Medigap OEP, you are not susceptible to denials or premium hikes, regardless of your health status. However, once this period expires, your Medigap application becomes subject to medical underwriting.

Medicare.gov outlines seven additional scenarios in which you might be eligible for guaranteed issue rights. These situations are typically linked to losing coverage, such as leaving an employer group health plan. Understanding these rights and when they apply can be invaluable in ensuring you receive the Medigap coverage you need, precisely when needed.

What is the best Medicare Supplement Plan for 2023?

Several providers stand out for their offerings in Medicare Supplement Plans for 2023. Here, we’ll provide an overview of some of the top options available to you:

AARP/UnitedHealthcare Medicare Supplement Insurance

Summary of benefits

AARP/UnitedHealthcare extends a comprehensive range of Medigap plans across the nation, excluding only Plans D and M. This widespread availability ensures that most applicants can find a plan to suit their needs.

- Pros

-

-

- In most states, eight out of ten standard Medigap plans are on offer, providing applicants with a diverse array of choices.

- AARP/UHC offers Medigap plans in all 50 states, including Massachusetts, where other providers don’t always provide coverage.

- High customer satisfaction ratings and low complaint rates make AARP/UHC Medigap plans a reliable choice.

-

- Cons

-

- Some Medigap plans may come with additional costs for health and wellness discounts, unlike competitors who offer similar perks for free.

- The existence of multiple variations within specific Medigap plans, each with distinct pricing, extras, and restrictions, can bewilder applicants.

- While Medicare Select plans offer lower premiums, they necessitate in-network care for inpatient services, potentially limiting your choice of healthcare providers.

State Farm Medicare Supplement Insurance

Summary of Benefits

State Farm’s Medigap plans are available in most states and boast a low member complaint rate.

- Pros

-

-

- State Farm’s members report complaint rates nearly 90% lower than the average for all Medigap insurance companies, indicating high customer satisfaction.

- Competitive premiums, especially in high-cost areas like Los Angeles, make State Farm an affordable choice for coverage.

-

- Cons

-

- State Farm may not offer the same breadth of premium discounts and extra perks, such as fitness benefits, as some competitors, potentially missing out on cost-saving opportunities.

- In specific locations, State Farm’s premiums might not always be the lowest, with other providers occasionally offering significantly more competitive prices, even before factoring in discounts.

Mutual of Omaha Medicare Supplement Insurance

Summary of Benefits

Mutual of Omaha is a standout choice for those seeking Medigap coverage, consistently earning high marks for member satisfaction.

- Pros

-

-

- Offering an impressive discount of up to 12% for applicants living with another adult, Mutual of Omaha surpasses the discounts provided by many other companies.

- Complaint rates among Mutual of Omaha members are notably lower, approximately 60% below the average for all Medigap insurance companies.

- With coverage available in every state except Massachusetts, Mutual of Omaha ensures wide accessibility.

-

- Cons

-

- For new Medicare beneficiaries, Mutual of Omaha typically offers a limited selection of Medigap plans, usually including plans A, G, and N in most states.

- Mutual of Omaha allocates a higher proportion of its resources to overhead expenses and administrative costs than the average Medigap company, which may impact member benefits.

Anthem Medicare Supplement Insurance

Summary of Benefits

Anthem Medicare Supplement Insurance goes beyond standard Medigap plans, offering options to add coverage for services not included in traditional plans, such as dental cleanings, eye exams, and allowances for glasses or contact lenses.

- Pros

-

-

- Anthem allows for the customization of coverage, offering multiple tiers of dental and vision plans that it can combine with Medigap plans based on individual needs.

- Eligible members can save on premiums through discounts tied to household and payment methods, potentially leading to cost savings.

- Anthem’s additional perks encompass a wide range of fitness, health, and wellness products and services, enhancing the overall value of their Medigap plans.

-

- Cons

-

- Anthem’s pricing structure may, at times, result in higher costs for plans with less coverage, leading to potential confusion during the shopping process.

- While Anthem offers popular Medigap plan types, the options may be limited, reducing choices for prospective policyholders.

- Medigap policies from Anthem are only available in 14 states, which may limit access for individuals outside these states.

Blue Cross Blue Shield Medicare Supplement Insurance

Summary of Benefits

Blue Cross Blue Shield (BCBS) Medicare Supplement Insurance is renowned for its nationwide coverage. Still, it comes with variations in plan options and costs.

- Pros

-

-

- BCBS companies offer extensive coverage, providing Medigap policies in all 50 states and Washington, D.C., ensuring accessibility for individuals nationwide.

- The “Blue to Blue” program by BCBS facilitates convenient adjustments to your coverage in the future, simplifying plan modifications as needed.

-

- Cons

-

- Pricing, plan types, additional benefits, and member experiences with BCBS can vary based on the specific BCBS company operating in your local area, leading to potential inconsistencies in coverage options and customer satisfaction.

- NerdWallet comparisons have shown that both Medigap Plan A and Plan N from BCBS tend to be at least 50% more expensive than the best market prices on average, indicating higher costs for these plans than competitors.

- BCBS offers Medicare Select plans, which can be more affordable than standard versions but require policyholders to remain in-network for inpatient care, limiting flexibility in seeking care outside the network.

When considering the best Medicare Supplement Plan for 2023, your choice should align with your unique needs and preferences. These providers offer a range of options, and it’s crucial to evaluate each based on your circumstances to find the most suitable coverage.

Is it better to have Medicare Advantage or Medigap?

A Medicare Advantage plan might be a superior decision if it has an out-of-pocket maximum that shields you from colossal bills. For the most part, customary Medicare and a Medigap protection plan give you more choices regarding where you get your care.

Unique Medicare permits you to utilize any U.S. specialist or clinic that acknowledges Medicare, and most do. Most Medicare Advantage plans limit you to using doctors in their organization and may cover less, or none, of the costs of using out-of-network and out-of-town providers.

Medicare Advantage plans are where care is composed, and your primary care specialist will be given all information and kept in the loop with care updates. With customary Medicare, you don’t need a referral to a specialist or prior authorization for procedures. Yet, you’ll have to ensure care is composed and your primary care physicians correspond with each other. It is done regularly by building a relationship with an essential care doctor and letting them refer you to experts.

How much does medicare supplement insurance cost?

One of the foremost considerations when navigating Medicare plans is the cost involved. It’s only natural; after all, how can you decide between Medicare Supplement Insurance and a Medicare Advantage plan without understanding the financial aspects? However, estimating these costs can often prove to be quite a perplexing task. The intricacy arises from private insurance companies selling Medicare Supplement plans, and each company establishes its premiums.

Furthermore, many factors come into play when insurers determine Medigap rates. Several pricing determinants come into play if you don’t possess a guaranteed issue right for a Medigap policy. Others, like the pricing methodology employed, may fluctuate according to state regulations. The key takeout is that there’s no standard answer to the question, “How much does Medicare Supplement Insurance cost?”

The cost of Medigap plans can waver considerably depending on diverse factors, including your location, the insurance provider, the particular plan you choose, and even your age. To get an exact idea of what you can expect to pay for Medicare Supplement Insurance, getting quotes from different insurance businesses and completely assessing your options is desirable.

This way, you can make a learned decision that aligns with your healthcare needs and financial thoughts.

Best Medicare Supplement companies

When it comes to Medicare Supplement plans, one notable advantage is their standardization. Regardless of which provider you choose, the benefits for each plan letter remain uniform across the board. In essence, Medicare Supplement Plan G from UnitedHealthcare mirrors the Plan G offered by Aetna regarding coverage.

However, what distinguishes these providers is their pricing structure for their Medicare Supplement plans. Rates can fluctuate significantly from company to company, making it essential to weigh this against other factors, such as the provider’s financial stability and track record of rate increases. While some companies may entice you with lower initial rates, they might implement steeper rate hikes as you age.

UnitedHealthcare/AARP Medigap

AARP, with its highly wanted-after plans, stands out by giving some of the most profitable rates, presenting a powerful option to reduce wasteful healthcare costs. UnitedHealthcare/AARP offers diverse Medigap plans, including A, B, C, D, F, G, K, L, and N. For instance, the monthly price of Plan G starts at $131.

The AARP approval, mixed with the backing of a major health insurance company like UnitedHealthcare, makes it a top-notch choice. Beyond its extensive coverage, UnitedHealthcare/AARP sweetens the deal with various add-on programs, including vision and dental care discounts. Moreover, they provide lower-cost choices like Medicare Select Plan G and N, which maintain the plan’s standard benefits but restrict certain healthcare services to in-network purveyors. UnitedHealthcare boasts excellent economic strength, collecting a rating from AM Best.

Aetna Medigap

Aetna is renowned for providing Medicare Supplement plans at competitive rates, focusing on affordability. For example, the monthly cost of Plan G starts at $137. Aetna’s offerings extend to high-deductible plans, which come in various forms. While these plans offer affordability, with average monthly costs ranging from $37 to $52, they entail higher medical expenses until you reach the $2,700 deductible. It’s important to note that Aetna’s Medicare Supplement program registers a slightly higher number of complaints than its counterparts of similar size.

Cigna Medigap

Cigna’s Medicare Supplement plans cover a wide range of states, spanning 45 in total. However, it’s worth noting that Cigna’s plans tend to come with relatively higher price tags than other providers. For instance, the monthly cost of Plan G starts at $150. Nevertheless, Cigna offers a household premium discount that can help you secure a more favorable rate. This discount is accessible in most states when multiple family members in the same household enroll in the same Cigna Medigap plan.

In your quest for the best Medicare Supplement company, consider the cost, specific plan options, location, and individual healthcare needs. By conducting thorough research and weighing these factors, you can make an informed choice that aligns perfectly with your health and financial goals.

Medicare supplement cost comparison chart

When selecting the right Medicare Supplement plan, understanding the cost variations is crucial. Below is a cost similarity chart for a 65-year-old nonsmoker in Florida. These magazine cost ranges are meant to give you a ballpark image, as actual rates may vary depending on location and insurance supplier.

Medigap Plan Type |

Medigap Cost Range (monthly) |

| Medicare Supplement Plan A | $181 – $380 |

| Medicare Supplement Plan B | $238 – $329 |

| Medicare Supplement Plan C | $288 – $364 |

| Medicare Supplement Plan D | $290 – $334 |

| Medicare Supplement Plan F | $278 – $495 |

| Medicare Supplement High-Deductible Plan F | $70 – $156 |

| Medicare Supplement Plan G | $241 – $413 |

| Medicare Supplement High-Deductible Plan G | $70 – $148 |

| Medicare Supplement Plan K | $82 – $189 |

| Medicare Supplement Plan L | $172 – $279 |

| Medicare Supplement Plan M | $268 – $314 |

| Medicare Supplement Plan N | $196 – $320 |

Let’s look at two extremes within this spectrum to provide some perspective. Plan K, the most budget-friendly option with relatively limited coverage, can start at just $82 per month when offered through AARP. On the other end of the spectrum, Plan F, which provides an extensive range, may reach as high as $495 per month when provided by Union Security Insurance Company.

Remember that these are estimated cost extents for a 65-year-old male nonsmoker in Florida. Actual rates can be selected based on your location, age, and the insurance company you choose. So, when deciding, it’s crucial to balance your healthcare needs with your cheap to find the Medicare Supplement plan that fits you best.

What is the average cost of medicare supplement plan F?

Medicare Supplement plans provide valuable coverage to enhance your healthcare benefits. The High Deductible Medicare Supplement Plan F is a cost-effective alternative to the standard Plan F, offering the same benefits but with a higher deductible requirement. Although it may take some time to reach the deductible, opting for the High Deductible Plan F often translates into lower monthly premiums when compared to the standard Plan F.

One important note is that you can only enroll in the High Deductible Plan F if you were eligible for Medicare benefits before January 1, 2020.

Essential example of the average monthly costs for High Deductible Plan F in Las Vegas, NV (88901), tailored to different demographics:

| Gender: Female, Age: 65 | $57.00 |

| Gender: Male, Age: 65 | $62.00 |

| Gender: Female, Age: 75 | $82.00 |

| Gender Male, Age: 75 | $91.00 |

Please keep in mind that the rates mentioned above are sample figures and are subject to change. We recommend contacting us for precise and personalized quotes tailored to your circumstances. Remember, eligibility for High Deductible Medicare Supplement Plan F requires that you were eligible for Medicare benefits before January 1, 2020.

Selecting the right Medicare Supplement plan is essential to ensure your healthcare needs are met while managing your budget effectively.

How to sign up for Medicare supplement plans in 2023

Medicare Supplement plans, also well-known as Medigap plans, provide vital coverage to enhance your healthcare advantages. Signing up for a Medigap plan is a simple process, and you can enroll any time during the year because there is no annual open registration period.

However, to make the most of your Medigap options, it’s essential to understand the optimal matriculation period and follow these simple steps:

1. Enroll in Medicare Part A and B.

To be qualified for a Medigap plan, you must recruit in Medicare Part A (hospital insurance) and Part B (medical insurance). This principal step is essential, as Medigap plans work alongside Original Medicare to give advance coverage.

It’s worth noting that neither Medicare nor Medigap plans cover medicine. If you require medication drug coverage, you may examine enrolling in a Medicare Advantage or an independent medicine drug plan (Part D). Remember that if you opt for a Medicare Advantage plan, you won’t be able to enter a Medigap plan jointly.

2. Identify licensed insurance companies

Visit Medicare.gov to acknowledge the authorized insurance companies that sell Medigap plans in your state. This step makes sure you have entrance to a range of choices to select from.

3. Compare costs and coverage.

Costs for Medigap plans can vary depending on several factors, including the insurance company, your state of residence, and other individual considerations. While the coverage provided by each plan is standardized and consistent, the pricing differs.

Take the time to match costs and gifts from various insurance companies. This step lets you find a plan that convulsions your requirements and is cheap.

4. Select your ideal Medigap plan

After evaluating your options and knowledge of the costs associated with each plan, make an informed ruling. Choose the Medigap plan that best suits your healthcare conditions and financial position. Once you’ve made your selection, proceed to acquire your Medigap policy.

When Is the Best Time to Enroll in a Medicare Supplement Plan?

The ideal time to enroll in a Medicare Supplement plan is during your initial Medigap Open Enrollment Period. This six-month glass initiates on the first day of the month you turn 65 and is also authenticated in Medicare Part B. It’s essential during this time:

- Insurance companies cannot reject a Medigap policy founded on your health status or pre-existing medical conditions.

- You can choose from the accessible Medigap plans without being charged higher fees due to your health.

Attempting to recruit in a Medigap plan outside this record period may result in penalty fees or denial of coverage. Following these steps and recording during the optimum timeline, you can secure Medigap coverage matching your Medicare benefits and broad healthcare protection.

FAQs

What is Medicare supplemental insurance, and why do I need it?

Medicare supplemental insurance, or Medigap, helps cover the gaps in Original Medicare. It pays for deductibles, copayments, and coinsurance, providing financial protection and peace of mind.

How much does Medicare supplemental insurance cost on average?

The ordinary cost of Medicare supplemental insurance is about $150 per month. However, costs vary broadly depending on location, age, and chosen plan.

Which is the least expensive Medicare supplemental plan available?

Plan K is usually the least costly Medigap plan, with an ordinary monthly cost of around $77 in 2023. It’s an alternative for those looking to protect themselves principally against major medical expenses.

Can I be denied Medicare supplemental insurance coverage?

You cannot be rejected based on a pre-existing medical environment during your Medigap open enrollment period. However, insurers may subject you to medical guarantees outside this period, which could affect your fitness or premiums.

5. Are Medicare supplemental insurance premiums tax-deductible?

Yes, Medicare supplemental insurance premiums, also known as Medigap premiums, are usually tax-deductible as an extrabudgetary deduction. It can provide a valuable tax break for eligible individuals.

6. How do Medigap costs change with age?

Some Medigap policies have age-based pricing. Two common types are Issue-Age-Rated and Attained-Age-Rated policies. Issue-Age-Rated plans set premiums based on age when you first purchase the policy. Attained-Age-Rated plans start with lower premiums but increase as you age.

7. Is there a “best” Medicare supplemental plan for everyone?

The best Medigap plan varies from person to person, depending on individual healthcare needs, preferences, and budget. Plan G is often favored for its comprehensive coverage, but what’s best for you should align with your unique circumstances.

8. Can I switch my Medicare supplemental plan?

While you can switch Medigap plans anytime, it’s typically easiest to do so during your initial open enrollment period or a guaranteed issue, right? Otherwise, you may face underwriting and potentially higher premiums.

9. How can I find the most cost-effective Medicare supplemental insurance plan?

To find the most cost-effective Medigap plan, compare plans from different insurance companies, consider your healthcare needs, and evaluate premium costs, coverage, and additional benefits.

10. Is Medicare supplemental insurance the same as Medicare Advantage?

No, Medicare supplemental insurance (Medigap) and Medicare Advantage are different. Medigap works alongside Original Medicare to fill coverage gaps, while Medicare Advantage replaces Original Medicare and often includes additional benefits like prescription drug coverage.

Conclusion

In conclusion, understanding the average cost of supplemental insurance for Medicare is crucial in making informed decisions about your healthcare coverage during retirement. Medicare Supplement Plans, or Medigap, offer a valuable layer of financial protection, filling in the gaps left by Original Medicare. While the costs of these plans can vary based on factors like location, age, and the specific plan you choose, having a ballpark figure in mind can help you plan your budget effectively.

It’s important to remember that Medigap plans are not designed to cover prescription drugs, so you may need to explore Medicare Part D or Medicare Advantage plans for comprehensive coverage. Additionally, the best time to enroll in a Medigap plan is during your initial Medigap Open Enrollment Period, which ensures you receive the coverage you need without facing higher premiums based on your health.

As you consider your options, remember that different insurance providers offer various Medigap plans with distinct pricing structures. While affordability is essential, it’s equally crucial to evaluate factors like customer satisfaction, coverage options, and additional benefits when choosing the right Medicare Supplement plan for your needs.

Ultimately, securing the best Medicare supplemental insurance ensures that your health and well-being receive the protection they deserve in your retirement years, allowing you to enjoy peace of mind as you embark on this new phase of life.