How Much Does A Doctor Appointment Cost Without Insurance

What you should know about a Doctor’s appointment without Insurance.

You may have been convinced by your children or your friends to get doctor appointment if you have health insurance, but you didn’t because what’s the worst that could happen? You’re healthy now; your family is doing well; you’re financially stable- everything’s well under control.

Your insurance type affects how much a doctor’s appointment will cost. The average cost of a doctor’s visit without insurance is between $300 and $600. However, charges can change based on several variables, including lab tests, where you receive treatment, and the procedures carried out during the appointment. The most expensive types of medical visits were those to orthopedists and cardiologists, primary care doctors, pediatricians, and psychiatrists were less costly than the norm.

A primary care physician in your neighborhood is an attractive choice for routine and preventive treatments. They can also get to know you and assist in keeping tabs on your health. If you have a good relationship with your primary care physician, they can quickly see you when you are ill. If an issue falls outside their view, primary doctors can refer you to a nearby expert.

Flash forward ten years; the worst is here.

You’re now either sick with some illness, or your routine checkup is due. Both ways, you can’t afford to pay medical bills because health is TOO expensive in this country. What do you do?

Ideally, you walk into a community clinic or a government hospital to be told you should have insurance because, otherwise, the treatment will be costly.

How Much Does it Cost Without Insurance?

So, let’s talk numbers now.

How much is a doctor’s visit without insurance?

Ideally, a routine checkup will cost you around $100-$250. This is, of course, not fixed; any additional prescriptions or treatment will increase your bill. Depending on where you live and what healthcare costs in your state, the rate could also be $300-$600 in 2023. What happens if you go to the ER without insurance? If you went through the hospital emergency room, the basic checkup bill could reach $400-$600. These are just average rates for a basic routine checkup; the account can soar up high if more treatment is necessary.

Without insurance, the fees for a basic level urgent care appointment vary from $80 to $280, and for an advanced level visit, $140 to $440. The price of your stay also depends on where you are. The best option for price and convenience is urgent care, whether for a fever, a painful throat, or even a sports injury.

Cost of a Doctor’s Visit for Different Specialists Without Insurance

Specialty Type |

Average Cost Without Insurance |

| Average | $265 |

| Psychiatry | $159 |

| Pediatrics | $169 |

| Primary care | $186 |

| Dermatology | $268 |

| OB/GYN | $280 |

| Ophthalmology | $307 |

| Cardiology | $335 |

| All Other | $365 |

| Orthopedics | $419 |

The Cost of a Doctor’s Visit With Insurance

It can vary depending on your insurance coverage. If you have insurance through your employer, the cost of your doctor’s visit may be covered in whole or in part by your insurance plan. Moreover, if you have private insurance, the cost of your doctor’s visit may be covered in full or part by your insurance plan. If you are a Medicare or Medicaid recipient, the cost of your doctor’s visit may be covered in whole or part by your insurance plan.

Cost (Copay) of a Doctor’s Visit for Different Specialists By Insurance Type

Specialty Type |

Medicaid |

Medicare |

Private Insurance |

| Overall | $83 | $112 | $130 |

| Primary care | $79 | $104 | $119 |

| Pediatrics | $82 | ** | $125 |

| OB/GYN | $81 | $109 | $141 |

| Ophthalmology | $91 | $127 | $149 |

| Orthopedics | $79 | $113 | $162 |

| Psychiatry | $91 | $100 | $112 |

| Cardiology | $84 | $117 | $168 |

| Dermatology | $86 | $132 | $124 |

| All other | $92 | $121 | $146 |

Urgent Care Cost without Insurance

Urgent care centers take patients who aren’t insured, which is relatively cheaper than going to a hospital emergency room. The average urgent care cost is around $100-$150 just for the services. The medical bill could be much higher if they prescribe more tests or medicines.

Can I go to urgent care without insurance?

Of course. And you can simply walk in; no need for an appointment either!

Urgent care is a little more expensive than if you choose walk-in clinics, but you’ll get better treatment and services at urgent care because of more resources and experienced doctors available. They are more equipped to treat severe injuries and illnesses.

One great advantage of critical care, other than being cheap, is that most urgent care centers offer their patients a payment plan if they can’t pay the money upfront. This type of facility is given to uninsured patients that come to urgent care, but if you choose to pay, urgent care is still cost-effective.

Factors That Influence Visit Cost

The severity of your illness, the location of your care, and the level of service directly impact your visit cost. Hospital emergency rooms often charge more than doctor’s offices. Additionally, the number of lab tests, X-rays, and other essential examinations can increase the overall cost.

Choosing between urgent care and doctor care also affects expenses. Urgent care typically handles less severe injuries or illnesses, making it more affordable than doctor care, which addresses more serious or chronic conditions.

Insurance type plays a crucial role in determining your out-of-pocket expenses. If your insurance only covers doctor visits, you’ll likely pay more for urgent care. Conversely, if your insurance covers both, the costs might be comparable.

Family doctor appointment charges are generally consistent across provinces. Doctors receive a portion of the fee, sometimes as much as 40%, to cover office rent, personnel wages, supplies, equipment, and maintenance. Provinces may adjust rates for longer visits or those requiring disposable or cleaned-up office supplies.

Without health insurance, you must weigh your options and potential costs. Being cautious with your medical treatment can lead to skipping vital care, endangering your health. If you go without insurance, be prepared for the financial repercussions of medical procedures.

Healthcare costs continue to rise, leaving many struggling to manage bills even with insurance. If you don’t have insurance, proactively seek affordable treatment options. Understanding the total cost of medical services is crucial. This guide provides average prices for popular treatments and services, helping you and your doctor choose the most suitable and affordable options.

How to see a Doctor without Insurance or Money?

First and foremost, people shouldn’t forgo medical care out of pure economic need. If you put off seeking the treatment you require, it can cost you more regarding your health and finances. You can still visit a doctor and get medical care, including preventative care, acute care, urgent care, and emergency care, even if you don’t have health insurance.

Finding economical services is the challenging part. According to surveys, most suppliers will provide a price quote upfront before scheduling. This enables you to compare prices and reduces unexpected doctor appointment expenses increases.

- Not being insured is one thing. You can still pay high bills if you’re rich.

- Not having money is another thing.

The latter situation applies to so many people!

Imagine you or your wife get sick in the middle of the night, and you rush to the hospital and find out it was a stroke. Before treatment, the hospital asks for money, which by the way, you DON’T have. What do you do? You arrange for the money; if you can’t, you’re in a fix now. Luckily, there are ways that you can see a doctor without insurance or money.

Following are some ways to get you a lower price on medical bills:

-

Mentioning that you are uninsured is very important:

when the doctor or hospital staff starts talking about numbers, you tell them you aren’t insured. They can then tell you if there are some discounts you may be eligible for or if there are some payment plans you can avail of. Press them to let you know if there are ways that the bills can be cut down on you.

-

Save on medicines:

Doctors usually have lots of free samples to give their patients, especially those who can’t afford them. Ideally, they will have some to offer to you too. All you have to do is ask. This can save you a lot of money you would otherwise spend on expensive medicines.

-

Medicaid:

Even if you don’t have insurance, you could still be eligible for specific aid programs like Medicaid. These depend on your income, household size, and other factors. If you’re eligible, you should approach this option to soften the blow of severe financial pressure.

-

Installments:

It seems like an impossible shot, but it wouldn’t hurt to try. Many healthcare providers can give you an installment plan to pay in parts for the treatment. If you convince them that you cannot pay the total amount upfront but you can pay it all in the next couple of months, they might consider your request.

-

Shopping around:

This is your last resort. Of course, this option won’t do you much good if you or your wife are still in the hospital waiting to get treated. You can shop around for opportunities for future visits; every area has a different fee structure for its hospitals and clinics. See which one fits your budget AND gives you the treatment you need. Talk to people, and see what options they’re doing to reduce their bills.

-

Community health clinics:

They frequently offer free or inexpensive medical services, including immunizations, health screenings, and preventative care.

-

Urgent care facilities:

They provide many medical services. Although many don’t require them, making an appointment in advance could reduce your wait time. A visit to an urgent care facility will likely cost you between $100 and $200, not including the price of any necessary treatments or tests.

- Nowadays, many medical establishments provide telehealth services, which are frequently more practical and inexpensive. However, a physical examination may be necessary for a correct diagnosis and course of action for some illnesses.

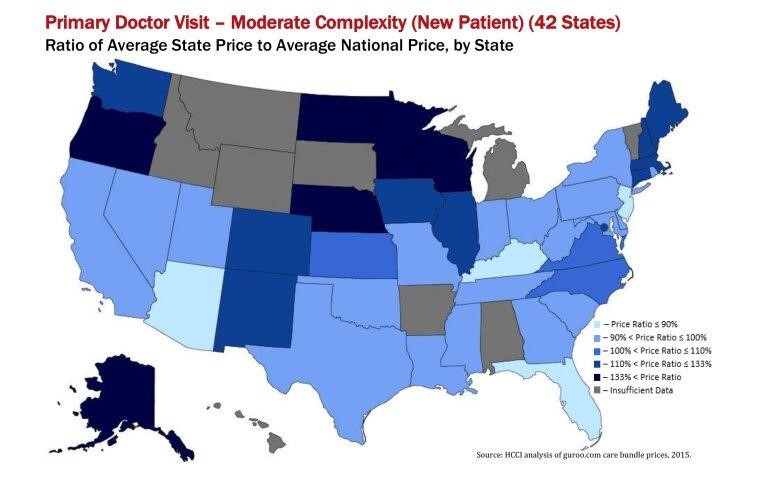

Cost of medical care by state

The following cost estimates will change depending on where the service is provided and are based on the average cash fees providers have traditionally charged for doctor visits. The expenses of anesthesia, imaging, and other typical medical visits are not included in the listed pricing.

Country Name |

Average price |

| Alabama | $83 – $127 |

| Alaska | $112 – $172 |

| Arizona | $94 – $144 |

| Arkansas | $82 – $126 |

| California | $103 – $158 |

| Colorado | $91 – $139 |

| Connecticut | $99 – $152 |

| Delaware | $97 – $148 |

| District of Columbia | $96 – $146 |

| Florida | $91 – $139 |

| Georgia | $86 – $131 |

| Hawaii | $87 – $132 |

| Idaho | $84 – $128 |

| Illinois | $95 – $146 |

| Indiana | $87 – $133 |

| Iowa | $79 – $121 |

| Kansas | $82 – $125 |

| Kentucky | $84 – $128 |

| Louisiana | $93 – $142 |

| Maine | $84 – $128 |

| Maryland | $99 – $151 |

| Massachusetts | $102 – $156 |

| Michigan | $94 – $144 |

| Minnesota | $106- $162 |

| Mississippi | $85 – $129 |

| Missouri | $84 – $128 |

| Montana | $87 – $133 |

| Nebraska | $85 – $130 |

| Nevada | $90 – $137 |

| New Hampshire | $90 – $138 |

| New Jersey | $109 – $167 |

| New Mexico | $83 – $127 |

| New York | $103 – $157 |

| North Carolina | $82 – $126 |

| North Dakota | $92 – $140 |

| Ohio | $86 – $131 |

| Oklahoma | $92 – $140 |

| Oregon | $93 – $143 |

| Pennsylvania | $96 – $147 |

| Rhode Island | $103 – $157 |

| South Carolina | $88 – $134 |

| South Dakota | $82 – $125 |

| Tennessee | $82 – $126 |

| Texas | $89 – $136 |

| Utah | $93 – $142 |

| Vermont | $91 – $139 |

| Virginia | $89 – $136 |

| Washington | $99 – $151 |

| West Virginia | $89 – $136 |

| Wisconsin | $94 – $143 |

| Wyoming | $91 – $139 |

How can I determine the cost of seeing a doctor at different offices?

If you have insurance, the best way to determine the cost of seeing a doctor at other offices is to contact your insurance company and ask them for a list of in-network providers. You can then get the office to find out their specific policies regarding insurance coverage.

Here are some questions you must answer to avoid extra fees

- How much is the total out-of-pocket cost?

- How much are the services I’m receiving today?

- How much is the treatment I’m receiving?

- Are there administrative fees or fees for seeing a provider?

- Is one type of medicine cheaper than another?

- Is one type of diagnostic test cheaper than another?

- What are my alternatives?

FAQS

Will a hospital treat me if I do not have insurance?

It depends on the hospital. Some hospitals may offer free or low-cost care to patients who do not have insurance, while others may require that patients pay for their care in total. Patients should check with their local hospital to see its treatment policies for those without insurance.

What affects the cost of a doctor’s visit?

Several factors can affect the cost of a doctor’s visit, including the type of insurance the patient has, the location of the doctor’s office, and the kind of care the patient needs. Patients should check with their insurance provider to see what coverage they have for doctor’s visits and should also ask their doctor about any potential discounts that may be available.

What is the average cost of a doctor’s visit?

The average price of a doctor’s visit can vary depending on several factors, including the type of insurance the patient has, the location of the doctor’s office, and the kind of care the patient needs. Patients should check with their insurance provider to see what coverage they have for doctor’s visits and should also ask their doctor about any potential discounts that may be available.

Why are medical appointments so pricey?

The administrative costs of doctor’s offices and the price of medical services are just two factors contributing to the high cost of doctor visits. The office contributes to the high cost of doctor visits. Your doctor’s office must communicate with several insurance providers and pay administrative employees with experience in medical billing. Your doctor may charge facility fees in addition to costs for their services, lab work, or imaging they provide.

What tells you a doctor is bad?

Knowing the telltale indicators of a subpar physician will help you avoid issues and receive better medical attention. One indication is if, throughout your visit, your doctor doesn’t listen to you or consider your worries. Another is when your doctor rushes through your visit and doesn’t give you enough time to address your fears. If your doctor doesn’t clearly explain why specific tests or treatments are necessary, that is a third red flag.

How long should a visit to the doctor last?

Your entire appointment with the doctor may take a while. Your work might last more than an hour in total. Many patients wait in the waiting area before being called back for an examination. You may have to wait a while, depending on how busy your doctor’s office is. The time spent with your doctor will pass quickly once you are in the examination room. Patients often meet with their doctor for around 20 minutes in the exam room.

Think About It

If you prefer not to get insured, create a contingency plan for the future. Set up a dedicated savings account for medical expenses. Each month, deposit a small percentage of your income into this account and watch it grow. When a medical emergency arises, you’ll have funds available to cover the costs.

Without insurance, medical expenses can be overwhelming, making it crucial to prioritize your health. While you can’t control every aspect of your life, you can prepare for unexpected situations. By maintaining a contingency plan, you ensure you always have the money to pay medical bills.